There's the optimist. There's the pessimist. And then there's the realist.

Realistically, real estate is not improving in 2023. In fact, there will be a fairly significant decline in the market. For those that bought at the inflated prices of 2021 and most of 2022, there will be serious heartache.

Expect a 10% to 25% decline in property values in 2023.

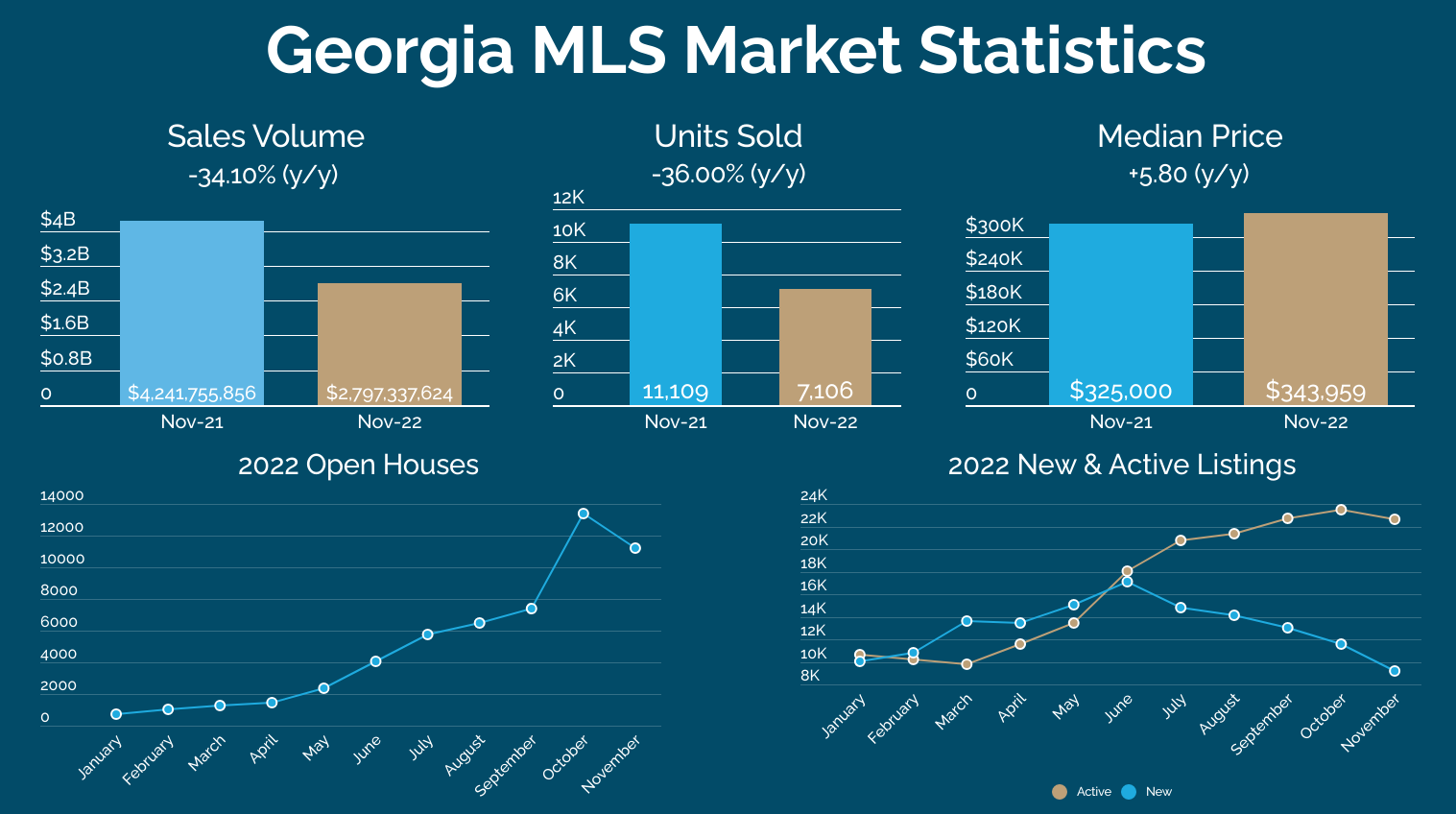

image courtesy of GAMLS.

image courtesy of GAMLS.

