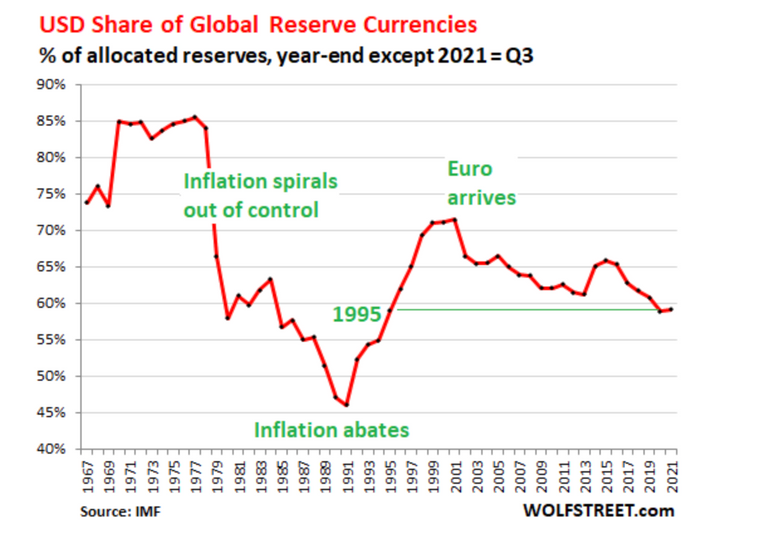

The US dollar status as a Global Reserve Currency has reached a 26 year low, meaning that its level is the same as the level in 1995. The status as a Global Reserve Currency is quantified as the percentage of the total foreign exchange reserves that are held by foreign central banks in US dollars. These dollar exchange reserves are Treasury securities, US corporate bonds, US mortgage-backed securities, and other USD-denominated assets. This percentage as of now is 59.15%.

The lowest value for this variable was in 1991, when inflation was finally under control and it was as high as 85% before the inflationary crisis that started in the late 70's. It has been decreasing steadily since 2000 when the Euro was created.

Since this variable is sensitive to inflation and because we are starting a new inflationary cycle, my opinion is that the US dollar status as Global Reserve Currency will continue to decrease.

For further reading, click here