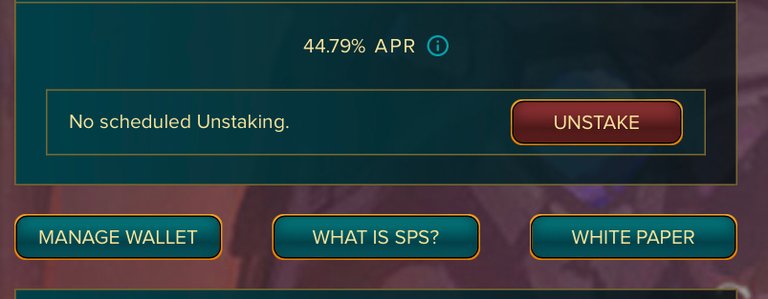

Whoever says DeFiis dead know not what they say. I was strolling around my Splinterlands dashboard today and I saw that staking $SPS was giving a yield of 44% APR, it seems like some stakers are unstaking perhaps to prepare for Riftwatchers leaving more yield on the table for the remaining stakers to earn from.

I wonder how much more the APR will grow before the sale of Riftwatchers is over. Then I continued hovering around my dashboard till I found myself at the pools section and saw some yield offers that were unbelievable. Offers as high as 79% at the time of writing this post especially in pools of tokens I’m really bullish on.

Ofcourse the first pool to catch my full attention was the Hive/SPS pool offering 79% APR. Almost double what’s on staking only SPS 🤩, the idea is to select two tokens which you are bullish on and pair them together, that way, in a bullish market, you earn more on both tokens, while in a bear market, such APR will like make up for impermanent losses, for me, at this moment, Hive and SPS are top choice.

There are other interesting offerings in the BNB, ETH and DEC pools with the highest being 82% APR. This is basically money on the table for anyone with liquid assets in any of these tokens. Some people will boldly claim that DeFi is dead and most DeFi apps are broken and interestingly, these sort of people are usually the loudest.

DeFi within a game is GameFi yeah? Or perhaps GameFi touches upon every financial interaction within the game, anyhow it is, Splinterlands offers the best GameFi protocol in Web 3 and that’s on that. If you know any better, I’ll be stoked to hear it. Are you taking advantage of these pools? I totally am.

Posted Using LeoFinance Beta