I first stumbled upon Rune some months back as it was quite spoken of on leofinance here, practically witness the price embrace the $15 price range, would be stupid to think I'd see it below $3 again and let it slide, that's like roughly 80% discount from it's all time high. I've been sleeping on the chain for a couple of hours now, jumping from one statistic to the other. I mean if I have to hold a rune, I'd love those yields that makes the heart warm right? Until pRune is a thing, what's your favourite Thorchain LP lions?

I initially wanted to do a chain/investment review on Rune, then I figured that was already talked about a lot, but here's a little shout out, I think Thorchain is awesome, I mean what they're building, so far the infrastructures are great, decentralized and autonomously running exchanges and investment protocols are super crucial in this ecosystem, the growth from here are limitless.

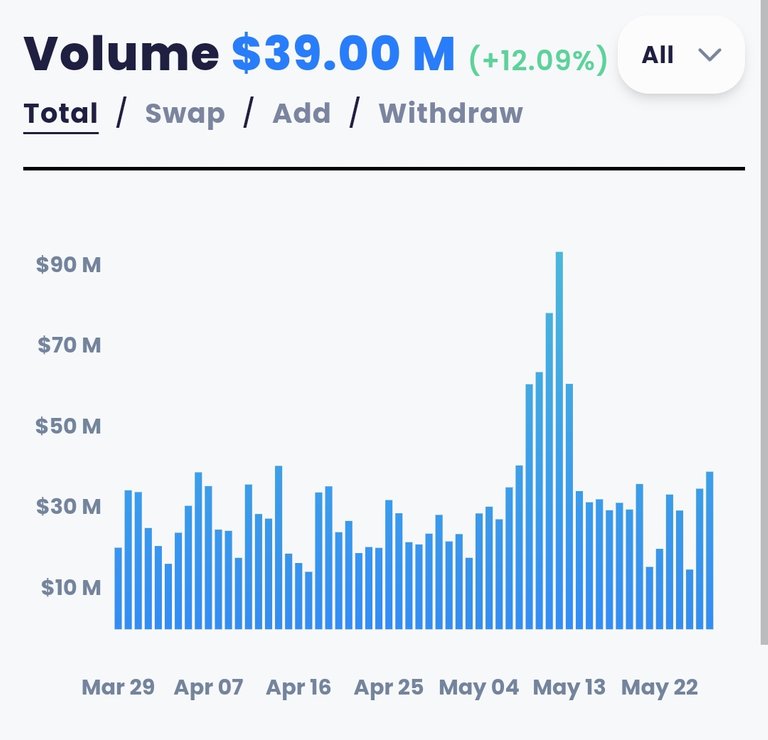

Thorchain controls numerous crypto assets with a TLV(Total Locked Value) of about $370 million at the time of writing. This is literally larger than most centralised running companies' market valuation, Rune is currently ×2.073 of its chain TVL in market cap, crazy right? Yes.

That's the beauty, this infrastructures are great like I said before, it's literally programmed to have a about ×2-×3 in market cap of whatever Locked Value it controls, how this works isn't yet clear to me, still on the research, but that's one of it's growth mechanism. So let's say Thorchain stumbles upon a $10 billion TLV, rune market cap is expected to be about $30 billion, could be higher for many other reasons or slightly lower, like ×2 the TLV, but that would propose a $100 RUNE.

What this entails is that RUNE has many mechanisms of growth, because judging from April 02 data where Runes liquidity was hovering around $117 million, its market cap was over $3 billion.

LP Mining

The main focus of this post is upon LP Mining, which is the act of providing LP assets to earn swap fees. Now this investment comes with its own amount of risks as it comes with a profit profile.

Imagine if centralised exchanges were to be highly investment in their users as to distributing even just a portion of their trading fees, well sorry to have you fantasize that, but DEXs do, that's the investors incentivizer for providing Liquidity. The value in this is that Dex swaps are near instant, and a much safer environment when it comes to market manipulation.

