The market has put every trader under two sovereign masters-- Profit and Loss. I am sure almost all traders in their lifetime have had an affair with profit and loss. Loss is always unpleasant and could be unhealthy, market has given you a tool to cut short the loss, i.e. Stop Loss.

The human tendency is always to obtain Profit and avoid loss as much as they can. Therefore the balance of Profit over loss is the ideal measuring unit to define a successful trader. The balance goes positive for a successful trader and the balance goes negative for an unsuccessful one.

Just like Profit and loss, the cycles, i.e. Bull and Bear cycles have become an inevitable and inalienable phenomenon of crypto ever since its inception, in fact, these cycles are so prominent and so prolific that, we all have a strategy to wait for that event to mature and prepare for the next one.

While the traditional market is on the brink of recession, the crypto market has been permeating a bear cycle for the last couple of months. Although a bull cycle is a condensation of accumulation of Hodling and a spark of sentiment in favor of upward revision, in terms of making money bear cycle is no less than a viable opportunity as long as your strategies & compliance with the defined action plan hold good.

Let's see how in the simplest possible way, in fact, in a layman's way we can make the most out of the bear cycle.

(1) Trade HBD with lowest possible risk

If you are Hiver, HBD should be your love, that's the most fertile coin, both in the context of fixed return, i.e. 20% APR in saving account, and in the context of floating return through trading.

By definition, HBD is a stablecoin, which means it is supposed to remain pegged around 1 USD. But in reality, it trades around 1 USD with a slight deviation of +/- 5% most of the time. And that's the catch, in fact, that's the market-making opportunity HBD offers.

I would substantiate this with data. How HBD has performed over the last three months, what exactly the range and how should you trade this coin to maximize your chance to earn a decent income with minimal to no risk.

