The crypto markets continue to be a rollercoaster ride, with continual political macroeconomic tensions and regulatory concerns fuelling uncertainty. BTC and ETH have been struggling to break key psychological levels, with both BTC and ETH unable to break past key levels of $100K and $3K, respectively. Altcoins continue to face choppy behavior with many being left in the dust of the continual negative sentiment caused by Sol's meme coin casino fiasco. Another week, another coin gets dumped on retail investors -- this week round it was the Argentinian president's turn to be involved in another meme coin rug pull.

Meanwhile, TradFi markets remain unstable, which only adds to the overall cautious sentiment in crypto. Investors in both TradFi and crypto are hesitantly waiting for something to push the markets into a clear uptrend. Amidst this, the sentiment around splinterlands and SPS has been positive and we starting to see some glimmers of hope in the splinterlands ecosystem with a very positive town hall this past week. Let us break down the numbers and see where things stand.

SPS Weekly Performance Overview

SPS started the week at $0.006564 (Feb 14) and closed at $0.006796 (Feb 20), which is a small increase of 3.5%. The SPS overall trend remains in the same tight range that it has been trading at for the past month, but this slight increase may hint at some interest from external buyers.

- Opening Price (Feb 14): $0.006564

- Closing Price (Feb 20): $0.006796

- Weekly High: $0.006809 (Feb 17)

- Weekly Low: $0.006564 (Feb 14)

While this may seem like a small increase, this price action does indicate that SPS is testing the upper resistance levels again. What does it indicate though -- a real breakout or another fake out?

Market Cap & Trading Volume

SPS's market cap fluctuated throughout the week, starting at $3.21M on Feb 14 and closing at $3.26M on Feb 20. Trading volume did decline when compared to previous weeks, but it does show that there is buying interest, but not just enough to break through key resistance levels.

- Market Cap (Feb 14): $3.21M

- Market Cap (Feb 20): $3.26M

- 24H Trading Volume High: $83.8K (Feb 19)

- 24H Trading Volume Low: $64.6K (Feb 20)

Support & Resistance Levels

SPS continues to hold firm for well-tested support and resistance levels that it has established in this tight range:

- Key Support: $0.0066 -- This level has held multiple times, and SPS has consistently bounced from it. If it breaks, we could see a drop toward $0.006.

- Key Resistance: $0.0068 -- This level has been tested but not broken. A move above it could push SPS toward $0.0070-$0.0071, which would be the real test of bullish strength.

SPS continues to remain range bound the past week, and if the majors rally past their respective key resistance levels, then SPS could break above $0.007.

What to Watch for Next Week

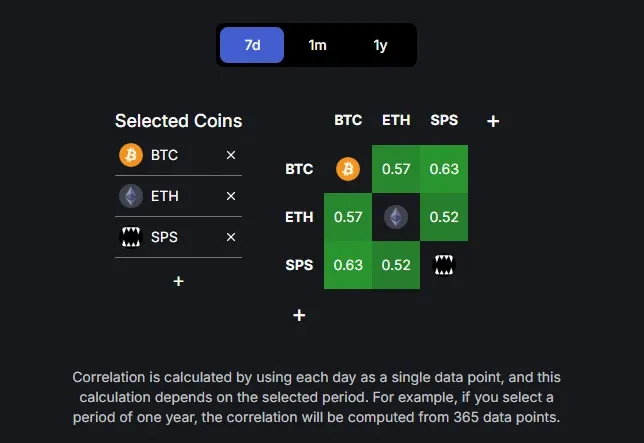

- SPS remains closely correlated with BTC and ETH. If BTC pushes toward $100K, altcoins like SPS could see a strong bounce.

- For SPS to break $0.0068 and hold, we need to see stronger volume pushing it higher.

Concluding Thoughts

SPS continues to show resilience, but it needs a solid breakout to shift sentiment from cautious to bullish. If it cracks $0.0068-$0.007, we could see more momentum toward $0.0075 and beyond. However, if support at $0.0066 fails, then a retrace to $0.006 could be on the cards. For now, the trend remains neutral to slightly bullish, but the next few days will be crucial in determining SPS's short-term direction.

Will we see a breakout, or will resistance hold firm? Keep an eye on the charts.

Are you new to splinterlands and want to learn to play the game? Check out my Ultimate Guide to Splinterlands: A Collection of Articles and Guides. If you enjoy reading my splinterlands content, please follow and support me by signing up to playing splinterlands through my affiliate link: https://splinterlands.com?ref=mercurial9.

Thank you for reading and hope you have a good rest of the day!

Follow me on these other platforms where I also post my content: Publish0x || Hive || Medium || Twitter || Torum

Posted Using INLEO