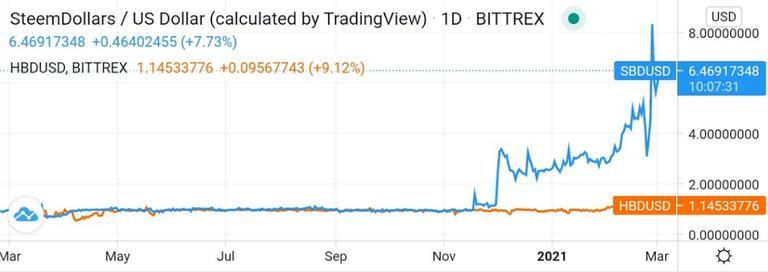

The HIVE-backed dollar (HBD) is an integral part of the Hive Blockchain and its economy, if not the most important hedge against volatility and stablecoin in its own right. The ultimate purpose of HBD is to maintain the simple equation of 1 HBD = $1 worth of HIVE.

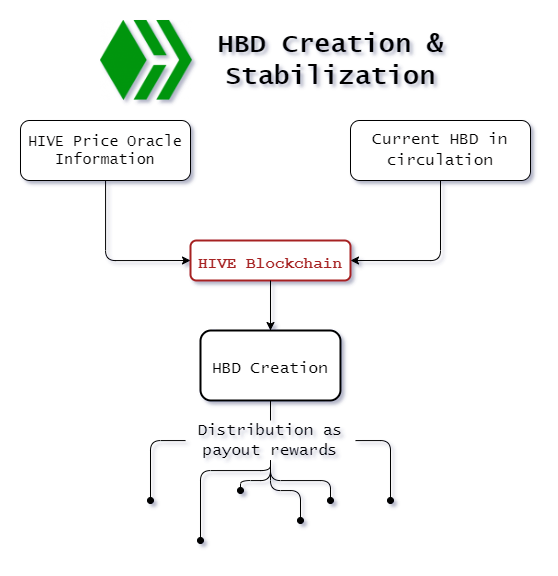

HBDs are minted natively by the Hive Blockchain. The rate at which HBDs are created is dependant on two prominent factors taken into account: A constant feed of information for both the HIVE price, as well as the current HBD in circulation. For HIVE's price, an oracle is utilized to feed the blockchain the necessary information regarding the price into the formula. For the HBD creation rate, The previous HBD's output rate is already being utilized for the next minting event.

This process can be simplified using the following flowchart model.

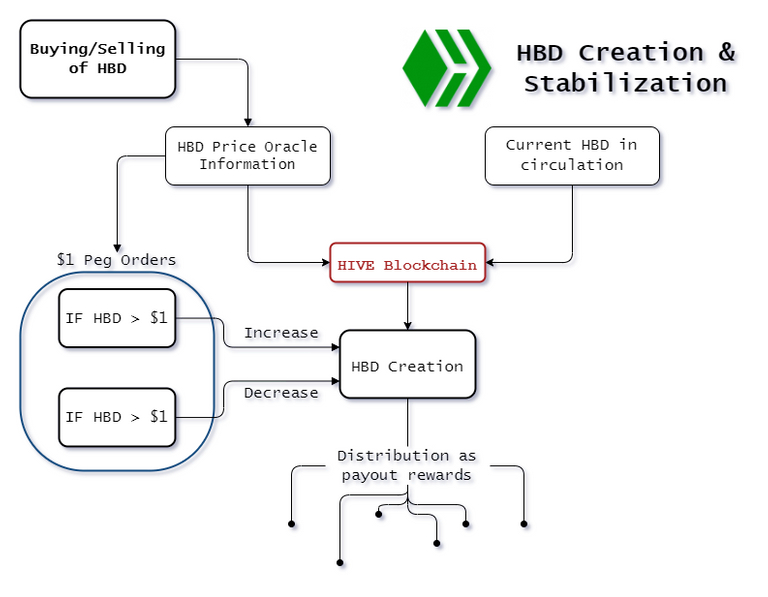

Naturally, two mechanisms must be implemented in place in order to snuff out any volatility coming from HBD's part, and to maintain the peg to $1.