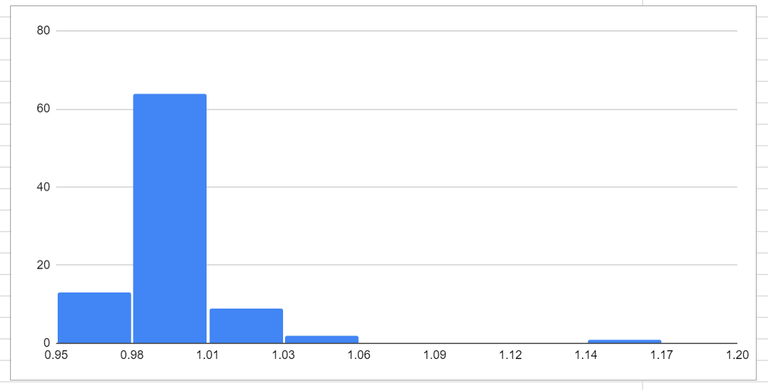

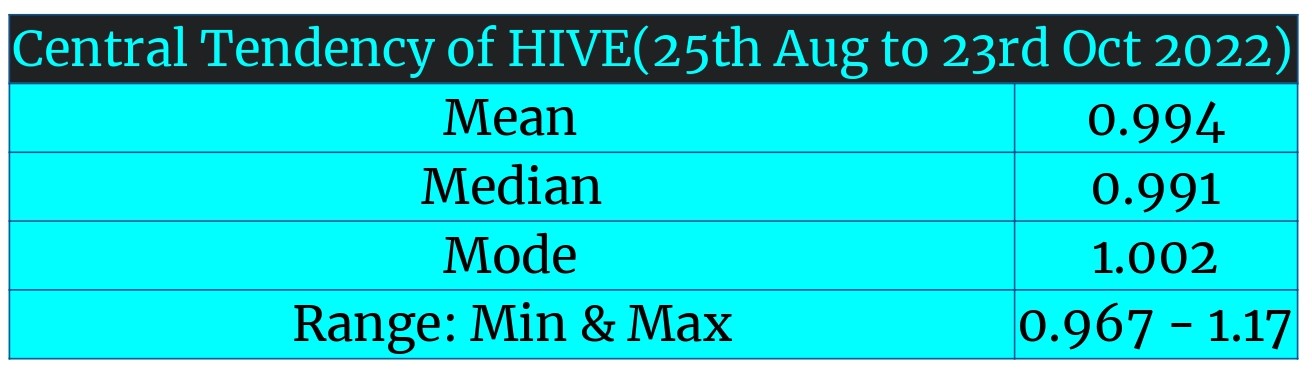

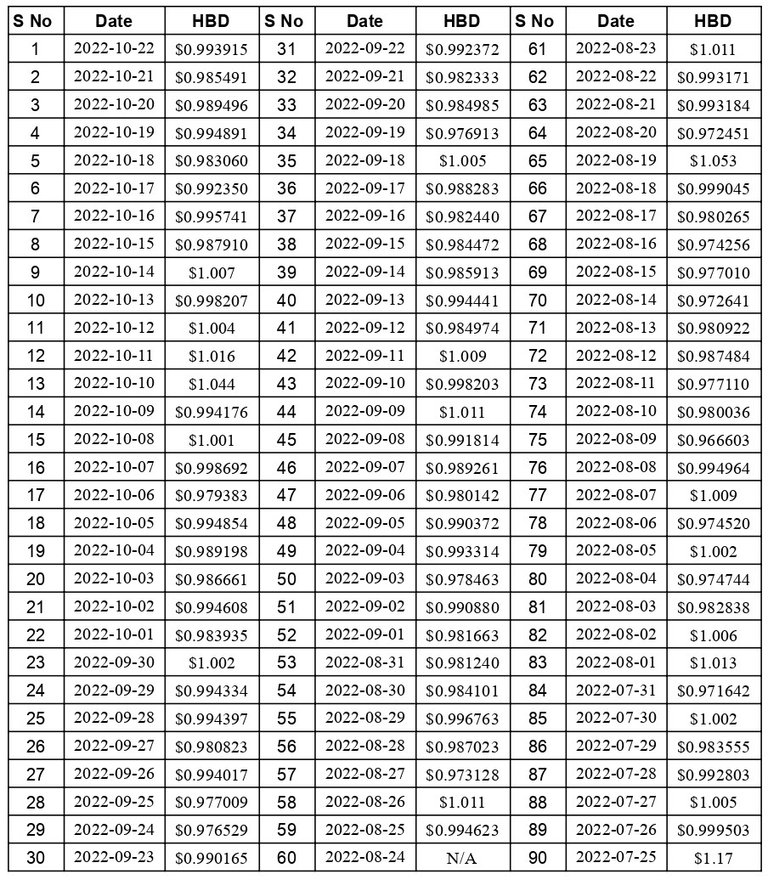

I have extracted the data of HBD and plotted its central tendency. Let's have a look.

The last 90 days range is 0.967-1.17 for HBD.

The most frequent range of HBD during this period is 0.98-1.01 with a total count of 64. In other words, in the last 90 days, this range has got repeated 64 times. So this one is the most reliable range during this period.

Now if you trade with 100 USD and try to play this range: Buy at 0.98, and sell at 1.01, then you will make 3 USD and since this range has been repeated 64 times, you can potentially make 64x3= 192 USD. So with just 100 USD capital, you can potentially make 192 USD profit in 90 days.

(2) If you wanna trade with minimal risk, always trade well-saturated and established coins-- BTC, ETH, etc

A well-saturated and well-established coin is defined by these things:-

- Since how long have they existed

- What is the market cap and their percentage

- Are they growing in terms of market cap on a YoY basis

If you have all three boxes ticked then it implies that they have a better adoption rate and their penetration rate is too big to fail. Such coins may not offer you a big return in a quick time, but they definitely won't liquidate you like LUNA or any other shit coin.

BTC, ETH, etc are classic examples of well-saturated and well-established coins, in fact, they are the flag bearer of the crypto sphere.

Source: Coingecko

Take the example of BTC, here the pair has been trading in a tight range for quite some time. The range is precisely 18500 to 20400. You can take advantage of this range. Just buy it every time it hits the floor and sell it when it hits the ceiling of this range.

(3) Identify & analyze the range in the top 10 coins in terms of market cap, and target that range to make profit

In the bear cycle, the coins generally plunge and sit at the low and they generally form a narrow range at the bottom and keep on consolidating there.

Taking advantage of such a development, we first need to identify that range within which the coin is oscillating then simply we can buy the bottom and sell the top within the narrow range and keep on repeating there, and generate surplus value in this bear cycle.

Source: Coingecko

But why the top 10 coins? Ans- Becuase they have better liquidity at any given time, and they have an established reputation sitting at the top 10, it's very likely that they dont produce any distorted outcome independently, if at all the market condition worsens, they will underperform collectively, not singularly. So always pick a coin with better liquidity.

(4) Inject your surplus value into DeFi, target stablecoins; farming-- e.g. Cubfinance

You put a certain amount into trading and generate a certain amount on a regular basis. The outcome(profit) should further be put into a suitable stablecoin and set them in farming in a suitable DeFi.

But why? Becuase you already expose your asset in to risk trading, therefore any profit you generate should not be risked again, rather they should be as stable as possible. So better go for DeFi and Stablecoin farming.

There are many DeFi options, and you can do adequate research to choose the best DeFi for your asset. One good DeFi you all are familiar with is Cubdefi.

Source: Cubdefi

Here you can see both Stblecoin-speculative coin pair and stablecoin-stablecoin pair, and I think both are lucrative as they all offer more than 30% APR, which is indeed very healthy return.

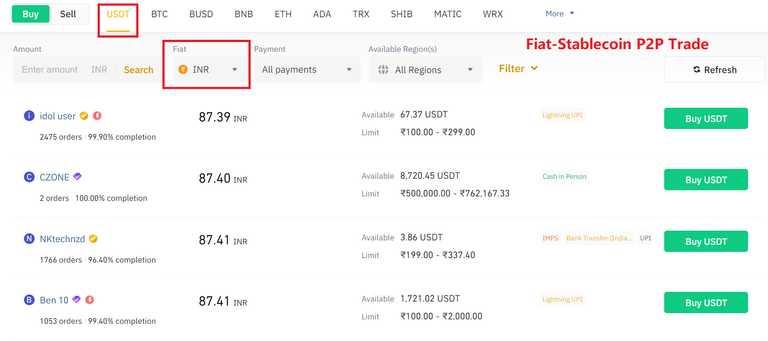

(5) Do P2P trade(Binance, Huobi, etc) to earn passive income daily

Fiat trading is one of the best and low-risk strategies to earn daily income. Binance, and Huobi are some of the best-centralized platforms to trade your fiat currency with stablecoins and earn daily income.

As long as you offer competitive prices, you stand to get more users willing to trade with you and your business will grow over time.

Source: Binance

But I would also add a caveat, make sure you comply with your country's regulatory requirement, and make sure you pay the tax as defined. Don't try to evade it, in most countries, there is no such clearly defined regulatory framework. So better if you act proactively and comply with your country's law, you can run a good business out of P2P trading.

Conclusion

No trading strategy is sacrosanct. The emphasis should always be less risky and long haul approach. TA trading requires very precise and advanced skill to accommodate with and may not suitable for all. Therefore the less risky approach and the layman approach by trading the range is something more general than other kind of trading. Taking advantage of the range in a bear cycle could earn you decent return.

Disclaimer:- This article is intended for educational and analytical purposes only. It should not be construed as financial advice. Thank you.

Posted Using LeoFinance Beta