Bitcoin has experienced several boom and bust cycles so far. The three previous halvings (2012, 2016, 2020) initiated extensive speculative price rallies delivering high returns, but also vast dips and losses for those invested late.

Yet, each halving delivers fewer rewards than the previous ones.

So far, during the bearish part of the Bitcoin economic cycles, it has always found a bottom at way higher prices each time.

We also observe a detail that marked the previous two cycles, making a retest of the bottom ($15000) possible in 2023.

This short rally will find a top in the following months, and the descent will begin again.

We examine these three facts, analyze the halving, and summarize how Bitcoin could perform if the cycles were to repeat, and we calculate the significance of the halving to Bitcoin’s price.

Moreover, we should enter a thought process of identifying the possible reasons the price will not significantly rise further unlike what most BTC proponents suggest. It could take two or three years more, but maybe some overestimate both BTC’s potential and their investment techniques.

The Halving Economics

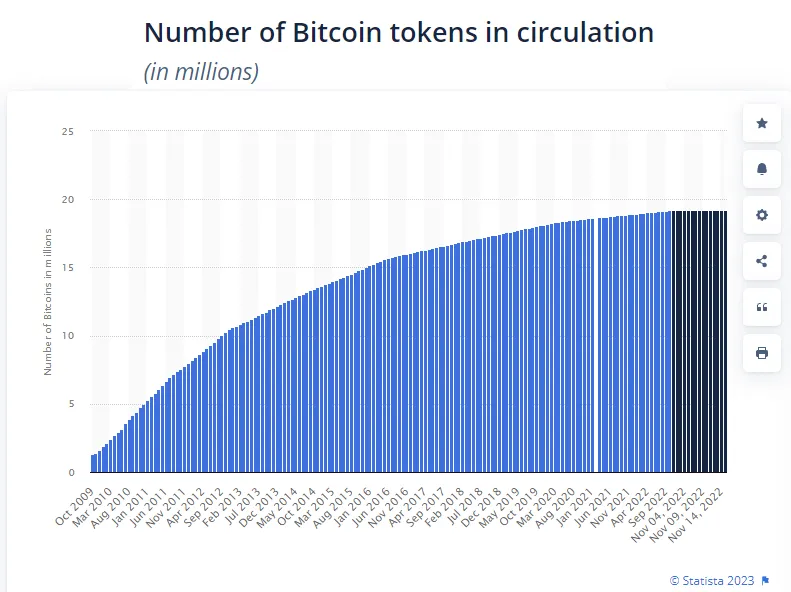

Source: Statista

The halving is an operation hard-coded by Satoshi in Bitcoin.

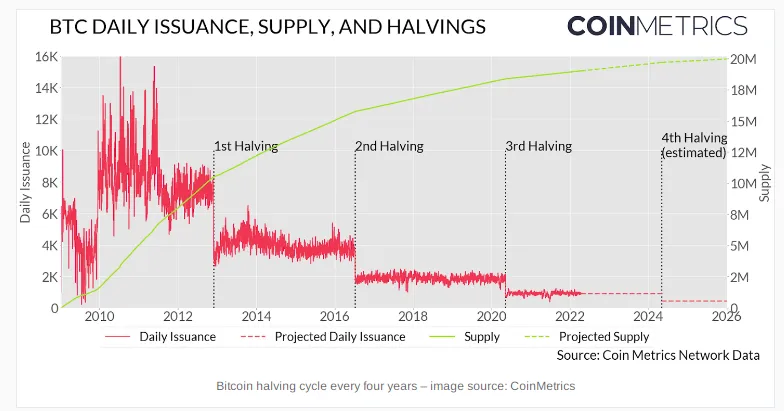

Every 210,000 blocks miner’s rewards are reduced by 50% with the halving.

So, until 2012, miners received 50 new BTC for every block they mined.

Between 2012 and 2016, the new Bitcoins per block were 25, and until 2020 12,5.

The last Bitcoin (out of the 21 million) will be mined in 2140.