There's a few important facts from the chart above. First we are looking at the Georgia, USA real estate market. Sales volume is down 34% and more importantly the number of units sold is down 36%.

When units sold drops, that means one of two things: Demand is reduced or supply increased. In this case, we look at the 2022 new versus active listings in the chart above. Notice that new listings are on the decline for the last six months. That means there are fewer people interested in selling their home or fewer new homes coming to market. Normally, a decline in supply would indicate a shortage and thus prices would rise. That's what happened in 2021 and half of 2022.

But the other element that is very important is the number of active listings in 2022. According to GAMLS, the amount of active listings on the market as of the end of November 2022 increased by 76.7% from November 2021 and the amount of units sold decreased by 36.0%. That means there are lots more homes sitting unsold on the market. Even if new listings are declining, the demand for homes is so low that inventory is increasing.

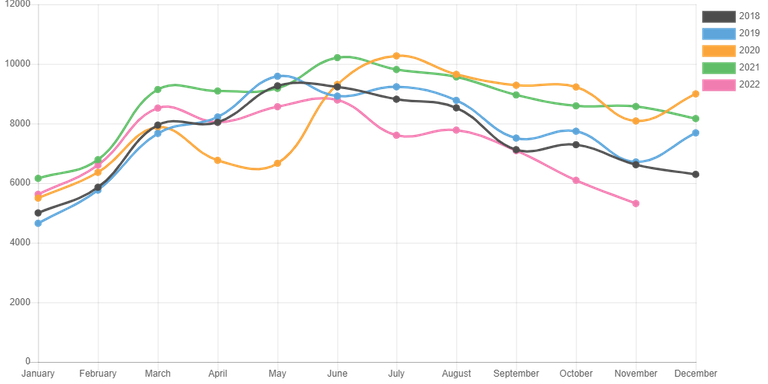

Residential Units Sold - Year Over Year

Image courtesy of GAMLS.

Image courtesy of GAMLS.

Check out the chart above and watch the pink line, that's 2022. It started really hot. Only 2021 was hotter, and 2021 was red hot! But in June 2022, home sales hit the skids. And for the second half of 2022, fewer homes are being sold than any other time in the last five years.

