Governance is an incredibly important feature for PolyCUB. It's one of the core utilities of owning POLYCUB and staking it as xPOLYCUB. The more xPOLYCUB you have, the more voice you have in how the platform mechanics are governed, which vaults earn the most yield, etc.

pHBD has radically reshaped our thinking on PolyCUB. The pHBD bridge and pHBD-USDC liquidity pool that we built are providing massive value for PolyCUB's Protocol Owned Liquidity. It's really crazy to see how well this is working.

This is enlightening our team on a new path forward for PolyCUB. A full 180 in how the platform works and what vaults are prioritized. We're currently working on some major additions to the platform that include pHIVE, pSPS and others.

All of these tokens will be PolyCUB bridges which - just like pHBD - will generate MASSIVE value for PolyCUB's PoL.

Our First Governance Vote

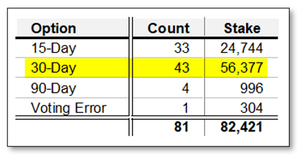

Our first governance vote went incredibly well. We had a solid voter turnout - which can be improved with better UI displays for future governance votes - and the DAO System we built worked flawlessly.

The update has been queued in our Timelock to update the claim window from 90 days to 30 days. This has some important impacts on PolyCUB.

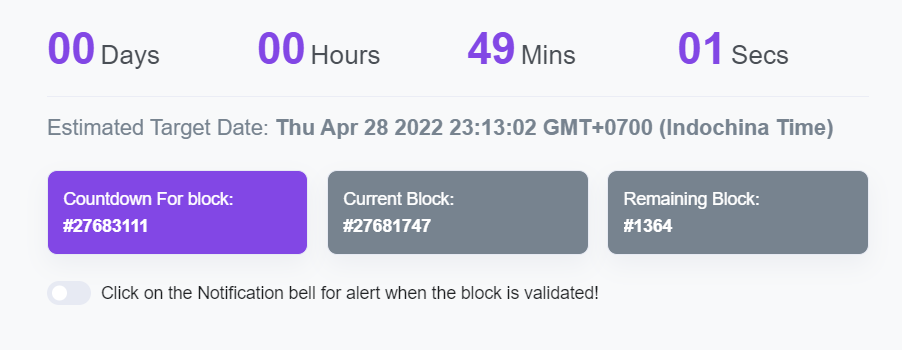

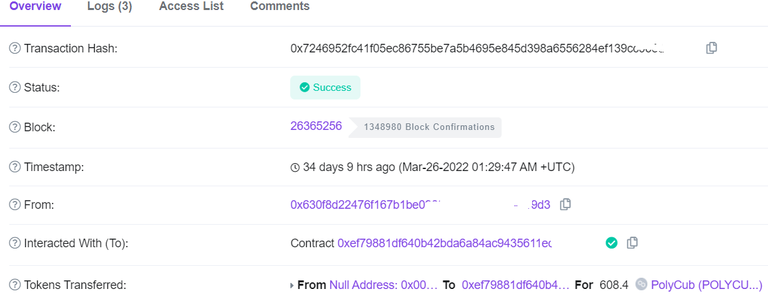

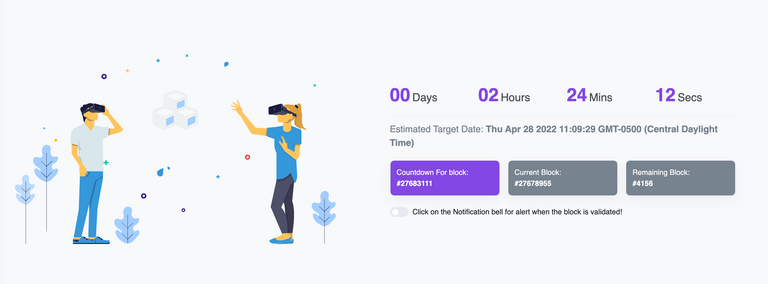

https://polygonscan.com/block/countdown/27683111

The claim window being 30 days makes pHBD staking a lot more attractive. With V2 Vaults getting ready to be deployed, this is more important than ever.

