The predictability of crypto price movements amazes me. The source of predictability is previous market cycles. I was in the "this time will be different" camp. However, the predictions made with reference to the previous bear markets were correct.

We must credit him: Analyst Youtuber Benjamin Cowen's predictions were correct. For example, he said that the recovery in the crypto market will take a long time. And he said that Bitcoin would rise in 2023 and outperform alts. He predicted that the FED would act decisively on rate hikes.

On the other hand, some of the predictions made by Benjamin Cowen on his channel named Into The Crypto were not correct. For example, he could have foreseen the strong performance of Ethereum in the bear market. He thought Bitcoin would be alone in this regard. He also announced late that we entered the bear market in 2022. In the first quarter of 2022, he still had hope for the market.

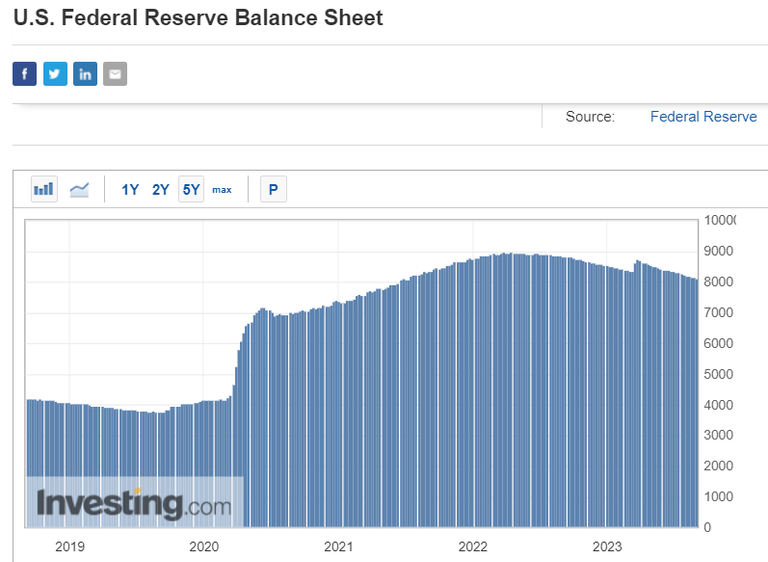

Benjamin Cowen predicted that altcoin prices would see new lows. This prediction turned out to be correct for some altcoins. Many altcoins, including Hive, have reached the bottom they saw in 2022, but they have not broken these levels down yet. However, it seems that we will see new bases in altcoins. The Fed continues to shrink its balance sheet. The chart below shows that the FED started the balance sheet reduction operation in the first quarter of 2022. The weekly data announced yesterday confirmed that the balance sheet reduction continues.

Although the Chinese central bank has taken expansionary steps recently, more liquidity is needed to rally the crypto market. The recovery of the crypto market is dependent on falling inflation in advanced economies.

Benjamin Cowen based his predictions on the Fed's actions and what happened during the 2018-2019 bear market. The chart below shows the crypto market's total value evolution from 2018 to 2019.

The price drop in February 2020 is related to Covid-19. Since COVID-19 is a black swan event that occurs once in a century, I do not expect it to be repeated. Therefore, we can assume that the bull market started in the months following the price drop in November 2019. Prices have begun to rise in the first days of 2020.

When we examine the crypto market value by excluding Bitcoin, we see a "double bottom" movement. Prices bottomed out at the end of the first year of the bear market and started to rise. Towards the end of the following year, it reached the previous low level again and at last started to rise.

TL;DR

Analysts like Benjamin Cowen, who were pessimistic about the crypto market, were right. The bear market has been extended, and we have not seen any signs of a price recovery. It amazes me that prices in the market follow such a predictable course. A shortage of liquidity is preventing enthusiasm from building up.

However, I reserve the right to expect a surprise. A low inflation data to be announced in the USA can change the mood momentarily.

Although my predictions about the bear market remained optimistic, I advised readers to be cautious in my articles. Following my advice, I sold several thousand dollars in cryptocurrencies at reasonable prices. I'm glad I don't have to sell crypto at a time when prices are so close to the bottom.

September started severely, and it's befitting the name Rektember, which I learned from @edicted. September is historically the worst-performing month for crypto. Turkey had a full moon for a few days, and all the werewolves were active. :) We'll see what the next days bring.

The Bitcoin halving is expected to take place in March 2023. Halving means halving Bitcoin inflation and has a positive effect on prices. Plan B, the creator of the stock-to-flow model, predicted that Bitcoin would rise from October because the rise started six months before the halving in the previous cycles.

The Fed rate is still in the 5.25%-5.50% range. According to futures prices, the probability of a rate hike in September is 12%. In November, the probability approaches 42 percent. Inflation rose slightly in August. On the other hand, rising interest rates put pressure on prices. For example, according to yesterday's data, house prices in England fell by more than 5% last year and continue to decline.

In short, macroeconomic data will affect prices in the coming period. If we see headline inflation below 3% in the US, it may positively affect the market. It's the perfect time for gradual buying. (Credit-based and leveraged transactions should be avoided.) And we must have the gunpowder to carry the position we will take for some time.

Thank you for reading.