A big question in 2023 is how hard the real economy lands. The stock exchanges live their own lives, and we should prepare ourselves for that. Most of the exchanges did suffer in 2022, few of them ended with a positive return. Mainly energy driven exchanges made it through the "storm", Oslo Stock Exchange here in Norway was one of them, but mainly driven by the energy companies, the rest was just a mess. Look at Nasdaq over in the US, one third of the value of the exchange just got wiped out. Not to mention S&P500 who took a right hook of 20%! Joyful times! Scary times! Unpredictable times...

Source: Infront

With this as a start every investor, trader or whatever out there should be careful… We still have unpredictable inflation and interest rate hikes. The price of stocks is still way above what it was pre Covid-19. Nevertheless, the year 2023 has started, just like a rocket on its way to the moon. Many signs and symptoms have been good lately, I am positive. The rapid increase of prices on consumer goods seems to finally calm down, or take a break, who knows. It is still too early and needless to say that we are over the worst, maybe the worst is yet to come.

Going forward, the topic of the stock market may also get a new twist. The stock markets' further course may be characterized by how hard- or how soft the real economies lands. In particular, investors will be interested in whether the interest rate hikes will lead the US further into a marked recession and a drop in consumption. A hard landing would definitely cut off some of the earnings of the many companies out there, especially those consumers driven. Moreover, stocks that we see cheap now might get even cheaper. It is more difficult to evaluate a company when they are struggling to make money - the risks are getting bigger and the calculations are getting harder.

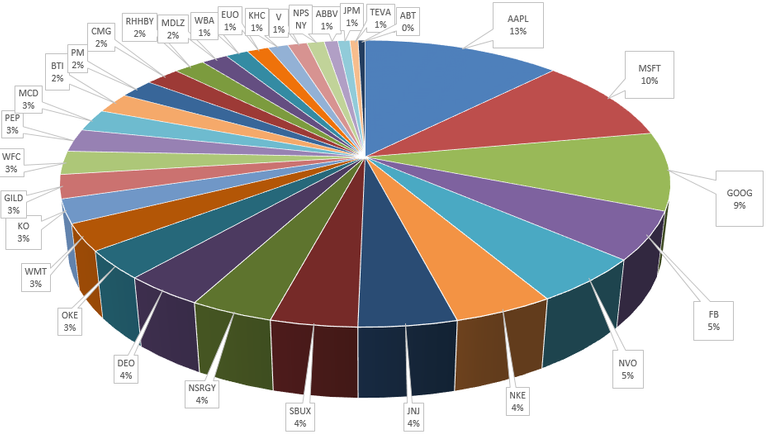

So, my dear Hivers that are into stocks and funds or whatever. It is up to us what we will do with our investments in 2023. Some of you might prefer to do nothing and keep your positions into a very long year that has just started... Others may be tempted to make new defensive choices - for example, by betting on stable and liquid shares that can withstand prolonged stormy weather. I am mainly talking about the MAANG stocks – Meta, Amazon, Apple, Netflix, and Google. Safest bet one can do from here to Mars, “did someone say Tesla"?!

Nevertheless, at the same time, it is possible that we will soon be moving towards brighter times. In more than a literal sense. Stock markets tend to turn around long before the real economies do. A good investor is always at the forefront. A well-balanced portfolio in January 2023 might advantageously also have offensive tendencies, just like the one below, LOL! Have fun investing in 2023!

What are your thoughts about the stock market in 2023? Will it be a “good”, “bad” or “ugly” year?

I am Olebulls and I’m working in IT and Finance. I’ve always been passionate about finance and finding smart ways to manage and save money. I believe establishing money management strategies as early as possible is the key to securing your future. I began using different strategies myself in real estate, stocks and crypto and I have now built some decent amounts.

||

I’m here to create content about finance, crypto, game-fi and money management.

Pleas follow me if you want to learn something valuable about these topics.

||

Disclaimer: This is not financial advice. I am not an expert. You should do your own research before investing.

Posted Using LeoFinance Beta