https://images.inleo.io/images/mercurial9_h5Zy79kbGnMe1EFC.webp

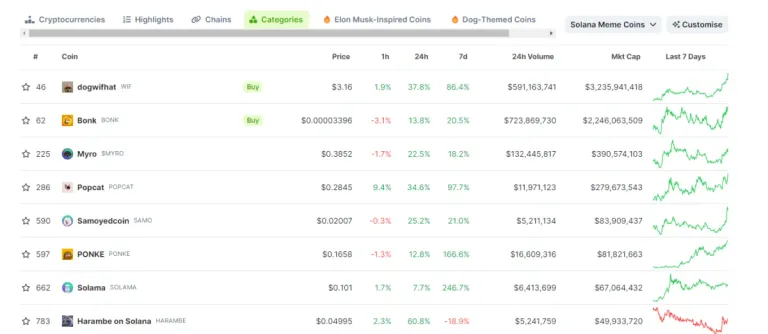

It might feel odd to approach splinterlands from an investment standpoint, but in the realm of Web 3.0, players often seek opportunities beyond their normal day-to-day, hoping for financial rewards inherent in the crypto ecosystem. Why should discussing the potential returns available in splinterlands be seen as a taboo topic when we witness Solana Memecoins ranking in the top 100 market cap? If this isn't a glaring indicator of the bull market, then what is?

Crypto Cyclical Patterns

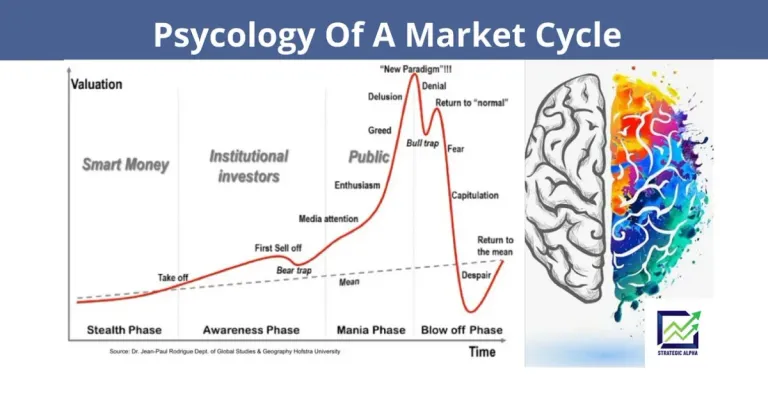

How do these Memecoins garner such attention, with some tokens boasting market capitilization surpassing $1 billion and witnessing daily volumes in the millions or billions? It's simple---majority of them are showcased to the masses through centralized exchanges (CEXs). By being readily available on these platforms, the masses, driven by FOMO and herd mentality, will invest in whatever is trending upward. I'm no seasoned trader, psychologist, or economist, but observing the cyclical patterns in the crypto space since 2016 suggests that the masses generally:

- Don't fuss too much with analyzing financial data or delving into the fundamentals of traditional finance businesses (TradFi).

- Utility -- what does it matter? As long as lines go up.

The accessibility of crypto trading through CEX websites and mobile apps, coupled with the option for leveraged trading, has democratized the investment and trading process. For years, TradFi trading was reserved for registered brokers, but the advent of crypto - the playing field has been leveled and allowing anyone to participate.

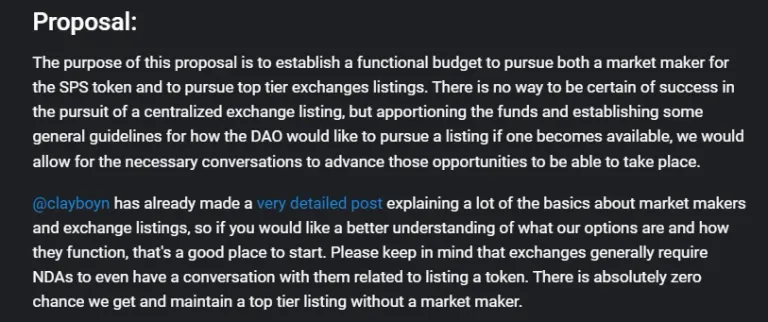

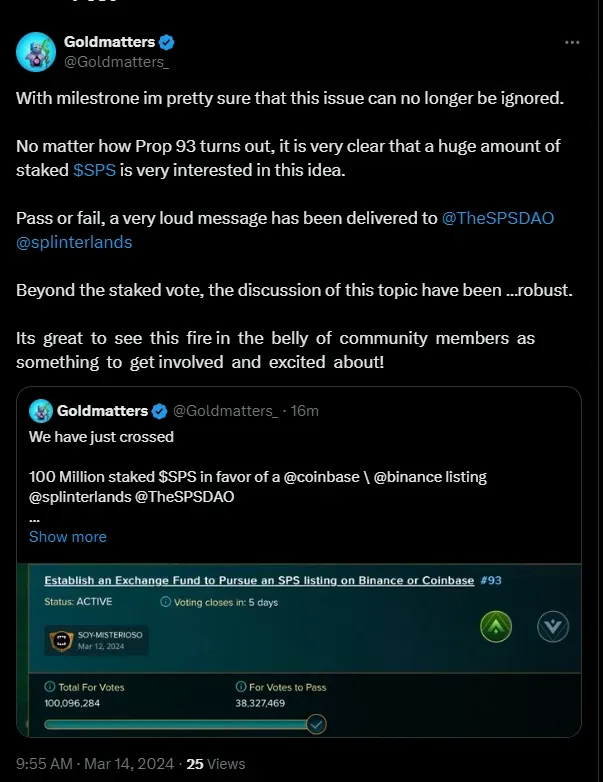

Yet, amidst all this, the question arises: Why isn't the splinterlands community rallying behind DAO proposals to secure a listing on a CEX? Vocal community members, particularly those on X (formerly Twitter), have been advocating for this for some time now - take @goldmatters, for instance.

Sure, I get the concerns that people may use this as an opportunity to dump their bags, but listing on a CEX would also inject liquidity into the splinterlands ecosystem. It might even attract new players to the game, encouraging them to stay longer. Many who joined during the 2021 NFT bull run departed when the bear market hit the ecosystem. However, this is typical of parabolic rises leading to inevitable regressions. However, as a community, we must embrace this as an opportunity to onboard new players and welcome them to the community. In the end, we are all wanting similar things -- for the game to succeed.

Jungles of Thece Land Update and SPS 100k Target

The past week has been relatively quiet, with only two claims on the Land plots. As the season draws to a close in the next day or so, we anticipate an uptick in numbers. However, the payback period and APRs have slightly dipped due to a decrease in SPS price over the past week (from $0.0299 to $0.0293).

Land Overview

- Total Spent: $267.524

- Amount Regained: $5.26 (179.66 SPS post-tax) (+$0.40)

- Payback Period: 8.34 years (-0.17 years)

- Annual Percentage Rate (APR): 99% (-0.25 %)

SPS Staked

- SPS Staked: 56896.32 (+ 1503.831 SPS)

- Progress to 100k target: 56.89% (+ 1.5 %)

Are you new to splinterlands and want to learn to play the game? Check out my Ultimate Guide to Splinterlands: A Collection of Articles and Guides. If you enjoy reading my splinterlands content, please follow and support me by signing up to playing splinterlands through my affiliate link: https://splinterlands.com?ref=mercurial9.

Thank you for reading and hope you have a good rest of the day!

Follow me on these other platforms where I also post my content: Publish0x || Hive || Medium || Twitter || Torum

Posted Using InLeo Alpha