Halvings:

- block 210,000: 1st halving: Nov. 28, 2012

- block 420,000: 2nd halving: July 9, 2016

- block 630,000: 3rd halving: May 11, 2020

- block 840,000: 4th halving (est.): April 2024

- block 1,050,000: 5th halving (est.): 2028

Mining Rewards

- 2008–2012: 50 BTC

- 2012–2016: 25 BTC

- 2016–2020: 12.5 BTC

- 2020–2024: 6.25 BTC

- 2024–2028: 3.125 BTC

Bitcoin Mined And Total Supply

2008–2012: 10,500,000 BTC mined (50% of total)

2012–2016: 5,250,000 BTC (15,750,000 / 21,000,000–75% mined)

2016–2020: 2,625,000 BTC (18,375,000 / 21,000,000–87.50% mined)

2020–2024: 1,312,500 BTC (19,687,500 / 21,000,000–93.75% mined)

2024–2028: 656,250 BTC

By April 2024, on block 840.000, 93,75% of the total supply (almost 20 million) of Bitcoins will have been mined already, leaving less than 1.5 million to be mined in the next 120 years.

The halving reduces the selling pressure on the market as the daily supply of new Bitcoins decreases by 50%.

Demand For Bitcoin

We should have considered the network effect with the rising adoption as a digital currency by businesses, merchants, and corporations as it transpired for Bitcoin until 2017.

But reality begs to differ. Bitcoin reverted all this adoption. Since 2017, it is marketed as an asset resembling gold’s features (digital gold, store of value), targeting institutional and wealthy investors.

Demand increases for speculative reasons. Right after the halving indicators (and marketing) suggest that Bitcoin (and the rest of cryptocurrencies) are back.

Most investors will enter Bitcoin at the wrong time (at the top of the cycles), but some consider it a long-term best. The use of Bitcoin in payments is limited.

High fees and the stagnation in on-chain scalability dismantled the money properties of Bitcoin (BTC), making it useless as money.

The Lightning Network (LN) adoption is weak and doesn’t indicate vast potential. Moreover, LN presents a strange adoption with custodian wallets, which defeats the purpose. Bitcoin wasted ten years of merchant adoption, allowing the banks to catch up and improve their services.

The lower new supply creates less pressure on the price, affecting demand speculatively as traders discover an opportunity.

More Bitconomics:

- Fixed supply: Supply of Bitcoin is fixed at 21 million.

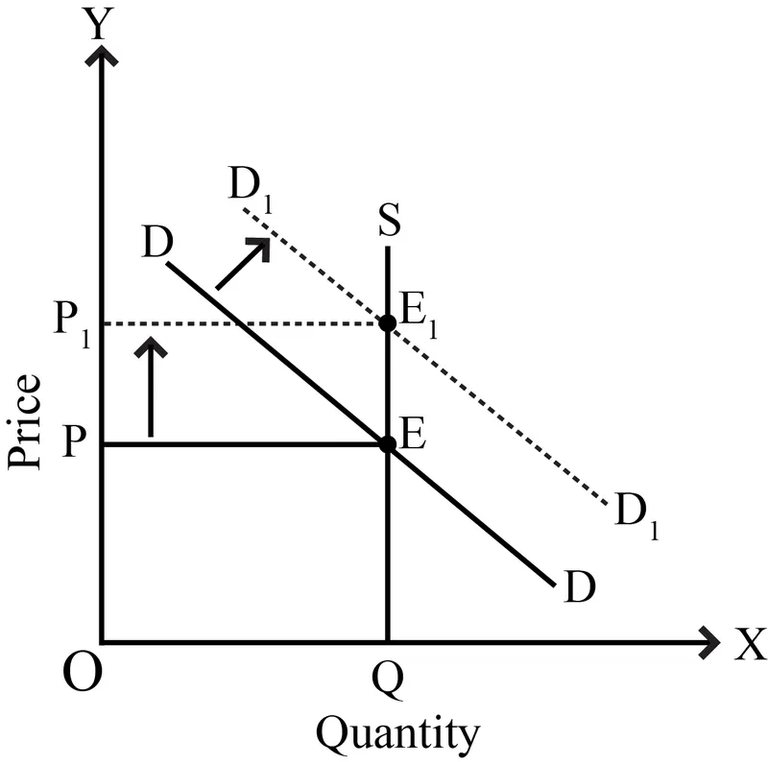

The (perfectly) inelastic supply, combined with increased demand, leads to a parabolic price rise.

