In the previous two editions of this series, I featured the following:

Onboarder's fundamental knowledge series: Blockchain as immutable records

Onboarder's fundamental knowledge series: Base layer and layer 2

Today, we shall look at the idea of Market orders and Limit orders. This is something that those new to crypto necessarily needs to know. If you are coming to crypto with some experience of trading stocks, this is nothing new. I am writing for those of you who are onboarded to Hive or crypto with limited knowledge of these two terms. Actually, Hive is a great place to learn these concepts. Let's see why.

Every thing has a price. That means there is a willing buyer who is willing to buy what someone sells, at a particular price.

It's easy to start discussing this when you take the perspective of the buyer.

Simply put, when you are willing to pay the price offered by the least expensive seller currently lurking around (i.e. seller who is offering at the lowest price), there is a deal!

This is what market order is all about. You pay the market price, so to speak.

Now, what if you think that the market price is still too expensive? You can lower the buying price and place a order limit. In this situation, you are hoping that someone would be more desperate to sell his/her assets than the current least expensive seller. If that seller actually comes along, you would have paid a lower buying price.

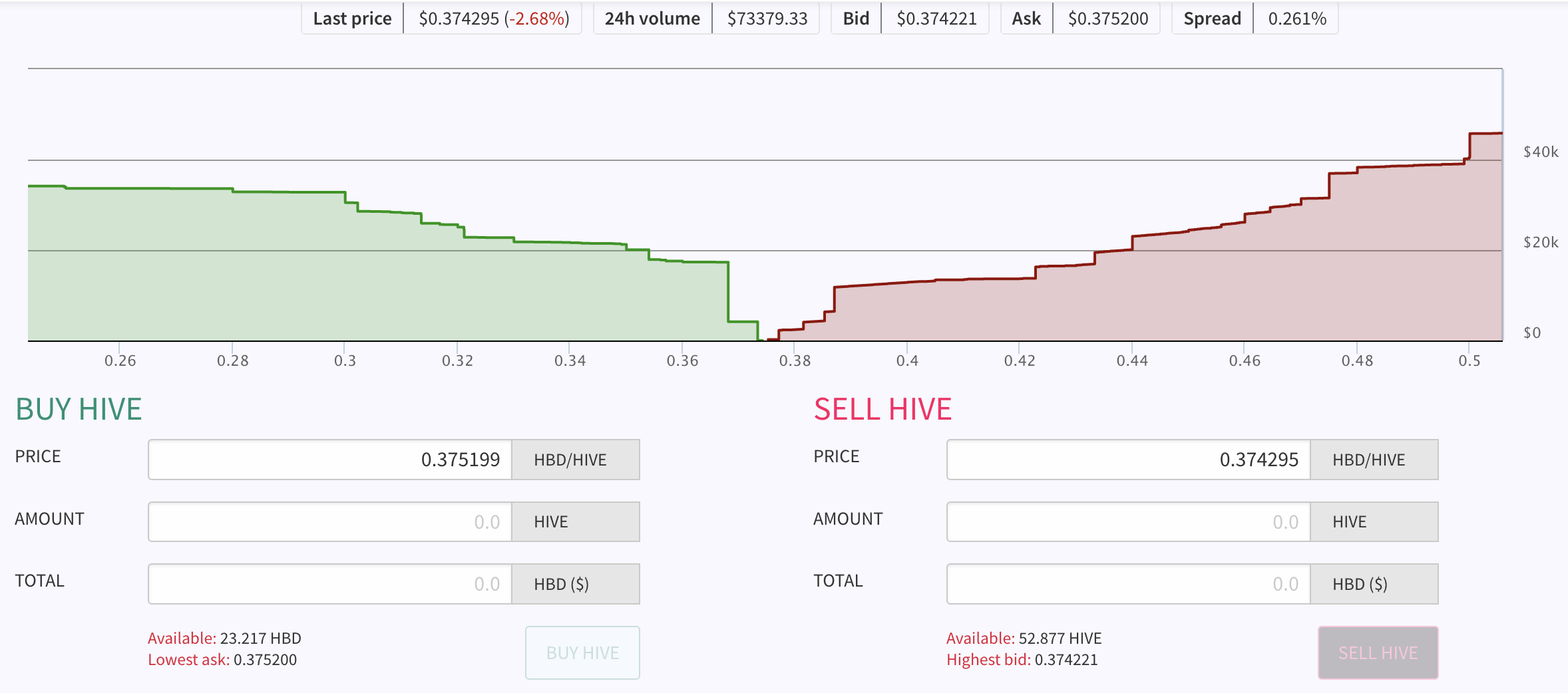

Let's look at how things play out on Hive through the image below.

The green side represents the buy orders placed at different prices. It is piling higher on the left, i.e. near 0.26, than on the right, i.e. near 0.36. It suggests that more people have placed buy order at the cheaper price of 0.26 than 0.36.

The red side represents the sell orders people puts out. There are lots more who like to sell it at the higher price as shown above, than at a lower price.

Each of these represents the data point of each buyer and seller's order.

At some stage someone is going to budge, or someone new may decide to buy the assets offered at the lowest selling price, which is 0.375199 per Hive as shown.

The main takeaway here is this: If you want to pay a cheaper price, don't set your buy price too high.

Contrarily, if you want to sell at a higher price, set your sell price higher.

You can check this site to learn more.

Posted Using LeoFinance Beta