TerraForm Labs Omnibus Update

Happy New Year everyone hope you're all enjoying the first few hours of 2025 and may you all receive good health, wealth and new comings. We've been following along with the TerraForm Labs bankruptcy case which has been publicly listed and hope to see some good outcomes for everyone.

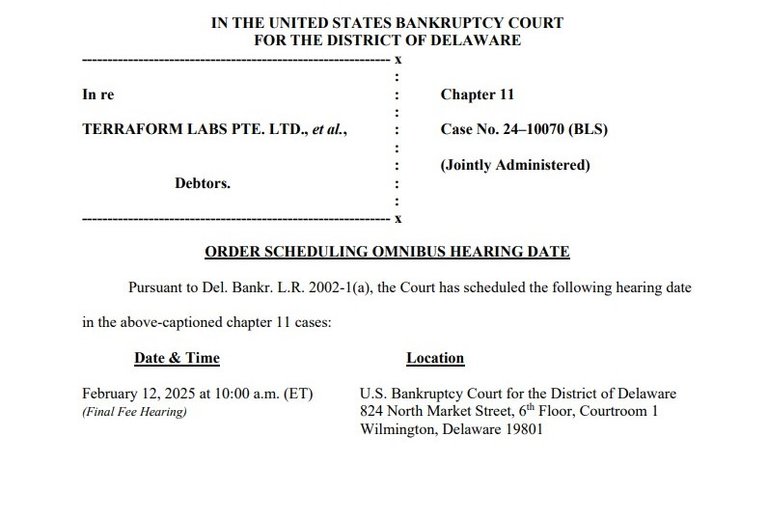

On February 12, 2025, at 10:00 a.m. (ET), the United States Bankruptcy Court for the District of Delaware will host an omnibus hearing for the Chapter 11 cases of Terraform Labs Pte. Ltd. and its affiliate, Terraform Labs Limited. This Final Fee Hearing will take place at 824 North Market Street, 6th Floor, Courtroom 1, Wilmington, Delaware 19801. The hearing marks a critical milestone in these ongoing bankruptcy proceedings, determining the resolution of several administrative and financial matters.

Case Background

Terraform Labs Pte. Ltd. initiated its Chapter 11 bankruptcy proceedings on January 21, 2024. The filing was a strategic step aimed at preserving the company’s operational capabilities and supporting the Terra blockchain community amid mounting legal and financial challenges. On July 1, 2024, Terraform Labs Limited, an affiliate, followed suit with its Chapter 11 filing. These cases have been jointly administered under Case No. 24-10070 (BLS), overseen by Judge Brendan Linehan Shannon.

The filings were driven by legal disputes, including litigation in Singapore and actions involving the U.S. Securities and Exchange Commission (SEC). So far, Terraform Labs has expressed its commitment to meeting financial obligations to employees and vendors while maintaining operations and advancing its Web 3.0 initiatives.

Key Developments so far

Administrative Expense Claims Bar Date:

The deadline for filing requests for payment of Administrative Expense Claims (excluding specific exceptions) was December 2, 2024. Any claimant failing to file by this date is barred from asserting such claims against the Debtors or the Wind Down Trust. This measure ensures that administrative matters are addressed promptly.

Rejection of Executory Contracts

Under the Chapter 11 plan, all executory contracts and unexpired leases involving the Debtors were deemed rejected as of the plan’s effective date unless specific provisions applied. Damages resulting from these rejections are treated under Class 4 (General Unsecured Claims).

Claims Deadlines

The General Bar Date for filing claims against the Debtors was August 9, 2024. Separate deadlines were established for governmental units and crypto-related claims, providing clear pathways for creditors to assert their rights.

Excluded Crypto Claims

Claims tied to digital assets associated with Terraform Labs, including those within the Terra Ecosystem, are categorized as Excluded Crypto Claims. Holders of such claims were required to file a Preliminary Crypto Loss Claim by August 21, 2024, for voting purposes on the proposed plan.