We've built a multi-token bridge for PolyCUB that can deploy tokens from Hive's second layer onto Polygon. This allows PolyCUB's Protocol to control deployed assets and generate massive value both for PolyCUB as a protocol and for the tokens to bring them a source of liquidity and list them on exchanges on Polygon.

We'll also use our connections to get these tokens listed on all sorts of platforms like CoinmarketCap and Coingecko. This will bring MASSIVE exposure to all the assets that utilize PolyCUB's Multi-Token Bridge layer.

PolyCUB is designed to be a Yield Optimizer DAO (Decentralized Autonomous Organization), let's allow the community's posts and data to also highlight just how anticipated this vote was and how the future looks for the entire LeoFinance Web3 Ecosystem. The community's voice matters and you all dictate how PolyCUB is governed from here on out.

It's time for a whole new world for PolyCUB utility. Governance is at the core of everything we're building.

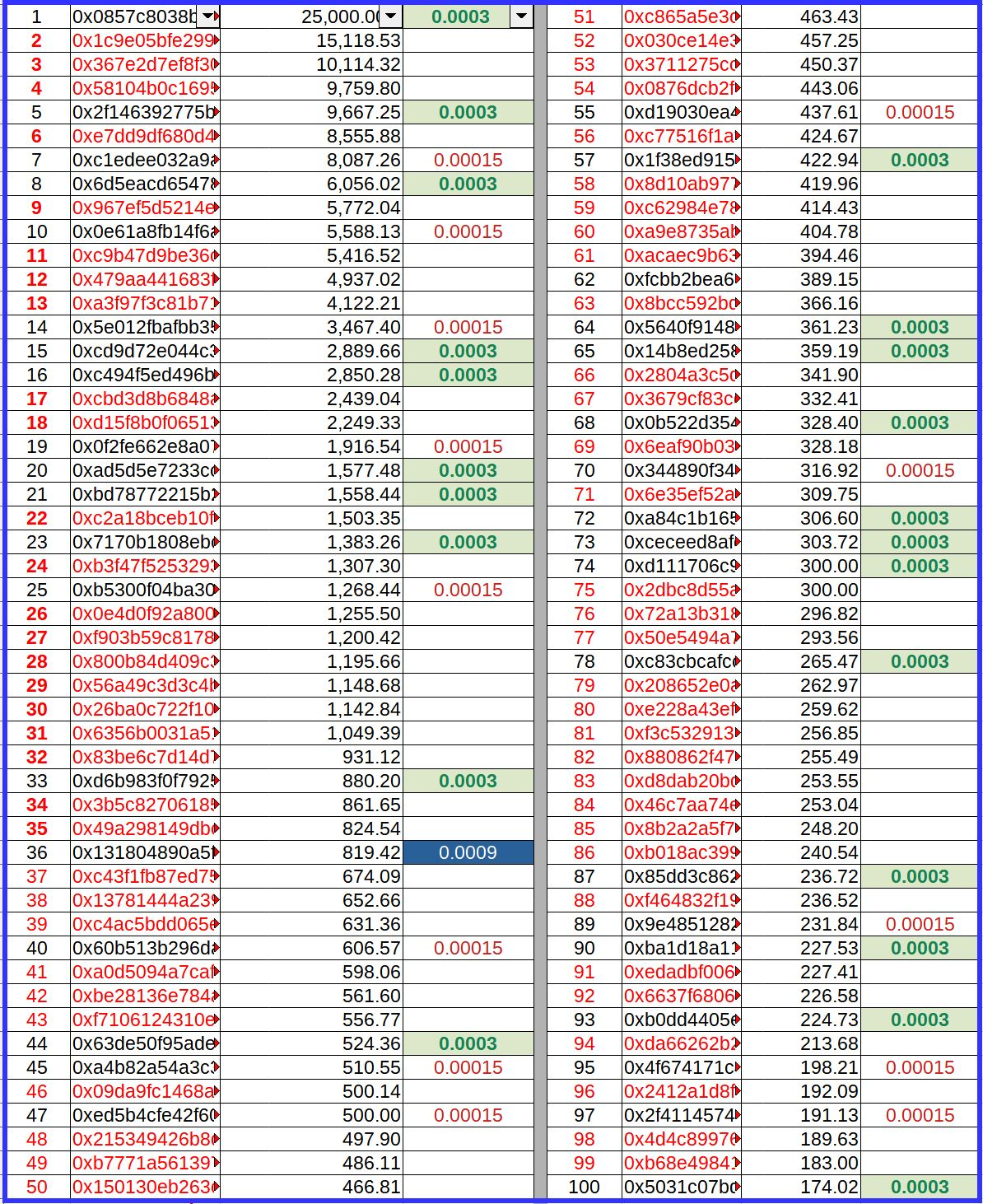

If you want to see two really great posts that broke down the data behind our first governance vote, check these out:

