Crypto Market Reacts to U.S. Employment Data Amid Bitcoin's Price Drop:

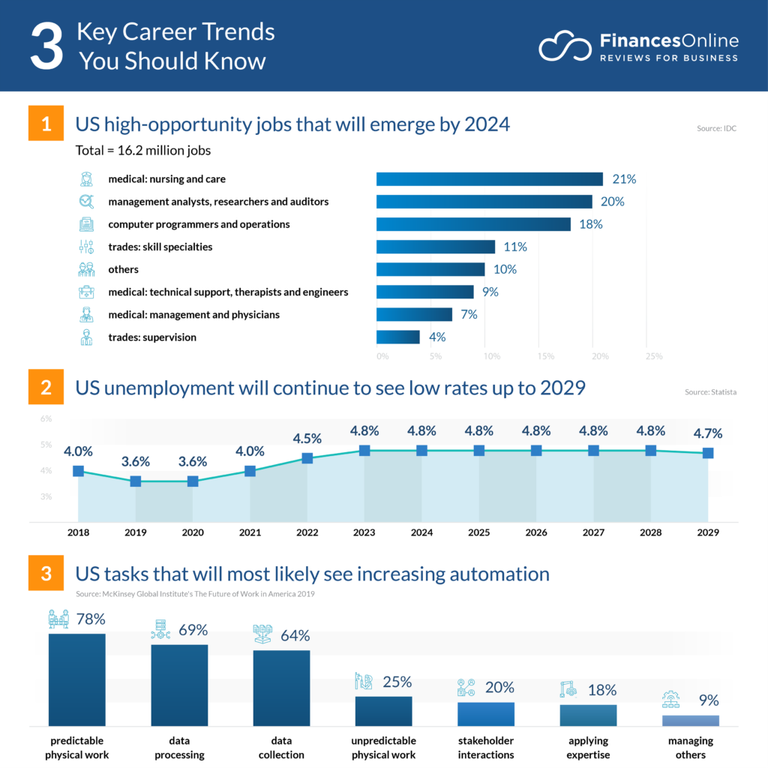

Recently, Bitcoin (BTC) fell to $55,000, leading the broader cryptocurrency market into negative territory. Now, attention has shifted to the latest U.S. employment data, a key economic indicator. The August 2024 report delivered mixed signals: unemployment fell to 4.2%, down from 4.3% in July 2024 but up from 3.8% in August 2023. This reduction suggests an improvement in the labor market compared to the previous month, although unemployment remains higher than last year.

Why Does This Matter?

The U.S. employment data is crucial because it will significantly influence the Federal Open Market Committee (FOMC) meeting on September 18. During this meeting, the Federal Reserve (Fed), led by Jerome Powell, will decide whether to cut interest rates. A rate cut typically benefits riskier assets like cryptocurrencies, as lower rates reduce the opportunity cost of holding non-yielding investments. However, the market is split on how this will impact Bitcoin.

Diverging Predictions on Bitcoin's Future:

While some expect a rate cut to be favorable for Bitcoin and the broader crypto market, other predictions suggest the opposite. Analysts from Bitfinex warn that a significant rate cut, particularly one as large as 50 basis points, could result in a 20% drop in Bitcoin's value. Their reasoning is that a sharp rate cut may signal deeper economic concerns, leading to risk aversion among investors.

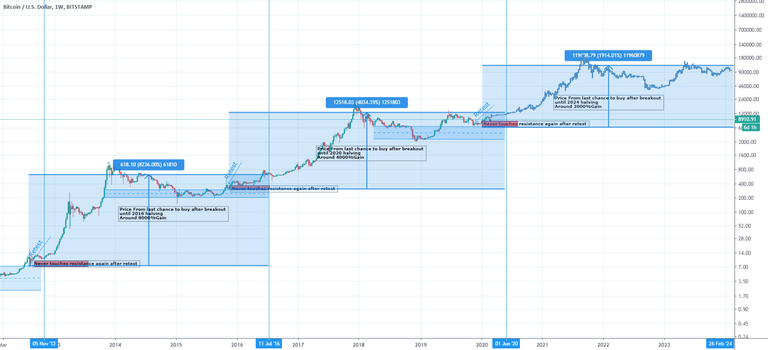

Bitcoin's Current Market Trends:

Following the release of the employment data, Bitcoin briefly rallied to $57,000, showing initial optimism in the market. However, this recovery was short-lived, as the price quickly reversed, dropping to around $54,000. This sudden shift highlights the ongoing volatility in the crypto space, and traders are urged to approach with caution.

The fluctuations were expected, as major economic announcements often trigger market turbulence. Investors should remain vigilant and exercise prudence, given the uncertainty surrounding upcoming economic decisions.

Key Takeaways:

U.S. Employment Data Insights:

The unemployment rate fell to 4.2% in August 2024, signaling some labor market improvement compared to the previous month. However, it remains higher than a year ago, reflecting ongoing economic challenges.FOMC Meeting and Rate Cut Implications:

The employment data will play a significant role in the Fed's decision on whether to cut interest rates on September 18. While a rate cut could favor cryptocurrencies, analysts caution that a large reduction might negatively impact Bitcoin.Bitcoin's Price Volatility:

Bitcoin initially surged to $57,000 following the news but quickly fell back to $54,000. This rapid turnaround underscores the market's fragility and the importance of careful monitoring.Market Caution Advised:

Given the potential for further price swings and the upcoming FOMC decision, investors are advised to proceed with caution.