The U.S. Securities and Exchange Commission (SEC) has issued a warning that it may challenge the proposed repayment plan of the bankrupt cryptocurrency exchange FTX if it involves returning funds to creditors using stablecoins. In a filing submitted to the U.S. Bankruptcy Court in Delaware on August 30th, SEC attorneys indicated that while repaying creditors with stablecoins isn't entirely illegal, the agency reserves the right to dispute such repayments if they involve cryptocurrencies pegged to the U.S. dollar.

SEC's Concerns Amidst FTX's Efforts to Compensate Creditors

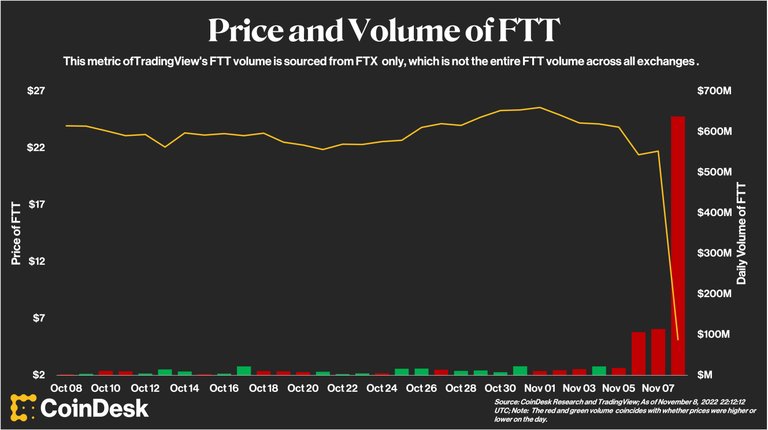

The SEC's stance emerges as FTX, following its catastrophic collapse in November 2022, continues to explore various avenues to compensate its creditors. FTX has considered multiple strategies, including a now-abandoned plan to revive the exchange. The latest proposal involves liquidating assets and paying out claims based on the dollar value of these assets at the time of the exchange's bankruptcy. According to this plan, creditors would be reimbursed either in cash or stablecoins.

However, the SEC's filing underscores that the agency has not taken a definitive position on the legality of these transactions under federal securities laws and maintains the right to contest transactions involving crypto assets. The SEC also pointed out that the current repayment plan has yet to designate a "distribution agent," a firm that would oversee the distribution of funds to creditors in either cash or stablecoins.

Criticism from the Crypto Community

The SEC's position has drawn criticism from prominent figures within the cryptocurrency community. Alex Thorn, head of research at Galaxy Digital, and Paul Grewal, chief legal officer at Coinbase, both publicly criticized the regulator's approach. Thorn accused the SEC of "overreaching its jurisdiction," especially considering that the agency dropped its case against Paxos, the issuer of Binance USD (BUSD), in July. Grewal echoed these concerns, arguing that the SEC's threats undermine market clarity and stability.

Scrutiny of the SEC's Regulatory Approach

The SEC itself is facing growing criticism over its "regulation by enforcement" approach to the cryptocurrency industry. Critics argue that the SEC has opted to pursue legal actions against major players in the sector rather than establish a clear regulatory framework for cryptocurrencies.

In a notable development, a coalition of seven U.S. states has banded together to challenge the SEC’s regulatory actions. Led by Iowa Attorney General Brenna Bird, the states have filed an amicus brief arguing that the SEC's attempts to regulate cryptocurrencies constitute an overreach that would stifle innovation, harm the crypto industry, and exceed the agency's authority. In addition to Iowa, the coalition includes Arkansas, Indiana, Kansas, Montana, Nebraska, and most recently, Oklahoma.

Earlier this year, SEC Commissioner Hester Peirce acknowledged that the agency is currently operating in an "enforcement-only mode" when it comes to regulating cryptocurrencies. This admission further fuels concerns that the SEC's heavy-handed approach may be stifling the growth and innovation of the cryptocurrency sector, rather than providing a clear and supportive regulatory environment.