This past week, the cryptocurrency market showed signs of renewed volatility, reflecting a mix of optimism and caution among people. BTC and ETH showed steady recovery driven by increased institutional interest. Altcoins, on the flipside failed to capture liquidity and trading volumes with many memecoins and mid-cap altcoins continuing to struggle. However, SPS the past week showed more resilience in relation to other altcoins. Let's delve into the performance of SPS over the last seven days.

SPS Price Trends and Key Metrics

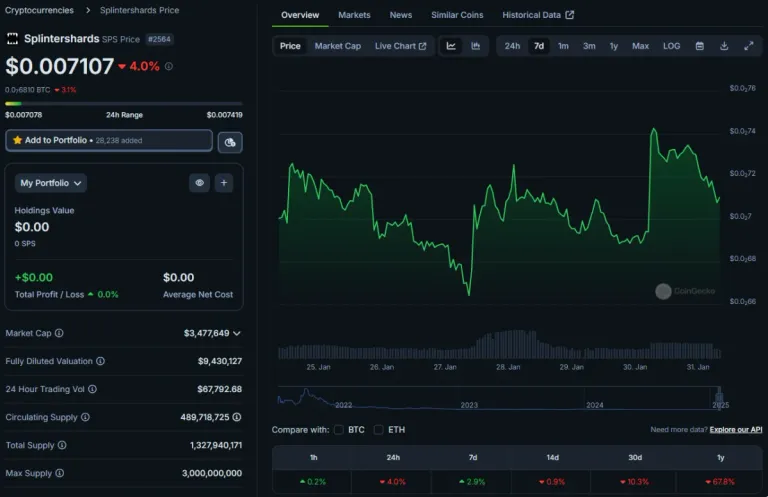

SPS began the week on January 24 at $0.00688 and closed on January 30 at $0.00717, reflecting a modest price increase of 4.2%.

Key Data Points:

- Opening Price (Jan 24): $0.00688

- Closing Price (Jan 30): $0.00717

- Weekly High: $0.00725 (Jan 27)

- Weekly Low: $0.00675 (Jan 26)

The token's market cap ranged from $3.31 million to $3.56 million during the week. While trading volume peaked on January 28 at $217,892 mostly likely related to the BTC and ETH crypto markets price action.

Support, Resistance, and Price Behavior

Throughout the week, the $0.00675 level acted as a strong support, holding firm during periods of downward pressure. This level, especially on January 26, proved important when SPS briefly dipped but found renewed buying interest. On the resistance side, $0.00725 continues to be a ceiling with price action failing to break past this level despite multiple attempts.

Volume Trends and Market Sentiment

Daily trading volumes for SPS ranged between $62,000 and $217,000, with the highest activity observed on January 28. This surge in volume coincided with broader market pumps, as BTC and ETH showed signs of recovery during the weekend. However, overall sentiment remains cautious for altcoins like SPS.

What to Watch for in the Week Ahead

Looking forward, there are several key areas to watch for SPS:

- Price Action at Critical Levels: Support at $0.00675 and resistance at $0.00725 will remain crucial in determining SPS's short-term trajectory. A break above resistance could signal renewed buying interest and pave the way for higher highs.

- Trading Volume: Consistently low volumes historically often precede significant price moves. It will be important to monitor volume activity on SPS as it may provide indications of potential breakouts or breakdowns.

- Broader Market Sentiment: BTC and ETH price actions will remain a correlated influence on altcoins like SPS. Any bullish price movement in these major crypto assets may provide the necessary bump for SPS to break past the $0.01 barrier.

Concluding Thoughts

The past week show that positive signs that SPS continues to navigate a volatile crypto market with relative stability. While the token remained range-bound between its key support and resistance levels, it showcased resilience amidst broader market uncertainties. The slight uptick in price and trading volume toward the end of the week may hint at improve conditions the following week, but as always I will need to monitor volumes and resistance and support levels, while monitoring the broader crypto environment sentiment.

What's your outlook on SPS for the week ahead? Share your thoughts in the comments below!

Are you new to splinterlands and want to learn to play the game? Check out my Ultimate Guide to Splinterlands: A Collection of Articles and Guides. If you enjoy reading my splinterlands content, please follow and support me by signing up to playing splinterlands through my affiliate link: https://splinterlands.com?ref=mercurial9.

Thank you for reading and hope you have a good rest of the day!

Follow me on these other platforms where I also post my content: Publish0x || Hive || Medium || Twitter || Torum

Posted Using INLEO