Inelastic Supply and rise in Demand — Chart on repetico.com

When demand for an asset with an inelastic supply increases, it leads to a rapid price boost.

In the chart, the supply is fixed at 21 million, so the S (Supply) curve stays stable, and we reach a new equilibrium point at a higher price (E1 in the chart).

- Marketing:

The issue is how demand will increase.

There are several artificial ways, but marketing will always do the trick. Vast numbers of social media accounts are employed to promote Bitcoin during bull runs, and advertisements of Bitcoin-related platforms increase. Marketing intensifies as the price keeps rising.

Vast marketing campaigns take place aiming to attract wealthy retail investors and institutions.

Although Bitcoin is struggling to convince finance about the digital gold features proponents claim it contains.

- Supply Shock

The fixed supply of 21 million and the halving events of Bitcoin (together with increased demand by speculators) generate a supply shock in cryptocurrency exchanges.

As the new supply keeps decreasing, the effect of each halving is smaller than the previous one.

A small change in demand after the halving sets in motion a chain of events that ends several months later with Bitcoin at a new ATH.

The market realizes there’s less BTC in exchanges, and some of them will fractionalize reserves or turn into re-lending schemes that offer high yields to sustain reserves. In the end, these schemes end up collapsing and generating vast losses to the customers of these platforms (Celsius, Genesis, Gemini Earn, BlockFi, etc.).

Speculation by traders and whales further enhance the effect of the halving event, but as we will find out below, in the long run, it will be insignificant.

Price Action In 2023

Months prior to the halving, we should expect a price of $30,000 to $40,000.

In 2023, the price could reach $40,000, as it seems the market dynamics can support this bounce from $16,000. Yet, a decline at any point between the current price of Bitcoin ($30,000) and a possible top for 2023 ($40,000) seems inevitable if we consider how the price moves the year before the halving and each cycle.

$40,000 possible but not likely

This rally does not have enough steam to escape the bearish trend.

The price can reach $40,000 within May or June, and after that, we witness a continuation of the bear market.

Whales and traders push the price higher, but that’s only business as usual, and since there is no actual demand or significant changes, any predictions at this stage are only hypothetical.

The chart below presents the possible price action for 2023 concerning the price action of 2019, although it also points to a massive incoming dip.

Possible price action for the rest of 2023 (source)

Exchanges have to liquidate shorts, shorts turn into longs, and various algorithmic trades take place to boost the price of BTC.

Bitcoin could go as high as $40,000 but also as low as $15000 in the remaining nine months of 2023 if it follows a similar trajectory as in the two previous times 12 months before the halving.

The Unfortunate Scenario (For 2023): $15,000

Odds suggest this is not likely, but if Bitcoin drops below $15,000 (in 2023), that would be devastating and can cause a cascade of catastrophic events.

Below $15,000, Bitcoin enters an unexplored territory, and if this scenario occurs, it will probably mean that Bitcoin’s price is doomed.

A further price decline is highly likely, and BTC will revisit prices lower than $20,000 before the 4th halving.

The current rally Bitcoin is witnessing at some point will have to slow down and turn bearish again.

Eventually, a new dip will happen, sending the price back close to the 2022 bottom and between $20k and $18k.

And this could be the trade of the year.

Bitcoin (BTC) Will Double Bottom Before The Halving

Right before all the previous bull runs, the price retested the bottom.

