I know people love their 'Magic of Compound Interest' posts here on Leo finance, they are the big vote winners and I feel like I'm the only person who hasn't written a post with that title.

There's a reason for that.

It's a pile of bullshit.

Almost as much as the bullshit talked about 'APRs' by a load of people who appear to be unable to grasp basic maths, anyway...compound interest.

Let's start with an example.

Let's imagine you have managed to scrape together $1000 from your salary after struggling to pay the bills in this period of ridiculous inflation. You excitedly pay it into a bank account or whatever investment vehicle you decide that you will reinvest the interest as you watch compound interest work its magic!

Let's imagine you're going to get 5% interest added annually...THIS is the APR!

How much will you have in 5, 10, 20, 40 years time, when you will really need that penison!

| Years | Value @ 5% |

|---|---|

| 5 | $1276.28 |

| 10 | $1628.89 |

| 20 | $2653.30 |

| 40 | $7039.99 |

THIS TABLE IS BASED UPON INTEREST BEING ADDED ONCE A YEAR.

Congratulations. After tying up $1000 for 40 years, you now have $7039.99.

but it's 'free' money'

Not really, if inflation averaged 3.8% as it did in the US from 1960 to 2022 your 'profit is now reduced to about $2800.

Let's have a look what happens if the interest is added to your principle sum each month...

| Years | Value @ 5% |

|---|---|

| 5 | $1283.66 |

| 10 | $1647.01 |

| 20 | $2712.64 |

| 40 | $7358.42 |

THIS TABLE IS BASED UPON INTEREST BEING ADDED ONCE A MONTH.

As you can see. Very little difference.

If you want to really make money, the only way you can do that is to add to the pot each month. So let's have a look at an example where you save $100 each month and add that to your principle sum.

| Years | Amount paid in | Value @ 5% |

|---|---|---|

| 5 | $7000 | $8083.97 |

| 10 | $13000 | $17175.24 |

| 20 | $25000 | $43816.01 |

| 40 | $49000 | $159960.43 |

THIS TABLE IS BASED UPON INTEREST BEING ADDED ONCE A MONTH.

Impressive? Not really.

$159,960 is a lot of money!!

It's fuck all. If you started this saving plan when you were 25, You'd be 65 when it finished. Hopefully with 15 years left to live which would give you an income of about $10k a year...Wow. Quality!

Let's not forget, average 3.8% Inflation would mean that the spending power of that dollar would now only be around a half of what it was back in the day.

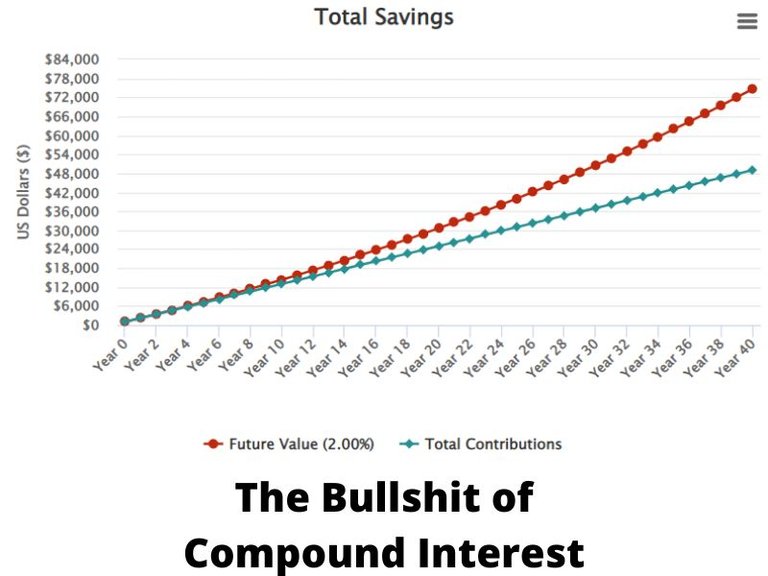

If you died sooner, you'd have more to spend each year, but would then be dead. So no fun there. Also don't forget that 5% interest from a bank or financial establishment has been unheard of for many years, if I changed that figure to 2%, after 40 years, your $49000 would have only changed into $74000 dollars. Worthless waste of time.

What does this mean?

It means that only if you have regular and large monthly income with some spare disposable income at the end of the month is compound interest of any..err...interest. That counts out the vast majority of the whole world who struggle to get by living from paycheck to paycheck or are desperately trying to eke out a dignified living.

With all sincerity, can I ask all my African and Asian mates here how many of you could follow this example. Invest a grand and then add $100 a month for the next 40 years? Seriously. How many?

So seriously. Unless you're rich.

FORGET COMPOUND INTEREST. IT'S BULLSHIT.

Now I hate people who just knock stuff down without giving a viable alternative and so in the next post, I will discuss an alternative to live and grow your money.

Until then. LIVE. How you choose, and not how others tell you to live.

This is not financial advice. Merely opinion. Don't be a follower. Make up your own minds. Form your own opinions.

If you want to work out your own figures. Go here

Posted Using LeoFinance Beta