Please take note that this is NOT A FINANCIAL ADVICE and I am willing to risk my assets for this small experiment to see how much it works

I remembered in one of those Robert Kiyosaki's interview he always mentioned about "rich people don't own anything" because they do not allow their assets sit around to do nothing.

This is actually a very high risk positioning, and without enough cash to save the liquidation, one can loose everything in a blink of an eye if any market crashes.

Look at those banks who actually "uses their client's funds" to "make more money" and keep most of those profit and distribute out a small percentage back to those who place their money in their banks in a token of "thanks for lending us money without realising the consequences".

How about we do our own part and learn to govern our own asset, choosing our own loan while collateralising it for better choice of return, with a 100% of self awareness and self-accountability?

Hence this is my first step to test what RealT and how I can "risk" a tiny amount of my token asset and see if there is a possible of a higher risk return and re-claim back my assets and cover my capital.

Step 1: Having an actual real asset

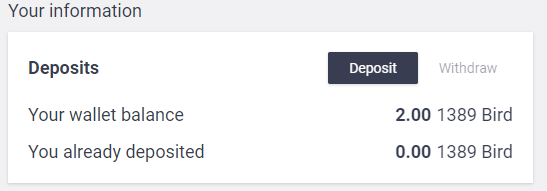

I was very fortunate (before RealT was opened to the masses) to acquire 2 share unit of a home offered by them in February 2022 and I have been enjoying their 14 cents weekly rental for many months now; however the recent of the need to prepare $600 USD ready for my mom's possible cornea transplant by the end of the year I have to learn and see if I can turn a $100 USD asset into something that can be rolled faster without selling it off and losing my asset portfolio

Of course, because RealT Market for setting owner's tokens as collateral is on Gnosis Chain, at least 1 xDAI is needed in my personal wallet so that I can perform these transactions.

It's DeFi afterall.

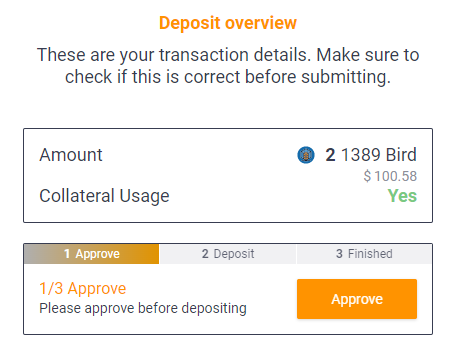

Technically it is pretty simple for the process is done

Right after that my tokens are ready to be set as collateral for my loans.

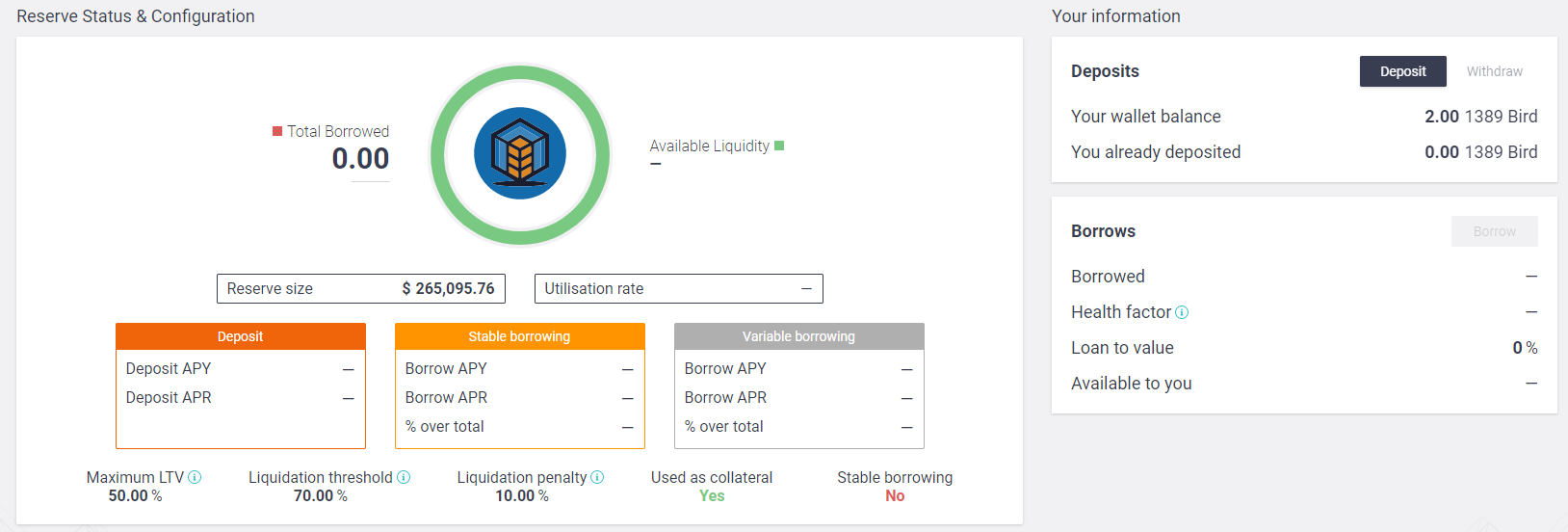

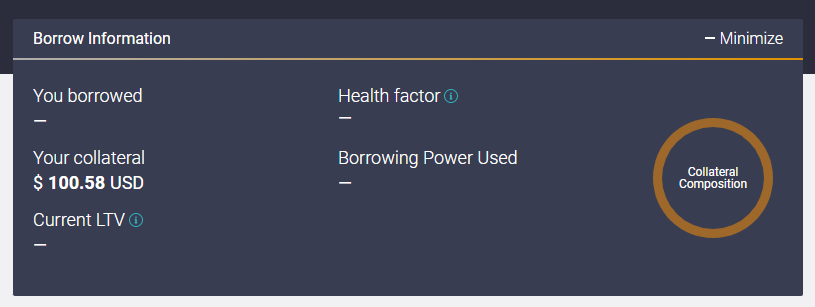

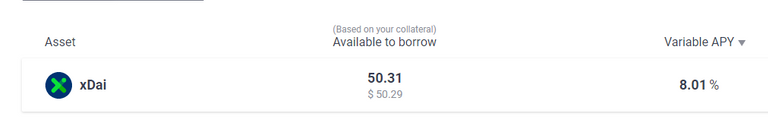

However I do wonder how much will I be able to borrow and how much will it cost me to pay back?

