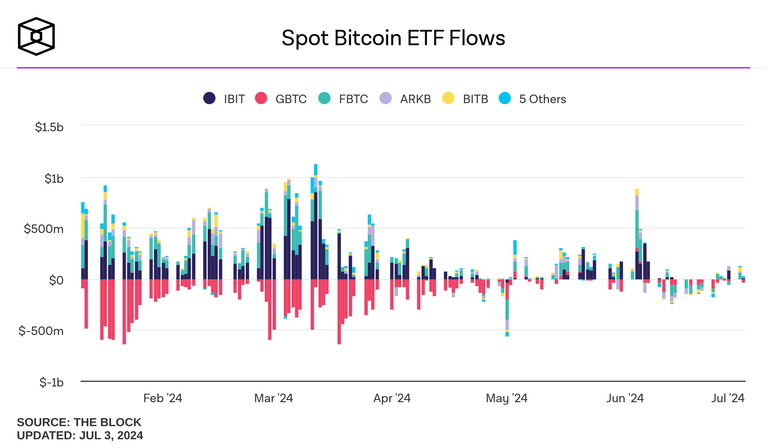

Significant Inflows on July 1st

On Monday, July 1st, Bitcoin spot ETFs saw significant net daily inflows of $129.45 million, marking the fifth consecutive day of positive flows. According to SosoValue, this is the highest level of inflows since June 7th. Leading the pack was Fidelity's FBTC, which attracted $65 million, followed by Bitwise's BITB with $41 million, and ARKB from Ark Invest and 21Shares with $13 million in net inflows. Invesco, Galaxy Digital, VanEck, and Franklin Templeton also reported modest inflows ranging from approximately $5 million to just under $5 million.

Market Performance and Trading Volume

Interestingly, the two largest Bitcoin spot ETFs by net asset value, BlackRock’s IBIT and Grayscale’s GBTC, did not report any inflows on Monday. Collectively, these 11 Bitcoin spot ETFs generated around $1.36 billion in trading volume on that day. Since their inception in January, Bitcoin spot ETFs have accumulated a total net inflow of $14.65 billion.

Digital Asset Investment Products See Outflows

Conversely, digital asset investment products as a whole experienced outflows for the third consecutive week, totaling $30 million. However, the outflow rate has significantly decreased compared to previous weeks, according to a recent CoinShares report. While most providers reported minor inflows, Grayscale saw substantial outflows amounting to $153 million.

Trading volumes for digital asset investment products increased by 43% from the previous week, reaching $6.2 billion, though still below the year-to-date average weekly volume of $14.2 billion. Geographically, the U.S., Brazil, and Australia saw inflows of $43 million, $7.6 million, and $3 million, respectively. In contrast, Germany, Hong Kong, Canada, and Switzerland experienced outflows of $29 million, $23 million, $14 million, and $13 million, respectively.

Ethereum and Other Altcoins

Ethereum registered the largest outflows since August 2022, with $61 million exiting last week, bringing the two-week total to $119 million. This makes Ethereum the worst-performing asset in terms of net flows year-to-date. Meanwhile, multi-asset and Bitcoin exchange-traded products (ETPs) recorded inflows of $18 million and $10 million, respectively. Short-Bitcoin ETPs saw outflows of $4.2 million, indicating a potential shift in market sentiment. Additionally, several altcoins, including Solana and Litecoin, experienced notable inflows.

Bullish Outlook for Bitcoin in July

Analysts at QCP Capital are bullish on Bitcoin for July, citing historical performance and seasonal trends. In a recent Telegram post, they noted that Bitcoin typically performs well in July, with a median return of 9.6%, especially after a negative June performance (-9.85%). The analysts observed that option flows last Friday were positioning for a bullish end to the month, possibly anticipating the launch of an Ethereum spot ETF.

QCP suggests a potential trading strategy involving a BTC accumulator expiring on September 20, 2024, over a 12-week period. This strategy involves purchasing Bitcoin below $60,000, capitalizing on a false breakout of this level and the anticipated bullish momentum. The strike price for this operation is set at $59,000, with a barrier at $71,000, meaning the trade would be capped if Bitcoin exceeds this threshold.