I prefer to measure the debt against the Potential Supply and not the Virtual Supply. The former is defined as the limit at which the virtual supply can grow before the haircut rule comes into play. You can calculate the potential supply by dividing the hive supply by 0.7 (1 minus the debt limit). The reason for this preference is that the virtual supply variates every time the feed price changes. With a known supply of Hive and HBD you can always estimate what the "actual" debt limit is with the current feed price.

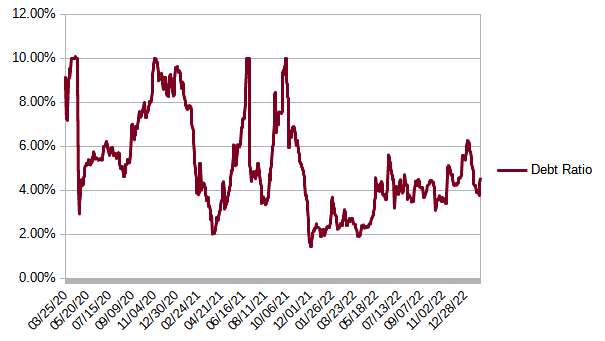

Below you can see the graph of the debt ratio using the potential and not the virtual supply. Please note that the data is adjusted every time there was a hardfork that changed the blockchain rules in question.