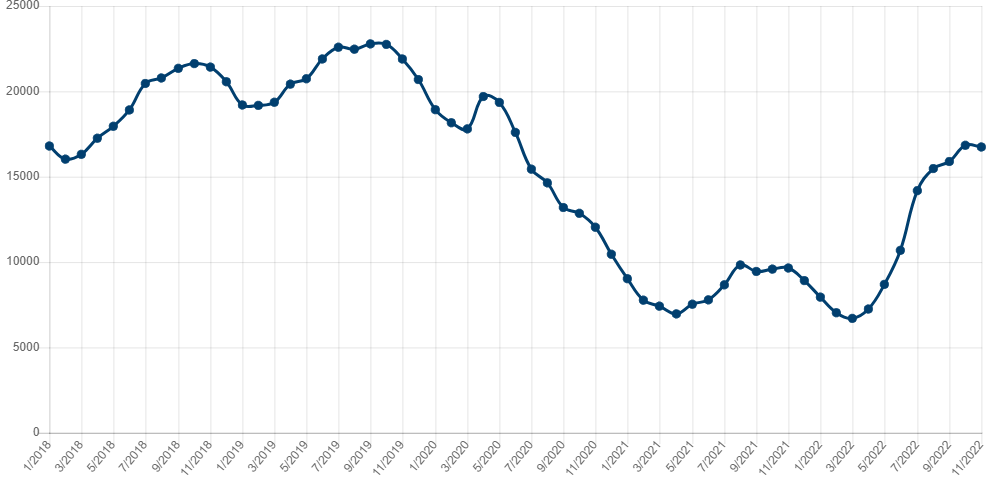

Active Residential Listings - 2018 - Present

Image courtesy of GAMLS

Image courtesy of GAMLS

The graph above is pretty important. This is the number of available homes. Demand was super high in 2020 and 2021, so there were few homes available. That's cooled off and the inventory is quickly rising. In the next six months, the number of active listings will reach up to or surpass the numbers in 2018. Why? New construction was started in the last two years based on the demand of the last two years. There's plenty of new subdivisions under construction. The money has been borrower by builders and developers. Those homes are being built at a fast and furious pace. New homes will flood into the spring market in 2023.

But there will not be a demand for those homes!

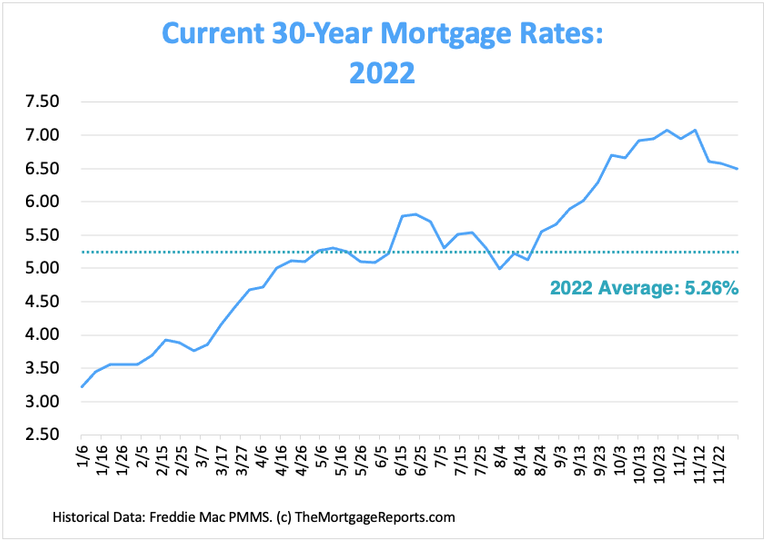

Why not? Because most buyers are not cash buyers. They are borrowers and the cost of borrowing is significantly higher now than two years ago.

The interest on buying a home has doubled in 2022. That reduces the number of buyers; and the buyers remaining in the market cannot afford as expensive homes as those buyers did in 2021.

The Federal Reserve has indicated that it will raise its rates through the spring. Mortgage rates will continue to climb as well. Which means, fewer qualifying buyers in a market that is quickly becoming overstocked with unsold homes.

And what happens when inventory stacks too deep? Prices will drop. And as prices drop, appraisals will be lower which will spiral the price of the next month's homes even lower. The spiral will continue through most of 2023.

So what should a buyer or a seller do?

If you are seller, understand that the home needs to be priced appropriately at the time of listing. Homes that are overpriced will not move. Price the home 5 to 10 percent below the current market price. Current market price is based on historical data, which trails actual price.

If you are a buyer, negotiate the best price possible. Ask that the seller buy down the interest rate for you. That will give you a couple of years of lower interest. Also, be patient, prices are declining so a similar home you see in January will be 10 to 20 percent less by July or August.

And finally, if you are a homeowner that purchased in 2020, 2021 or early 2022, then don't worry that your home is worth less than you paid for it. That's temporary, prices will rebound in 5 to 10 years.

Thanks for reading. Charts and graphics are credited. Thoughts and predictions are my own. Remember, Free Advice is worth what you paid for it!

Posted Using LeoFinance Beta

Posted Using LeoFinance Beta