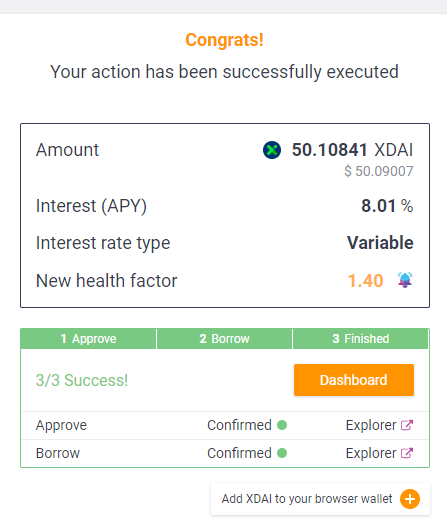

Judging from what is stated here, my 2 tokens can only borrow 50% of its value, and my APY returns is 8.01%; that's pretty high even for a personal loan from my local bank (in promotion) is only around 4.81% APY; however if I can have a chance to roll back around

However if I overspend with my Credit Card, it charges interest of 18% APY until I fully paid up. That is definitely a no-go for me.

So my first experiment is to maximise my risk and with finger's crossed, I can pay back 50% of my loan in 45 day's time.

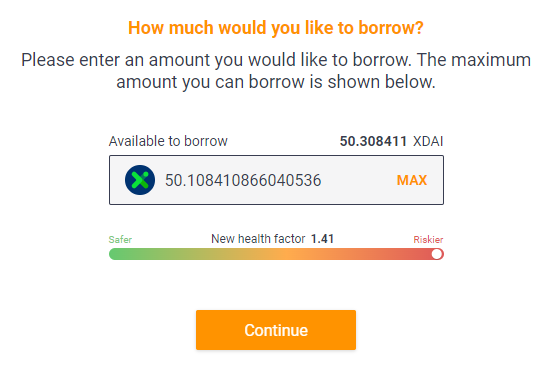

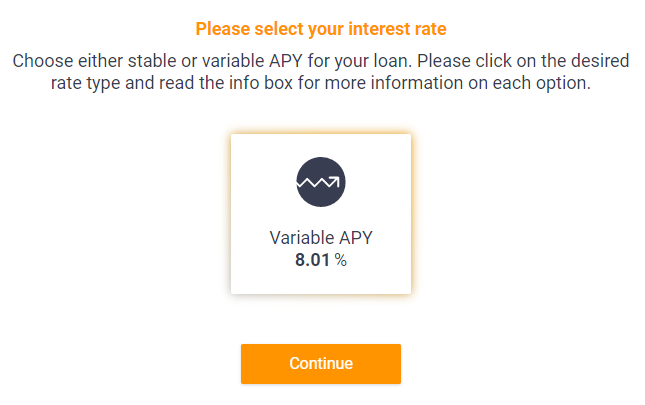

Unfortunately there is no stable APY for me to choose. And this is the only pathway to go.

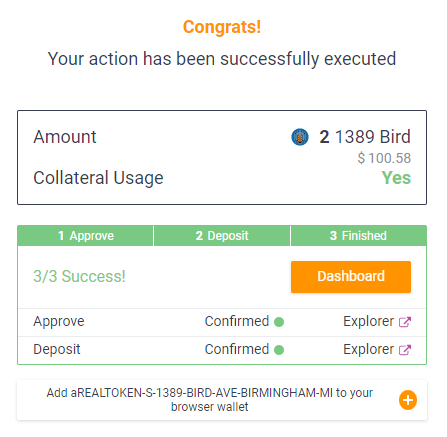

It is technically super easy to do and I must say that within seconds, I already have my loan approved

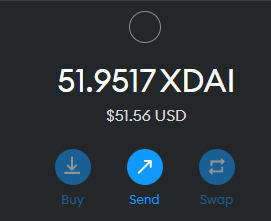

Seamlessly at the same time, I already have my xDai ready for me to port out to be used through a bridge.

There is one question posed in my mind though:

With my token already collateralised, will I still be able to receive rental tokens to my wallet?

I think I can only update it on next Tuesday and check if my rental is totally gone from my token

This entire exercise is only available for XDAI and not other types of tokens to be used; but since DAI is technically still almost $1 (slightly de-pegged due to USDC most likely) it isn't like UST that has been drowned into zero out of total chaos.

I do however hope to return my payments ASAP so that I can keep rolling. Losing 8% for such service is still better than borrow from loan sharks, which is calculated daily.

Once again I must stress!

This is NOT FINANCIAL ADVICE

Just an experiment I am willing to risk on for the sake of my personal education and in hope, I can get $600 USD ready for my mom in no time.

I am just grateful I had the opportunity to learn about RealT. Nothing is of chance or coincidence.

Faith wise, I am relying 110% from on High to guide me through this all the way. 🙏 🙇♀️

Until then

Posted Using LeoFinance Beta