Final Fee Hearing Agenda

The February 12 hearing will address the approval of professional fees and expenses incurred during the bankruptcy proceedings. Richards, Layton & Finger, P.A., and Weil, Gotshal & Manges LLP, representing the Debtors, along with other professionals, will present detailed fee applications for court review.

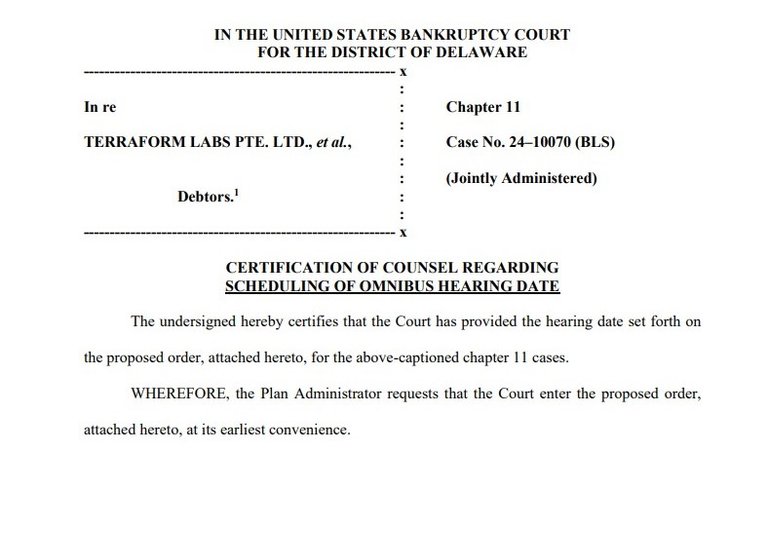

Plan Administrator's Role

The Plan Administrator has emphasized the importance of expeditious resolution in these cases. A certification filed on December 2, 2024, confirmed the scheduling of the February 12 hearing. The Plan Administrator seeks prompt approval of the proposed orders to finalize fee-related matters, ensuring a smooth transition to the next phase of the bankruptcy process.

Terraform Labs remains optimistic about its future. Since the filings, the company has:

Expanded Web3 Offerings: Acquired Pulsar Finance, a cross-chain portfolio manager and launched Station v3, a cross-chain wallet enabling seamless multi-chain transactions.

Community Engagement: Reaffirmed its commitment to the Terra blockchain community, emphasizing resilience and growth even after the Terra ecosystem’s significant setbacks.

CEO Chris Amani has highlighted the importance of these developments, stating, “This step protects our ability to continue working with the community on infrastructure, innovative tools, and other ecosystem support.”

Terraform Labs has retained a robust legal and advisory team to navigate these complex proceedings:

Bankruptcy Counsel: Richards, Layton & Finger, P.A., and Weil, Gotshal & Manges LLP.

Special Litigation Counsel: Dentons.

Singapore Counsel: WongPartnership LLP.

Financial Advisor: Alvarez & Marsal.

These experts have been instrumental in managing creditor claims, legal disputes, and operational restructuring.

What's Next For Terra Form Labs?

The February 12 hearing is a pivotal moment for creditors and stakeholders. It will address the distribution of funds, resolution of fee applications, and the broader financial trajectory of the Debtors. Stakeholders should closely monitor developments, as the court’s decisions will significantly impact their recoveries.

Creditors and interested parties can access case documents via the U.S. Bankruptcy Court for the District of Delaware’s website or the dedicated portal maintained by the claims agent, Epiq Corporate Restructuring, LLC. For assistance, inquiries can be directed to TerraformLabs@epiqglobal.com.

The Final Fee Hearing will provide a resolution for Terraform Labs’ bankruptcy cases. With strategic initiatives in place and continued focus on community support. It looks like the company aims to emerge stronger. As stakeholders await the court’s rulings, the outcomes will set the tone for Terraform Labs’ future in the blockchain industry.

image sources provided supplemented by Canva Pro Subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services.

Posted Using InLeo Alpha