- https://leofinance.io/@onealfa/changes-to-polycub-coming-soon

- https://leofinance.io/@roleerob/demographics-of-polycub-s-1st-vote

via @onealfa's post

Via @roleerob's post

The Future - 5 Value Accrual Mechanisms for Second Generation PolyCUB Vaults

In Tuesday's AMA, we mentioned that the 2nd generation of PolyCUB vaults will have 5 value accrual mechanisms for the PolyCUB PoL. Compare this to the 1 value accrual mechanism on Kingdoms and you can see why pHBD has completely reshaped our thinking on the longevity and growth of PolyCUB as a platform. Everything is about to change.

PolyCUB Vault V1: (Kingdoms)

- insert_kingdom_asset (i.e. WETH-WBTC or Aave Stablecoins) generates management fees (10% of all yield) = value accrual for PolyCUB PoL

PolyCUB Vault V2: (Bridged Assets)

- insert_hive_asset (i.e. pHIVE or pSPS, etc.) - held as 1:1 collateral for the wrapped equivalent - staked on native platform (i.e. HIVE POWER or SPS staking on splinterlands.com) = value accrual for PolyCUB's PoL

- insert_hive_asset 0.25% wrap and unwrap fee = value accrual for PolyCUB's PoL

- insert_hive_asset cross-chain arbitrage = value accrual for PolyCUB's PoL

- insert_hive_asset-POLYCUB = utility for people to buy POLYCUB to LP against their insert_hive_asset = value accrual for PolyCUB's PoL

- insert_hive_asset-POLYCUB holders need to buy more POLYCUB to stake as xPOLYCUB to control governance and drive insert_hive_asset-POLYCUB vault yield higher

As you can see, the V2 idea we have for radically reshaping PolyCUB has FAR MORE value accrual mechanisms for PolyCUB in the long-run. We believe that we're on a path right now to achieve this. We already built a multi-token bridge. Now it's time to implement it for pHIVE and pSPS. After those are implemented, we'll start looking to other Hive communities who can generate signifcant volume to warrant adding them to the bridge.

If you're a Hive community and want to discuss this with us, please reach out. In some circumstances, we'll also provide seed liquidity to get your pool rolling. From there, it's up to you and your community to acquire xPOLYCUB to vote your vault up in the governance rankings and drive more yield to your token's pair on PolyCUB.

Then, we put up an xPOLYCUB governance vote to add their token and seed liquidity. That community - let's take POSH for example - can then vote up their vault to get it added to the platform. Then they have to vote yield into their vault. The more xPOLYCUB stake that community has, the more voice they have to dictate how much yield should be driven into their "pPOSH-POLYCUB" vault.

This creates a "Communities War" over xPOLYCUB governance which ultimately leads to more value for PolyCUB which also drives up the yield on all vaults.

We're extremely excited about this new V2 Vault Path for PolyCUB. Combine this with collateralized lending and variable earn rates and the utility for hodling xPOLYCUB has just gone through the roof.

But all of this is for a new whitepaper release of its own. That should be out soon which will talk about all of these changes in great detail AND give the numbers on pHBD to show just how many thousands and thousands of dollars in value its generating for PolyCUB's Protocol Owned Liquidity every single month.

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

Our mission is to put Web3 in the palm of your hands.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

LeoMobile (IOS): https://testflight.apple.com/join/cskYPK1a

LeoMobile (Android): https://play.google.com/store/apps/details?id=io.leofi.mobile

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

Polygon HBD (pHBD): https://wleo.io/hbd

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

LEO Wrapping Bridge: https://wleo.io

Posted Using LeoFinance Beta