Image source: https://mobile.twitter.com/metfi_dao

When I get in touch with people offering me extraordinary results. At first I become suspicious and then I start cross-checking the information.

A few weeks ago, this “business” had been proposed to me and, as always, I did my research and decided to share it with you because I found some relevant information.

What is MetFi?

MetFi defines itself as a decentralized autonomous organization (DAO) that aspires to be the world’s best Metaverse and Web3 incubator.

The main offer revolves about a huge APY on your crypto holdings. You have to buy MetFi NFTs, which are accompanied by MFI tokens. If you hold those tokens and you don’t sell them, you can earn up to 1000% APY.

It means that in theory you should be able to multiply your money 10 times in a single year.

Is MetFi legit? Can you really earn that much money in an automatic way?

To answer this question we should look for sources on how MetFi generates returns. At the moment I haven’t found any official reports on that, so we don’t know anything about that yet. The reason that makes me suspicious is that the yields are very unsustainable based on the business that should generate them.

What is very curious is to see how many of the promoters are former promoters of other famous defaulted companies such as Hyperverse/Hyperfund or Onecoin.

I found out about it because I saw on social media some former Hyperverse promoters who are now promoting MetFi and also participated in a private training with a major European leader just to launch the project.

According to https://behindmlm.com/mlm-reviews/metfi-review-1000-a-year-nft-cash-grab-ponzi-scheme/, it appears from an August update that former OneCoin promoters such as Staffan Liback and Stephan Steinkeller also attended conferences and meetings. The Youtube videos from which the site took the screenshots appear to be gone, but for more details try reading in the link above.

What do you do to get started in MetFi?

MetFi immediately requires you to set up an account to earn massive profits. You come across multiple videos and guides in their website, explaining how it operates. MetFi requires you to purchase NFTs via BUSD. In return, receive a complimentary MFI token which stays in your wallet, accumulating massive profits (something similar happened also in Hyperverse). There is no data explaining any assets you purchase or products available for investment. How it manages to generate profits in your wallet is also questionable.

Despite representations nobody is running MetFi, MetFi’s owner(s) communicate to investors through a Discord chat group.

MFI tokens

MFI tokens are minted out of thin air to fuel the MetFi ecosystem. You can trade tokens on LBank and PancakeSwap.

Image Source: https://coinmarketcap.com/it/currencies/metfi/

These exchanges are based on liquidity pools that people need to provide liquidity.

Have you heard of the rug pull in the crypto world?

Most of the time this happens when scammers use their useless tokens to remove all liquidity from the pool. The same can happen to MFI at any time. Metfi is the issuer, so they can basically take any amount, dump it on a decentralized exchange and let the value of the MFI collapse, while effectively removing liquidity from all pools.

This kind of token remind me the famous Hyperverse token HVT…all of promoters said it was sustainable…well, let’s see what’s happened:

source: coinmarketcap.com

Seems like it collapsed.

I mentioned the Hyperfund collapse in my “ScamBuster — Hyperfund Review”, one year ago, and it seems like my crystal ball worked fine.

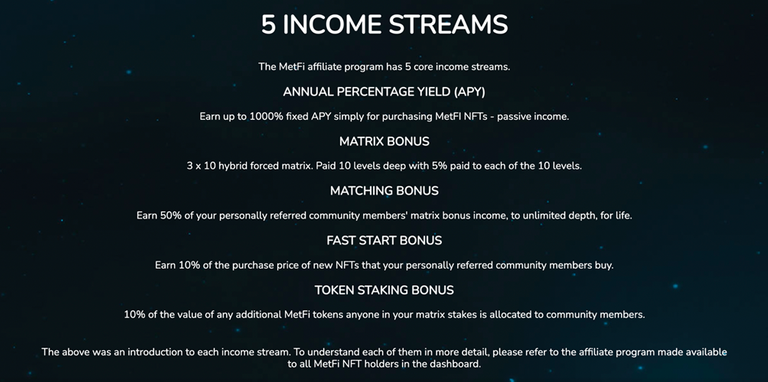

MetFi’s Compensation Plan

Image source: https://metfi.io/earn-program

MetFi runs a ten-tier investment scheme in Binance USD (BUSD). BUSD is the Binance stablecoin represented to be pegged to the USD.

MetFi’s ten investment tiers are:

Shrimp: 100 BUSD

Crab: 200 BUSD

Octopus: 400 BUSD

Fish: 800 BUSD

Dolphin: 1600 BUSD

Shark: 3200 BUSD

Orca: 6400 BUSD

Whale: 12,800 BUSD

Whale Shark: 25,600 BUSD

Humpback: 51,200 BUSD

These tiers correspond with NFT investment positions.

When a MetFi affiliate invests, they receive a set amount of MFI tokens. MFI tokens are then parked with MetFi on the promise of an annual ROI, calculated and paid daily.

Shrimp tier: receive $10 worth of MFI tokens, invested on the promise of a 100% annual ROI.

Crab tier: receive $20 worth of MFI tokens, invested on the promise of a 200% annual ROI.

Octopus tier: receive $40 worth of MFI tokens, invested on the promise a 300% annual ROI.

Fish tier: receive $80 worth of MFI tokens, invested on the promise of a 400% annual ROI.

Dolphin tier: receive $160 worth of MFI tokens, invested on the promise of a 500% annual ROI.

