It takes some years to save up a considerable amount of money, particularly when reliant on a single job for income. While the concept of a considerable amount may vary, once you've saved up a decent chunk, the big question arises – how will you make it grow?? Well, one of the options is to buy a property with the purpose of renting it out.

Prior to purchasing a property, it is essential to delve into the intricacies of calculating real estate investments and assessing its potential for generating favorable returns.

Start reading about how to calculate real estate investments and what types of properties to purchase for high returns before you go buy a property.

Look for a property strategically located near universities or just outside vibrant cities, where the rental market thrives and offers endless opportunities for both individuals and families. By building the right property solution in the right area it is possible to create money-making machines. Additionally, if you refurbish to the highest standard, the tenants and the neighborhood benefit from living in a high standard property – it's basically a win-win!

In short:

Your approach could be to buy rental properties, renovate them to the "highest original standard," and then rent them out. The maintenance costs can be deducted from the rental income when calculating taxes. Any increase in value after the renovation belongs to the owner, not the bank. This allows you to refinance the loan, giving enough equity to invest in new properties, while the rental income covers the new loan. Once the maintenance costs are covered through the rent, regular taxes must be paid. But here is the deal, you can deduct renovation expenses from the taxable profit you get from the rental income.

Numbers example

Let’s say you purchase a property for $500,000 and you use your savings for a total down payment of $100,000! However, the house needed renovation, so you spent $100,000 on this as well. After the renovation, the property was reevaluated at 1 million dollars, which is $400,000 more than what you bought it for.

After acquiring the property and renovating you can go ahead to the bank and ask for a refinancing of the loan, freeing up fresh capital for additional investments. You see, beauty happens when the property's value appreciates, you gain the ability to borrow more “against” it. If you excel in managing rental properties, the rental income generated can effortlessly cover the costs of the increased loan.

You have now refinanced and are able to take out the equity you invested. Refinancing is a loan, but the rental income is sufficient to carry the increased loan, that is key. Without this last step, you wouldn't have been able to invest again, understood?

With this new valuation, the bank has increased security and allows you to borrow back the original equity of $200,000 you used to purchase the property and renovate it – completely tax-free. So, all your savings are back in the account, but you now own a property that generates annual rental income without tying up any equity.

And you know what? You forgot that I mentioned that the renovation expenses and new furnishings were deductible from the taxable base. Thanks to these deductions related to maintenance, you have tax-free rental income the first year!

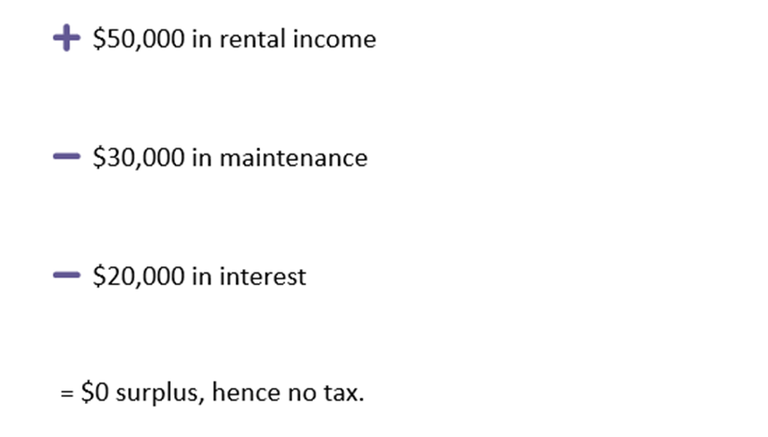

Easy number example again, just for fun:

Rental income $50,000, you spend $30,000 on maintenance and $20,000 on interest (loan), the calculation would look something like this in the first year:

Please note, maintenance renovation means restoring the property to the highest standard it has ever had, including before you bought it. Typical examples of maintenance include replacing floors, windows, painting walls and ceilings, new kitchen countertops, and surface improvements.

Thank you for reading my blog post. If you enjoy what I write about, feel free to upvote, like, or follow me for more similar content. I write about the world of finance, crypto gaming, and cutting-edge projects within the Hive Blockchain.

This blogpost should not be considered financial advice or the like but rather as an informative overview.

-Olebulls

Posted Using LeoFinance Alpha