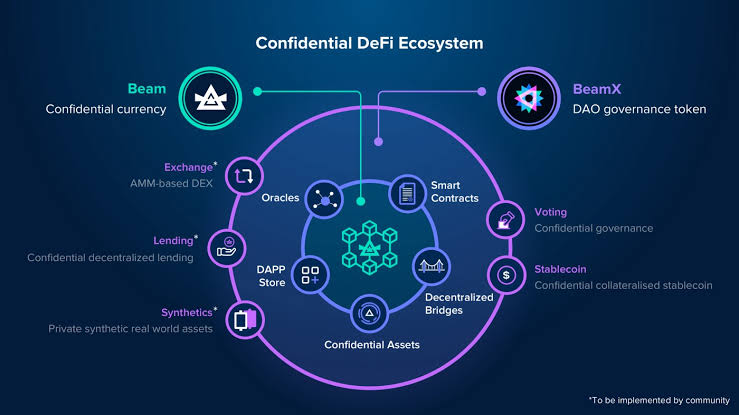

With testing finally here, the Beam DEX is approaching its inaugural mainnet launch. With this comes some questions on how to bootstrap the initial liquidity pools for Beam and BeamX on the AMM-based DEX. The team is preparing a forum post outlining the intended launch parameters and invites the community to start sharing their ideas on the matter in the Beam community channels. The Beam DEX will be a huge boost to the ecosystem, allowing for trade to seamlessly take place between Beam and Confidential Assets, and for Beamers to easily provide liquidity on the decentralized exchange. It will also present the possibility to generate assets for the BeamX DAO treasury, with the potential for a % fee on swaps being directed there.

The Beam DEX is coming! And with it, the option to both trade and provide liquidity to the markets. The Beam DEX will be an Automated Market Maker style DEX to accompany the already available in-wallet Asset Swaps.

The DEX will allow anyone to spin up a liquidity pool by providing two assets, setting the price/ratio for the assets, and setting a fee tier for the pool. It is following the same general principles as the popular Uniswap protocol on Ethereum.

The DEX allows other users to buy and sell from the pool itself, rather than other users as is the norm with a central limit order book, which is commonplace on centralized exchanges.

The Beam DEX will provide a huge boost to the Beam ecosystem, allowing users to easily provide liquidity and trade Beam and Confidential Assets with privacy, including those bridged over from other networks!

Beam, a privacy-focused cryptocurrency, is gearing up to launch its highly anticipated decentralized exchange (DEX), which will allow for the trading of Beam and Confidential Assets without needing a third-party intermediary. With testing now underway, the Beam team is seeking input from the community on how to bootstrap the initial liquidity pools for Beam and BeamX on the AMM-based DEX.

The Beam DEX will operate as an automated market maker-style exchange, similar to Uniswap on Ethereum, allowing users to provide liquidity by setting the price/ratio for two assets and a fee tier for the pool. This model allows for seamless trade to take place between Beam and Confidential Assets, and for users to easily provide liquidity on the decentralized exchange.

One notable feature of the Beam DEX is the potential for a percentage fee on swaps to be directed towards the BeamX DAO treasury. This presents an exciting opportunity for the Beam community to contribute to the growth and development of the ecosystem.

The launch of the Beam DEX follows the recent release of Beam bridges to the main net, which allows for the bridging of assets from other networks onto the Beam blockchain. The bridges have already been audited and supporting guides and documentation will be released this week to assist users in utilizing the technology.

In addition to the DEX launch, Beam is also working on hardware wallet integration, which will enhance the security of users' funds and provide greater accessibility to the Beam network.

Overall, these upcoming releases mark an exciting time for the Beam ecosystem as it continues to expand and provide innovative solutions for users seeking privacy and decentralization in their financial transactions. Learn more.