- If HBD > $1, the HIVE blockchain is to increase the output supply of HBD in circulation, in accordance to the already circulating supply in order to accurately decrease the price down to the peg of $1.

- If HBD < $1, the HIVE blockchain is to decrease the output supply of HBD in circulation, in accordance to the already circulating supply in order to accurately increase the price up to the peg of $1.

In addition to these mechanisms, there is another measure of maintenance that comes along organically with any stablecoin. This measure is driven by the community buying when HBD is down, and selling when its above, the $1 peg. Unfortunately, HBD's design makes it so that this measure becomes unreliable. Users are encouraged to lock in their savings in order to accrue the %12 interest, making this defense line against volatility practically useless.

These two mechanisms have, for the most part, remained steadfast in the maintenance of HBD's peg to the dollar. But This primitive system has become antiquated, archaic, and obviously would not respond as quickly in case of a sudden influx of users pouring in and purchasing HBD. A second, more reliable, line of defense is in order.

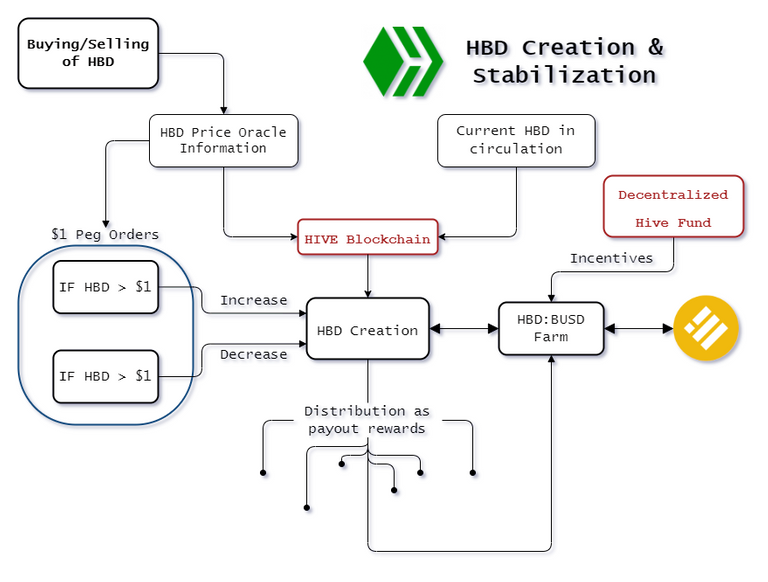

BUSD:HBD Pool Proposal

Few days ago, a pool to form that second line of defense was proposed to the DHF. This pool not only helps to stabilize HBD, but to also trailblaze the way the Binance ecosystem.

Essentially, we are opening up the doors for arbitrageurs to equilibrate the differences between HBD and Binance's BUSD price. Not only would this help maintain the peg, but would also provide liquidity and volume to HBD, given that most of the HBD in circulation is currently locked-in.

In order to incentivize users to lock-in their HBD funds in the pool rather than in their savings account, a similar rate of return must be offered. Currently, the witnesses' consensus of %12. The pool has proposed a funding of 329 HBD per day to liquidity providers in order to catch up to that %12.

Ultimately, HBD funds in any given user's account are not going to sit idly, collecting interest. Rather, they'd be used to provide liquidity to the added benefit of accruing comparable rewards as if they were in locked-in to savings.

With this proposed farm in mind, the stabilization flowchart model would look like this.

Clearly, this proposal is of absolute benefit to HBD, to its users, and by extension the entire Hive economy as well. Vote now, lest we end up like SteemBD's horrible 'stable'coin.

Vote Here!

Posted Using LeoFinance Beta