A recent study by accounting automation firm Dancing Numbers estimates that former U.S. President Donald Trump’s proposal to replace federal income taxes with tariffs could generate lifetime savings of at least $134,809 for the average American. The savings could rise significantly—to $325,561 per person—if state-level wage-based income taxes are also abolished, the report highlights.

States with High Tax Burdens Stand to Gain the Most

The study suggests that individuals residing in states with high tax burdens—such as New Jersey, New York, Connecticut, Illinois, and Massachusetts—would reap the most substantial benefits from the proposed tax relief. By eliminating both federal and state income taxes, these residents could retain a greater portion of their earnings, potentially redirecting those funds into investment and economic growth.

20% Tax Refund as a Precursor to Full Income Tax Repeal

Dancing Numbers founder Punit Jindal proposed that the initiative could begin with a 20% “DOGE Dividend” tax refund, allowing taxpayers to experience immediate financial relief before the complete repeal of federal income taxes takes effect.

Trump initially introduced the idea of abolishing federal income taxes in October 2024, advocating for a tariff-based revenue system. He drew historical comparisons to the 19th-century U.S. economy, which relied heavily on tariffs before the advent of permanent income taxation.

In a recent appearance on The Joe Rogan Experience, Trump reiterated that tariffs historically contributed to American economic independence and prosperity.

Economic and Market Implications of the Proposal

Supporters argue that eliminating income taxes could stimulate financial markets, as consumers and investors would have more discretionary income to allocate toward assets, potentially driving up prices. Proponents further assert that the plan could offset potential cost increases resulting from retaliatory trade tariffs imposed by other nations.

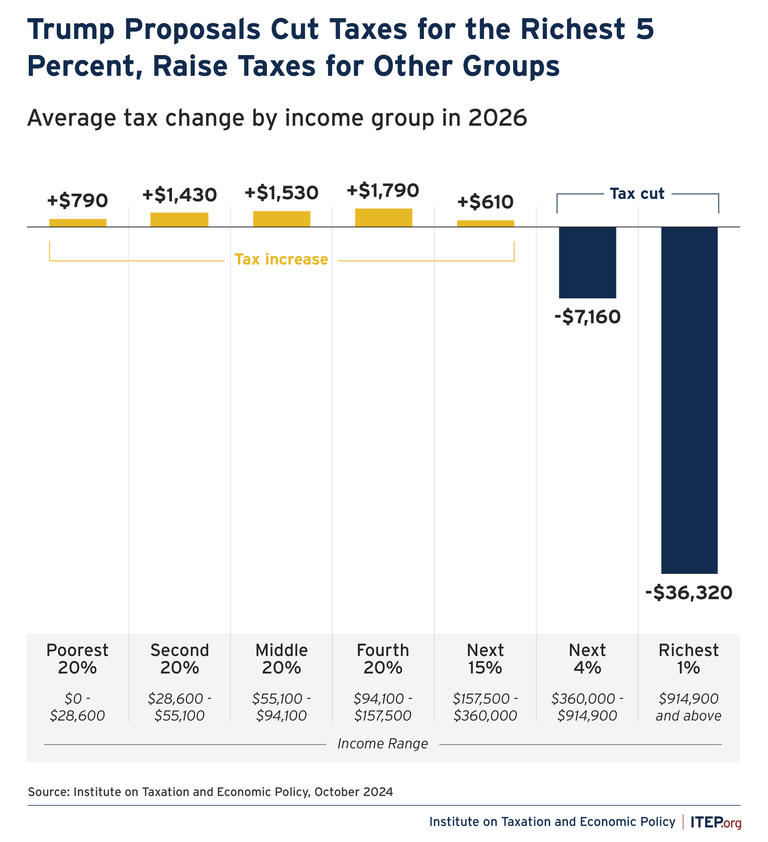

However, critics caution that shifting government funding to tariffs alone could lead to elevated consumer prices for imported goods, disproportionately impacting middle- and lower-income households.

Newly appointed Commerce Secretary Howard Lutnick, who was confirmed in February 2025, reinforced Trump’s vision by proposing the replacement of the Internal Revenue Service (IRS) with an “External Revenue Service” focused on collecting tariffs.

“At the start of the 20th century, America was the wealthiest nation on Earth, protecting its workers with fair trade policies,” Lutnick stated. “Now, politicians overspend and demand more from taxpayers every year—this plan seeks to reverse that trend.”

Crypto Industry Reacts to Trump’s Ambitious Digital Asset Plans

Coinbase CEO Brian Armstrong recently noted that Trump’s crypto-related initiatives have sparked widespread interest and speculation throughout the financial and tech sectors. Speaking about his experience at the World Economic Forum (WEF) in Davos, Armstrong revealed that discussions among major market leaders were overwhelmingly centered on Trump’s stance on digital assets.

“Nearly every conversation I had with key financial figures revolved around what the Trump administration intends to do with crypto,” Armstrong remarked. He emphasized that Trump’s decisive vision is encouraging industry players to act swiftly to avoid being left behind in an evolving regulatory and economic landscape.

During the WEF, Trump pledged to position the United States as the “world capital of artificial intelligence and crypto.” This declaration, one of his first major policy statements since assuming office on January 20, has set a transformative tone for the industry.

Armstrong commended Trump’s market-oriented approach, along with the leadership of Argentina’s President Javier Milei and El Salvador’s President Nayib Bukele, for championing economic freedom and technological innovation. Among Trump’s speculated initiatives is the creation of a Strategic Bitcoin Reserve, though his most recent executive order suggests a broader and more comprehensive vision for digital assets and blockchain integration.

As the regulatory and economic landscapes continue to shift, both traditional investors and crypto enthusiasts are closely monitoring how these proposed tax and trade policies will shape the future of U.S. finance and global market dynamics.