FED did not change the interest rate as expected at yesterday's meeting. FED Chairman Powell's statements were perceived positively by the market for the first time in a long time. Powell did not change his rhetoric, and his slight lowering of the hawkish tone was enough for the market to get excited. The FED may not increase interest rates at the December meeting either because futures pricing shows that the probability of an interest rate increase at the next meeting has fallen below 20 percent.

Bitcoin

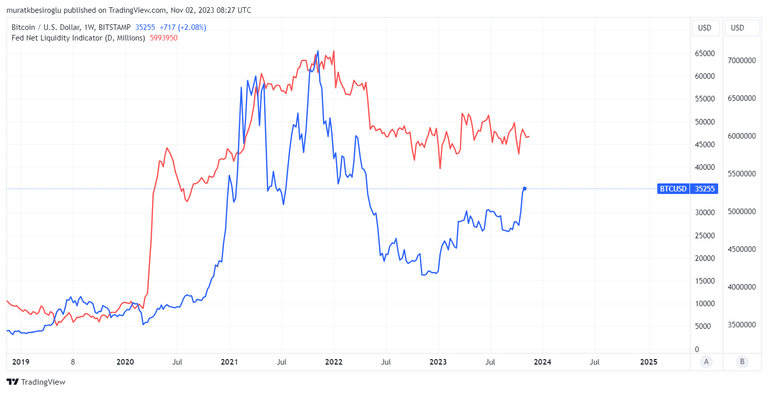

Bitcoin price continues to be strong. What are investors who did not like the $16k Bitcoin price last year thinking now? The price is above 35k, and the weekly RSI is as high as 70. In the chart below, the blue line shows the Bitcoin price, and the red line shows the Fed net liquidity.

Net liquidity decreased from $7 trillion to $6 trillion in the first half 2022. Since then, liquidity has remained flat. And in 2023, Bitcoin is in a significant uptrend. The increase in Bitcoin's share in the crypto market was effective in this rise. Bitcoin dominance has increased from 40% to 54% in the last 12 months. Will it rise further? %53-%54 were the support levels in dominance in 2017, 2018, and 2019. Could the same area be the resistance level this time? I believe we have reached a saturation point in Bitcoin dominance because the long-term trend of Bitcoin dominance is negative.

Stock Markets

Stock markets, which can be a reference for crypto, have been in a downward trend since July. We see lower highs and lower lows in the Nasdaq 100 and S&P 500. Could we come to an end to this downward trend? While the FED balance sheet shrinks, treasury expenditures increase. There is an election in the USA next year, and economic management will avoid being restrictive. The 4100-4200 range on the S&P 500 is a strong resistance zone. Because when the price reached this range, we encountered a substantial purchase. Sales in Nasdaq 100 may continue for a while, but if there is a positive outlook in S&P, Nasdaq 100 will also rise over time.

Crypto Total Market Cap

One of the arguments of analysts who were pessimistic about crypto was that the total market value of crypto could not exceed the peak it saw in April. Yesterday's rise allowed the crypto total market cap to surpass the previous peak. Thus, the argument that no new money entered the crypto market was weakened. We are in a transition period where the bear market is over, but the bull market has not yet begun. Rumors that altcoins will make a final bottom are losing credibility as time progresses. On the other hand, it may take time for the market to go up.

TL;DR

Bitcoin continues its strong course. Bitcoin dominance reached 54%, with an increase of 14 points in the last 12 months. It would be a surprise if Bitcoin's share in the crypto market increased further. Altcoins may get a larger share from the possible rises in the future. Although the FED balance sheet is shrinking, net liquidity remains flat. If investors start putting their aside funds into crypto, we may see positive price movements.

Stock markets have been in a downward trend since July. We may be nearing the end of this decline. In the chart below, the red line shows net liquidity and the blue line indicates the S&P index. In the graph, we see that S&P tracks net liquidity. The S&P has recently become more in line with net liquidity, so the possibility of new declines has diminished.

Bitcoin is 120% above its November 2022 low. Altcoins are around 25% above their bottom levels. As confidence builds in the market, altcoins will close the gap. However, this movement may take a long time to occur. Therefore, dollar cost averaging (DCA) seems to be the most suitable investment strategy.

Thank you for reading.

Image Source: Midjourney App