Given the world economy's current precarious position and the spike in speculation and criticism around cryptocurrencies and blockchain technology, I took some time to consider what decision I or anybody else would make if we were to adopt one of these options as legal tender. If you're new to cryptocurrencies, this will be a brief read about money and the factors that contribute to the value of any currency, and why Hive and other cryptocurrencies can be used as monies.

Anyone who tries to pay for a product or service with a piece of paper will almost certainly encounter difficulty, unless the scrap of paper is a $100 bill. This begs the question of what makes a dollar note significantly more fascinating and valuable than other forms of paper. There isn't much you can do with the bill anyway, given that you cannot eat it, construct anything with it, or burn it (did you know it is illegal to burn money?). What is the big deal, then? Is it necessary for money to be actual paper or figures that appear in our bank apps?

It just so happens that the government prints and designates a $100 bill as legitimate currency, whereas other pieces of paper are not. However, this feature explains simply why $100 bills are legal. On the other hand, the value of a $100 note is contingent upon the quantity or scarcity of the bills, i.e., their circulation. I argue that with continuing widespread adoption and acknowledgement by governments worldwide, particularly in underdeveloped countries like mine, HIVE could easily supplant fiat money. It may take some time, but it is certainly possible.

Throughout history, the majority of currencies, including the US dollar, have been linked to precious commodities, and the quantity of currency in circulation has been determined by a government's gold or silver reserves. Then, in 1971, the United States government abolished the gold standard, ushering in the age of fiat money. This means that the US dollar and all other major currencies are not dependent on any external resource, but rather on government decisions that determine how much currency to create.

Surprisingly, none of the government's branches or tiers set these policies. Indeed, monetary policies are set by an autonomous central authority known as the Federal Reserve system, abbreviated as "The Fed" or "central banks" in the case of nations. The Federal Reserve System is composed of 12 regional banks located in major cities throughout the United States, each having its own board of governors nominated by the president and ratified by the Senate. The board is accountable to Congress, and the Fed's profits are deposited in the US Treasury.

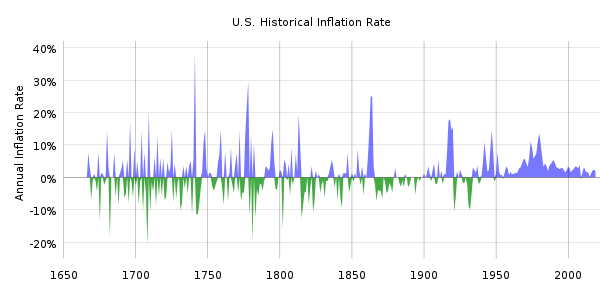

Source:The Balance by Bailey Mariner

To avoid being influenced by the day-to-day fluctuations of politics, the Fed is not directly controlled by any body of government. This enables the Fed to produce an endless number of $100 bills if necessary. This results in a flood of these bills entering circulation, diminishing their value and eventually rendering them useless. HIVE has an opportunity to make a difference in this situation. Due to the blockchain's decentralized character, this role is assigned to the code rather than a board of governors. This assures that no central authority has the power to determine how many HIVEs can be "printed" and is unaffected; the code remains true regardless of the circumstances.

After all, the aim of currency is to facilitate the exchange of commodities and services. When the overall amount of currency in circulation exceeds the entire value of goods and services in the economy, as has occurred in a number of countries worldwide, the individual bills flooding the economy can only purchase a fraction of those goods and services. This is referred to as "inflation." That sounds familiar, doesn't it? I'm sure it's occurring right now in nearly every country on Earth! Deflation, on the other hand, occurs when the supply of these bills remains constant but production of goods and services increases, resulting in an increase in the value of the individual bills.

Annual inflation (in blue) and deflation (in green) rates in the United States since 1666

Source ; Public Domain

Inflation indicates that the money in your wallet now will be worth less tomorrow, causing you to want to spend it immediately. This would promote economic activity, but it would also encourage excessive consumption or hoarding of commodities such as food and gasoline. It cascades into price increases, resulting in a cycle of consumer shortages and increased inflation. In reverse, deflation causes people to hoard their money, and a decline in consumer spending reduces corporate earnings, resulting in more unemployment and further declines in expenditure. This results in economic contraction, and most economists agree that while too much of either is harmful, a small, constant level of inflation is necessary to stimulate economic growth.

The Federal Reserve's access to huge amounts of economic data, such as inflation rates, worldwide trends, and unemployment rates, is critical in deciding the appropriate quantity of currency to circulate. This establishes the Fed as the central authority responsible for determining the value of the paper in our wallets and even our chances of acquiring or keeping a job that pays us that paper. Through the use of cryptography to secure transactions and a decentralized system to record these transactions and issue new units, HIVE empowers us to determine the value of our tokens! Not a board of governors or elected officials. A society in which businesses operate, transact, and pay with HIVE ensures that we all have true power over our economy and even our employment!

Over time, the inefficiency of fiat money will dawn on everyone, and the transition to popular use of cryptocurrencies such as HIVE as a store of value and legal tender will be tremendous, just as it was with the internet. With scalability as a primary consideration, there is no doubt that a world in which billions of people use HIVE will be significantly more economically efficient than one based on backless fiat money.

Are you beginning to see the wider picture? How might we persuade governments to abandon "independent bodies such as central banks or the Fed" in favor of more intelligent mechanisms such as HIVE and allow it to operate autonomously? I eagerly await your feedback and recommendations.

Check out more details here:

How the Value of Money Is Determined

How Currency Works

What is the Gold Standard?

Understanding Economics: Why Does Paper Money Have Value?

Understanding How the Federal Reserve Creates Money

What is cryptocurrency and how does it work?