No doubt, pCUB has implemented in its tokenomics a slew of new and innovative gears and features. All of these new toys are designed to satisfy two criteria every investor wants to see. These are:

- An established, reliable price floor

- The continuous prevalence of demand for the asset in question, yielding positive price action

With the soon-to-be introduced Protocol-owned Liquidity and the collateralized, self-paying loans, pCUB has evolved a long, long way from the early days of CUB. This article aims to put into perspective the significance of these mechanics, map out the flow of the pCUB emissions and user capital across all farms and pinpoint the areas of tokenomics that make it all click together.

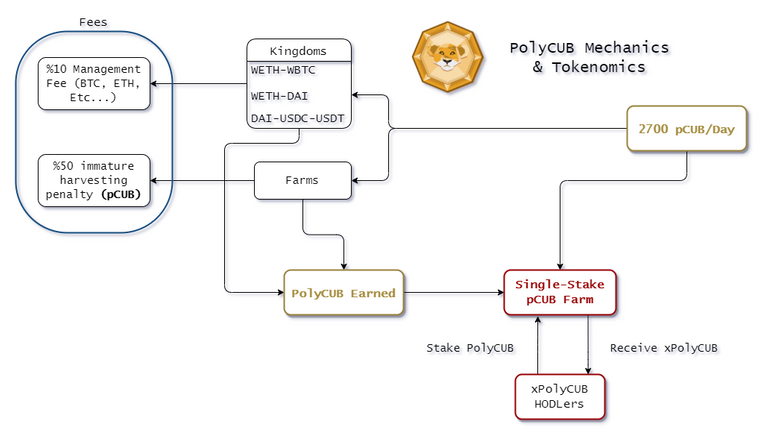

The Polygon network processes blocks every 2 seconds. Per day, that comes to 43200 blocks. In this flowchart, we will assume the emissions, after all the halving cycles are over, to be 0.0625 pCUB per block. These emissions flow to three major farms: the Kingdoms, single-stake pCUB and the typical farms. With their assorted fees, the flowchart comes along like so:

This is what the brass tacks of pCUB look like. Arguably, the trump card of the entire platform is in the utility of xPolyCUB in collateralizing loans, and its synergy with pCUB in order to self-pay that loan.

This is massive. This essentially defies the entirety of the legacy finance system. If this mechanism of self-paying loans gets heavily adopted throughout the DeFi space, it would without a doubt put a sizable dent on the traditional banks.

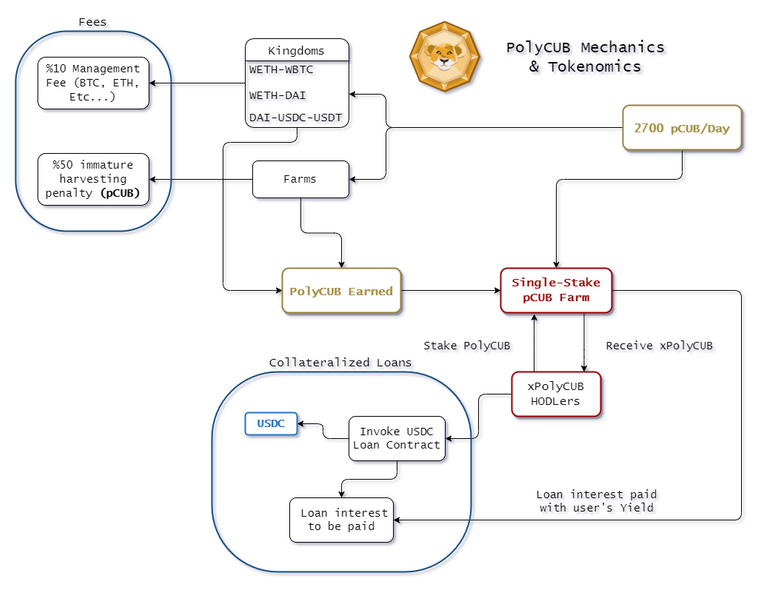

Taking into consideration this mechanism of collateralized loans, the flow chart becomes as such:

Whenever the loan contract function for a certain asset is invoked, two things happen: The agreed-upon amount of USDC is lent to the xPolyCUB user, and the loan interest to be paid begins ticking. In order to pay off that interest, the Protocol-owned Liquidity is to take that user's xPolyCUB, stake it off-platform to yield assets (xSUSHI, etc...), the protocol assumes its own profit and pays the user's loan interest off.

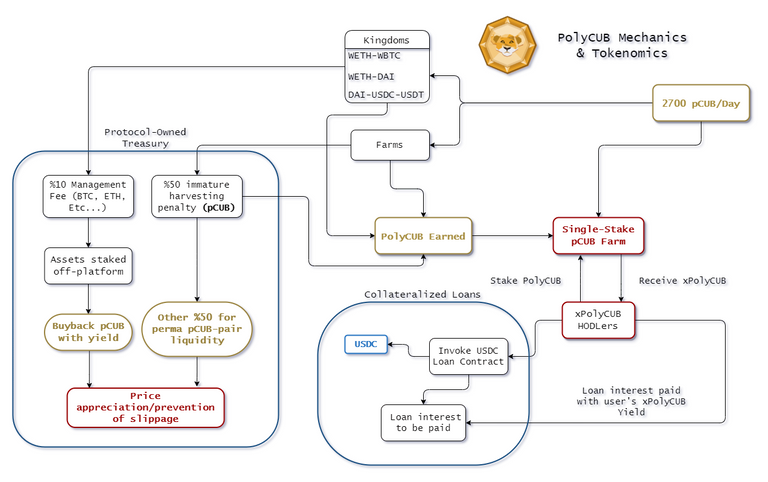

In addition to collateralized loans, the pCUB treasury is going to be instated in order to either impose price appreciation by buyback of pCUB, or to maintain the dollar value through maintaining liquidity. Both of These things are done by staking the assets earned through Kingdom's %10 fee off-platform, and taking the %50 immature harvest fees and using it to liquify any pairs associated with pCUB, respectively.

The final flowchart, then, becomes the following:

It's hard to believe that it has been almost a year since CUBFinance was launched. Its one thing develop A DeFi platform during the height and craze of it all, its another to be still in the DeFi game even after the rally is way past its cooldown. That, to me, commands a ton of respect for the people involved.

Here's to another year full of fortune!

Posted Using LeoFinance Beta