Shark tier: receive $320 worth of MFI tokens, invested on the promise of a 600% annual ROI.

Orca tier: receive $640 worth of MFI tokens, invested on the promise of a 700% annual ROI.

Whale tier: receive $1280 worth of MFI tokens, invested on the promise of an 800% annual ROI.

Whale Shark tier: receive $2560 worth of MFI tokens, invested on the promise of a 900% annual ROI.

Humpback tier: receive $10,230 worth of MFI tokens, invested on the promise of a 1000% annual ROI.

MetFi do not publish the current internal MFI trading value on their website.

The MLM side of MetFi pays on recruitment of affiliate investors. Note that while MetFi solicits investment in BUSD, MLM commissions and bonuses are paid in tether (USDT).

Fast Start Rewards

Fast Start Rewards are paid out during a newly recruited affiliate’s first thirty days. To qualify for Fast Start Rewards, a MetFi affiliate must recruit at least five affiliates who’ve invested at tier 4 or higher (Fish Tier).

Once that condition is satisfied, and if an affiliate is still within their first thirty day period, they receive a 10% Fast Start Reward on all BUSD invested by personally recruited affiliates.

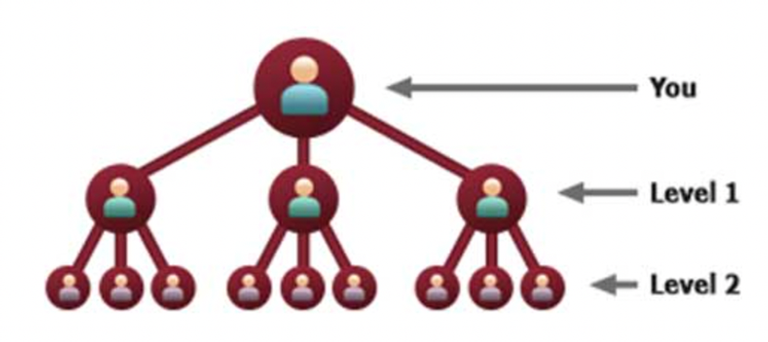

Residual Commissions

MetFi pays residual commissions via a 3×10 Matrix. A 3×10 Matrix places an affiliate at the top of a matrix, with three positions directly under them: These three positions form the first level of the matrix.

The second level of the matrix is generated by splitting each of these three positions into another three positions each (9 positions).

Levels three to ten of the matrix are generated in the same manner, with each new level housing three times as many positions as the previous level.

Each MetFi investment tier corresponds to its own 3×10 matrix tier, resulting in ten 3×10 matrix tiers in total. Positions in each matrix are filled via direct and indirect recruitment of affiliates who have invested in that particular investment tier.

Image Source: https://sites.google.com/site/programmaairbitclub/

For each person recruited into a MetFi affiliate’s matrix (on any tier), the receive:

5% of the BUSD invested; and 1% of any additional MFI token investment made at time of BUSD investment.

Note that MetFi affiliates only earn on matrix tiers they have personally invested on.

Matching Bonus

MetFi affiliates earn a 50% match on residual commissions and daily ROI amounts paid to personally recruited affiliates.

To qualify for the Matching Bonus, a MetFi affiliate must recruit five affiliates who’ve all invested at tier 4 or higher (Fish Tier).

How will MetFi move forward?

This is a good question. Until MetFi proves the sources of its investment returns, it looks like new investors’ money is being used. Since there are no official financial reports it is difficult to have an official answer but some assumptions can be made.

In any case you can be quite sure that it’s almost impossible for any crypto project in the world to be able to generate you 1000% ROI guaranteed every year.

*Remember Terra Luna and Celsius? *Despite billions of dollars flowing through their projects they were not able to sustain 19% yearly and crashed. So, how can MetFi sustain these mega high APY?

To make MetFi look better, for 5 years 25,005 LP tokens valued at about $2.5 million were locked to a smart contract on June 9, 2022. But locking worthless tokens doesn’t mean anything.

Their marketing

Image source: https://metfi.io/earn-program

Like all of this kind of “high APY projects”, bets everything on guaranteed ease of gain and high returns. All in a passive way without doing anything.

Nice, isn’t it? Who wouldn’t want to make 10x every year without doing anything?

Then they leverage the marketing plan of networking, which is necessary to greatly increase earnings.

The target audience is always the same. People new to the industry or complete strangers who have a few or no skills and trust friends, family, etc.

Usually, big leaders who already have networks in other projects, are called in first to promote these new projects. In MetFi we can find former leaders of OneCoin, Hyperverse, Meta Utopia for example.

My final thoughts

Until MetFi proves with official and audited reports the source of the rewards given to promoters and investors, I have decided to stay away. So far it can be assumed that it may be another Ponzi scheme because there are many red flags in common with these schemes.

When we get in touch with new investment opportunities we always ask:

Where does this money come from? Is the return sustainable? Do they always guarantee it or is it variable?

These are just some of the questions that might help you understand the sustainability or legitimacy of the project.

With this article, I hope to have clarified the MetFi issue a bit more. We must always pay attention and try to verify as best as possible all the investment opportunities that are presented to us, to avoid falling into possible scams and never see our money again.

Let me know what you think about it in the comments below.

For any questions, write them in a comment, I’ll reply to all of them!

See you at the next review!