Still to this day, HEX has been the epicenter of controversy. From the day it was proposed, it has received sharp criticism all along its pipeline of operation, some even leveled on Richard Heart's shady past when it came to his previous projects. This article aims to provide a near-accurate flowchart model of the tokenomics HEX is built upon, as well as to pinpoint the origin points of controversy within it.

HEX is a Certificate-of-Deposit (CD) DeFi token built upon Ethereum. Much like the legacy finance's model of CD, HEX offers stable interest rates upon the deposition of its token for a set period of time, the maximum time period being 15 years, and the minimum 1 day.

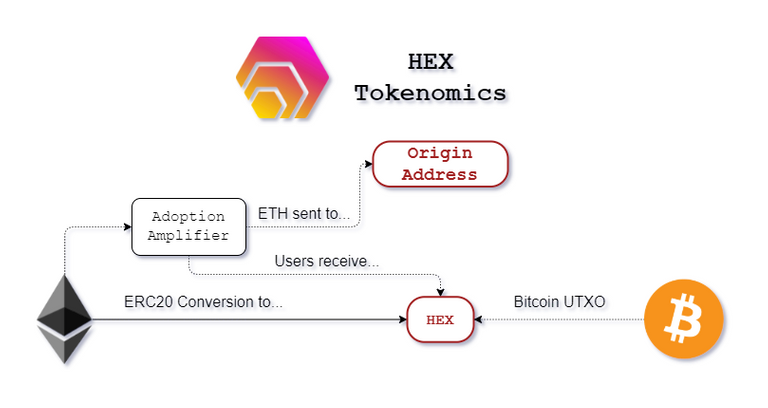

During its 351-days long launch phase, one method to obtain HEX back then was by simply pooling ETH in what is termed the Adoption Amplifier pool, which stores that ETH on a singular address on the blockchain that is not a smart contract. The other way was through a Bitcoin UTXO snapshot, where any address that owned Bitcoin at the time of that snapshot had the opportunity to claim HEX. After the launch phase was over, HEX is now solely obtainable by simply purchasing it on Uniswap.

Therefore, the entry points in the HEX tokenomics can be visualized like so:

Immediately, the first culprit is identified. In pooling your ETH in the Adoption Amplifier, the ETH is sent to an origin address that is not a smart contract, essentially entrusting your funds, and betting that you would even be paid once the launch phase was over, to Richard Heart.

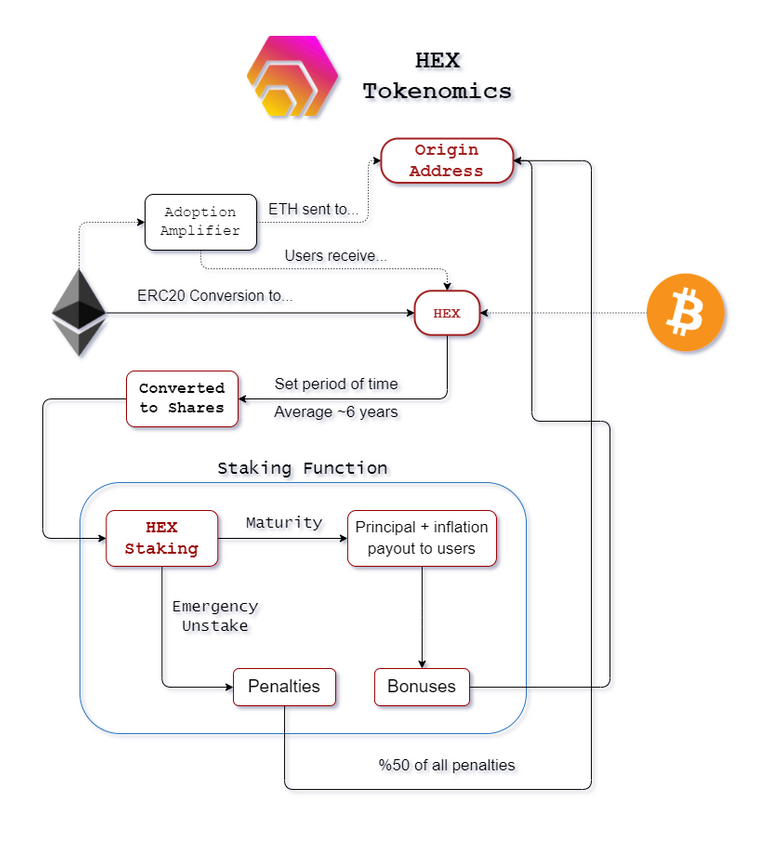

Perhaps the sharpest criticism there is is leveled at the fact that the Origin address (OA) does much more than simply hold users' ETH funds. The OA presently controls %~45 of the HEX supply, in addition to the fact that the penalties to unstaking before the agreed-upon period of time and bonuses are copied (Double-spent) by the smart contract over to that problematic address. Essentially, much more importantly than this looking like a ponzi-scheme is the fact that integrating this address in the tokenomics completely defeats any semblance of decentralized trustlessness Cryptocurrencies are known for, and this is the crux the majority of HEX's detractors are under.

Integrating the staking function into the tokenomics of HEX, with all the assorted pipelines leading to the OA, the diagram can be visualized as the following:

It is remarkable at this point to note that HEX possesses no economic activity, no underlying value to keep itself buoyed on top and certainly no utility that could incentivize its use outside of simply staking. For as complex as the HEXicans love to play HEX's ecosystem up, the diagram above represents the brasstacks, if not the complete, tokenomics of HEX.

Bitcoin v. Hex

Richard Heart has contested Bitcoin's model of coinbase creation for as long as HEX held its head out the water. Heart proposes that the continuous minting (inflation) of bitcoin towards miners ultimately creates sell pressure, whilst HEX enables buy pressure by simply offering incentives to staking.

Now that the tokenomics have been laid out in this article, one can make the stark inference that HEX offers nothing of value, certainly nothing better than what Bitcoin already offers. The second inference, arguably the biggest flaw of the model, is that HEX's tokenomics, if we take into account that the big whales stake for >5 years, delays the consequences of inflation significantly, as people are encouraged to stake for longer periods. Richard Hearts basically admits to this flaw of the model with this website that allows you to view all the stakes, and their set period of time until maturity, in order to stake your HEX accordingly before a whale's end stake.

Conclusion

While this token represents an attempt to mirror the legacy economy's CDs, mixed in with the crazy-high APRs in cryptocurrency, it has unfortunately been executed by the wrong hands, as evident by the OA's dominant centralization at the core of HEX, in tandem with Hearts' shady past and marketing tactics. To add salt on top of the wound, HEX has had no economic utility outside of staking and accruing inflation, the consequences of which are going to be much more pronounced in the coming years, as whales begin to claim their mature CDs and sell.

Posted Using LeoFinance Beta