LP Mining is a great tool of empowerment to any investor, when it comes to Thorchain, there are numerous choices…

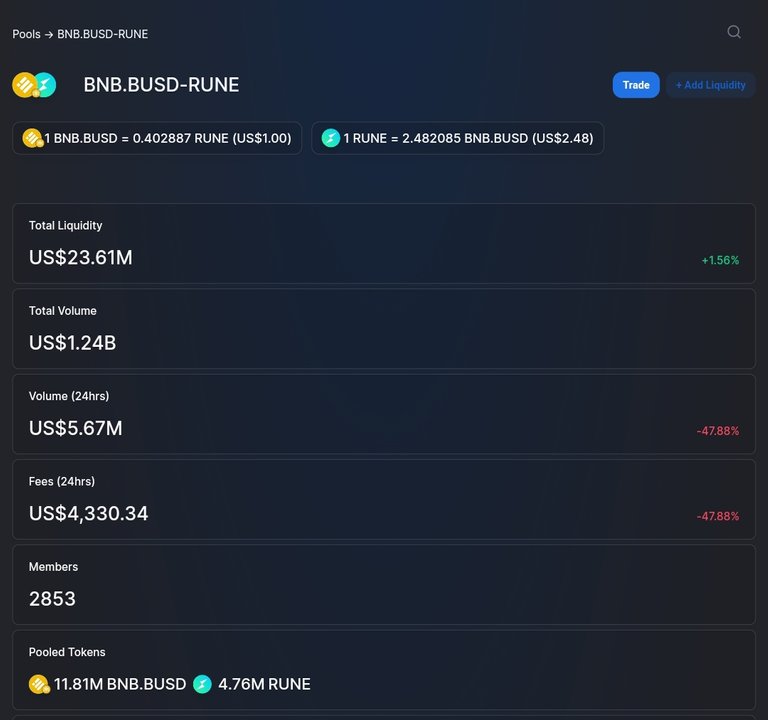

BUSD-RUNE

I personally think pools with 50% Stablecoin Assets are great, considering that it's more like a security, protecting a portion of your wealth from price volatility. The current Apy of this pool is 20%, with 2853 participants, it's quite the pool. These figures are based on the 24hrs volume which in this case is about $4,330.34.

In comparison to the USDC pool, this looked more healthy in my opinion, but a certain pool got my attention afterwards.

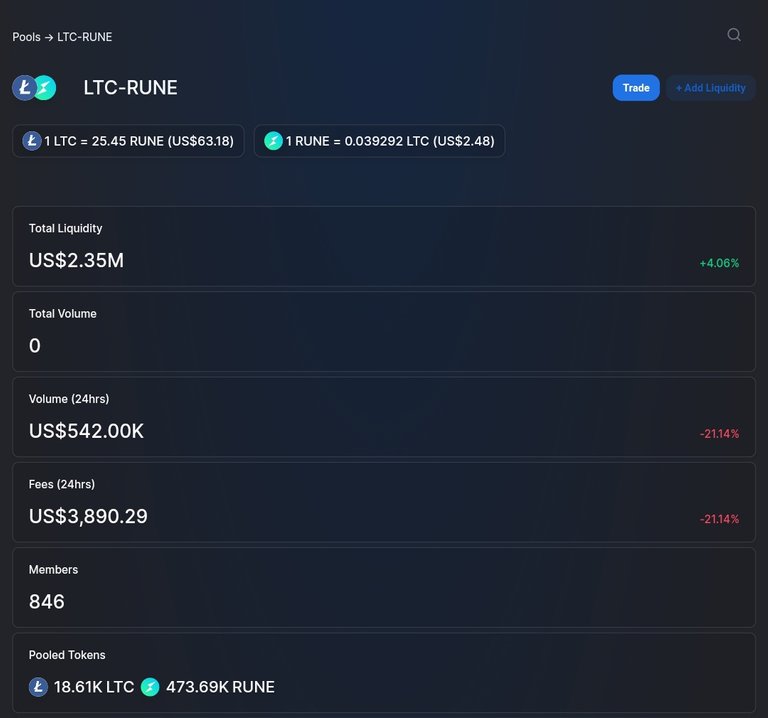

LTC-RUNE

The current APY is 35% with lower liquidity but quite an active market. When you compare the size of Liquidity here with that of BUSD-RUNE, then look at the pool fees, the pool is crazily more rewarding. I would still go for Busd pool or even USDC, I barely invest in litecoin anyways so it's definitely a speculative move.

Are you in any of these pools? What's your favourite and why? Holding any Rune? If yes, why? If no, why?

Posted Using LeoFinance Beta