What Is LeoStrategy (LSTR)

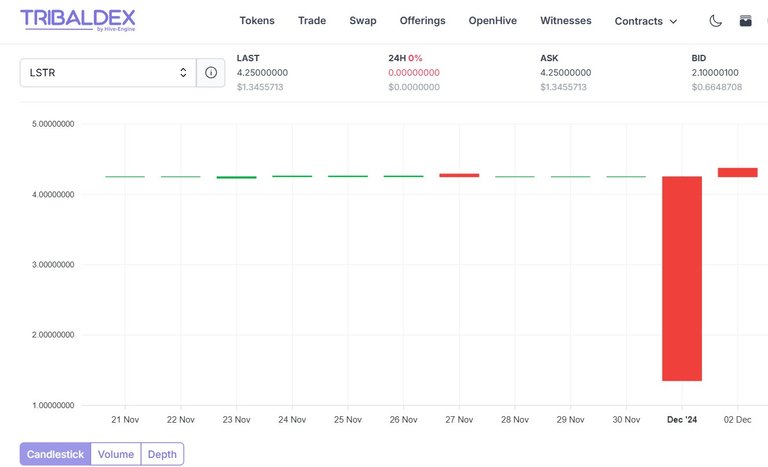

Launched 13 days ago on TribalDex is the LeoStrategy Token (LSTR) and you might be wondering what it is. So we’ve taken a deep dive into the information available to see if we can find out exactly what LSTR is.

LSTR was launched on the Hive blockchain it is designed to provide leveraged exposure to the LEO token. Based on the MicroStrategy’s approach to acquiring Bitcoin LeoStrategy adopts a similar methodology to build a robust treasury of LEO tokens.

By doing so it aims to deliver accretive value to its token holders while contributing to the long term growth of the LEO ecosystem.

As published on the @leostrategy account LeoStrategy (LSTR) is a tokenized fund built on the Hive blockchain with the primary goal of acquiring and staking LEO tokens to generate a yield of 10 20% annually. The core idea mirrors Michael Saylor's strategy of accumulating Bitcoin via MicroStrategy and positioning LeoStrategy as the "MicroStrategy of LEO."

The tokens are staked as LEO POWER ensuring that all holdings directly contribute to the growth of the LEO ecosystem. This strategic alignment provides LSTR holders with a leveraged long exposure to the LEO token’s value appreciation.

Why The Focus on Leo?

LeoStrategy’s confidence in the LEO token stems from several key factors:

Limited Supply and Adoption:

With a maximum supply of 50 million tokens LEO’s scarcity positions it as a strong candidate for long term value appreciation. Its adoption is fuelled by the INLEO Social Ecosystem and innovative revenue models.

Strategic Partnerships:

The Leo team continues to show their ability to form impactful partnerships. Notable examples include collaborations with Thorchain, Maya Protocol and Dash which has expanded LEO’s presence across diverse blockchain communities.

Over five years, the INLEO team has established its reputation as a top tier social media platform in the cryptocurrency space and ensuring continued growth and relevance.

Tokenomics of LSTR

LSTR is designed with a capped supply of 1,000,000 tokens. The initial launch released 100,000 tokens at USD 1 each and raised USD 100,000 for the acquisition of LEO. Future issuances will be strategically timed using an “At-The-Market” (ATM) strategy to raise additional funds for acquiring LEO during favourable market conditions.

Key Features

Maximum Supply: 1,000,000 LSTR.

Initial Offering: 100,000 tokens at $1 each.

Future Issuances: Controlled and randomized to maintain scarcity and align with market opportunities.

The fund leverages its LEO holdings to generate yield, which is reinvested into acquiring more LEO. This compounding mechanism builds a leveraged exposure to LEO while maintaining accretive value for LSTR holders.

LeoStrategy recently reported acquiring 42,270.145 LEO for approximately USD 2,311.71 at an average price of USD 0.0546 per token. This represents just over 3.5% of the initial token offering.

So far, each LEO purchase has been documented and published on Hive and the INLEO platform with transaction data verifiable on the Hive blockchain. This open approach ensures that LSTR holders remain informed about the fund’s performance and strategic direction.

How It Gains Value

LeoStrategy employs multiple methods to create value for its token holders:

Staking LEO:

All acquired LEO is staked as LEO POWER, generating rewards that are reinvested into acquiring more LEO.

Content Creation:

Regular blog posts and threads on Hive and INLEO generate additional HIVE, HBD, and LEO rewards. These earnings are converted into LEO and staked.

Leveraged Growth:

Over time, LeoStrategy aims to raise funds through debt instruments to further expand its LEO holdings, providing LSTR holders with amplified exposure to LEO’s price appreciation.

Impact on the LEO Ecosystem

LeoStrategy is committed to benefiting the broader LEO ecosystem. By staking a significant amount of LEO, it enhances the token’s utility and liquidity. Additionally, the fund actively supports content creators and curators within the INLEO community, rewarding those who contribute positively to the platform.

One of their initiatives involves redirecting rewards toward Threads a current popular feature on the INLEO platform. Threads incentivizes engagement and strengthens the ecosystem's overall value proposition.

The LeoStrategy team envisions a future where LEO’s market capitalization reaches USD 250 million, a significant leap from its current valuation of USD 1.25 million. Achieving this would represent a 200x increase in LEO’s price and making LSTR a highly lucrative investment vehicle for early adopters.

While it is ambitious the outlook is grounded in the Leo team’s track record of innovation and leadership. Recent integrations with Dash and Keystore provide an insight into their ability to execute strategies becoming pioneers in the Web 3.0 space.

Where to Buy

The initial LSTR offering is available for a limited time on platforms like Beeswap and TribalDEX. With only three weeks left in the sale. Early investors have the opportunity to acquire LSTR at an equivalent value of 20 LEO per token.

This limited time window is a chance to gain early exposure to a fund poised for long term growth. As LEO appreciates the leveraged exposure provided by LSTR could offer significant returns for holders.

Looks good but as always

LeoStrategy (LSTR) seems to be more than just a token by leveraging blockchain technology to create value for both investors and the LEO ecosystem. By combining innovative tokenomics, strategic partnerships and Hive’s transparency. LeoStrategy is positioning itself as the new kid on the block for decentralized finance (DeFi0.

image sources provided supplemented by Canva Pro Subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services.

Posted Using InLeo Alpha