2015–2016 BTCUSD 1W

In the years before the halving (2016, 2020), Bitcoin, after bouncing retreated again close to the bottom of the cycle (forming a more bullish pattern than a double-bottom at $200 in 2016 and $3500 in 2020). This is one of the most bullish signals a trader can get.

2018–2019 BTCUSD 1W

The second bottom stays at a little higher price than the previous one.

The Math Behind The Expected $100K ATH In 2024

The Halving Is 82% Less Effective on The Price Each Cycle

We explain here why Bitcoin will not reach more than $100k (during the next cycle).

2024 will be the year of the halving. Odds suggest that BTC will recover in 2024, and the price will reach a new ATH by the beginning of 2025.

However, each halving does not have the same effect as the previous ones.

The new supply entering is already too low, almost insignificant. So, any further reduction (beyond the fourth halving) will not bring the supply shock we witnessed in previous cycles.

BTC has the potential to achieve $100,000 within 2024 after the 4th halving, as all the forces that sustain it are still active.

Why $100K is the top (if the 4th Bitcoin halving kicks off a new bull run)?

Here are some numbers I calculated that we should consider when speculating about the price Bitcoin can achieve IF the fourth halving initiates a new bull run:

- a) 2013–2017 Top to top: $1300 to $20000: 1400% increase

- b) 2017–2021 Top to top: $20000 to $69000: 245% increase

While we can only bring into the sequence these two percentages, we can still observe that:

****The change between a) and b) was 82% less in 2017–2021 than 2013–2017.****

If BTC achieves $100,000 in 2024 (or 2025), that will indicate:

- c) 2021–2025 Top to top: $69,000 to $100k: ~45% increase

The difference from top to top between b) and c) will again be 82% less (81.63%).

Here, we have mathematical proof of the declining effect each halving reflects to the price of Bitcoin.

Thus, each halving of BTC presents 82% less effect on the price.

Also, we should consider that with 93% of all the BTC in circulation, the fourth halving of 2024 might be the last one with great odds of profitability unless drastic changes apply from the development side of Bitcoin.

There is also another issue. The consequent drop from each new Bitcoin ATH that marks its cycles is close to 80% (from top to bottom) at all times. The dip can last 360–400 days until the price of BTC finds a bottom price from the ATH at 75–85% lower.

When BTC hits the ATH of the next cycle, it will dive 70–75%. In this scenario where the next ATH for BTC is $100K, then a year later (2026), the bottom will be $25,000.

Will There Be A New Bullish Cycle?

Chances are in favor of a new bullish cycle for Bitcoin and the cryptocurrency market as a whole.

Perhaps the best opportunities are in coins that have passed the test of time and develop secure and robust networks.

We can already spot traction that will support a new cryptocurrency rally.

Twitter partnered with e-Toro recently and will soon allow the trading of cryptocurrencies (and grab a large piece of the market).

Activities like this one will soon multiply (before and after the halving).

In the centralized part of crypto (platforms, exchanges, custodians), new players emerge, smaller players reach sizes nobody expected, and old rivalries turn to friendships as long as synergies serve the viability and profitability of enterprises in the field.

Will $100K Be The Last BTC ATH?

$100,000 for Bitcoin is the probable top for 2024 (or Q1 2025), but the halving alone without a rising network effect will not assist Bitcoin for anything better.

$100K should be the maximum Bitcoin can reach, with the current macro conditions (inflation dropping to 5% (ICP) and the dollar stabilizing).

The next BTC halving of 2024 will be the final one that will bear any significance.

Bitcoin is doomed to obscurity in the grand scheme of things since Core-devs and Blockstream erased their disruptive potential.

It will remain like a great idea that failed, and other cryptocurrencies will take over.

Except for Bitcoin (BTC), more cryptocurrencies will soon experience a halving (Litecoin and Bitcoin Cash), which contain the same model, with limited supply and a similar halving mechanism.

In Conclusion

Source: Nicehash

At a high rate this is the most probable scenario. Perhaps the timeframes given will be slightly different.

While every random crypto-influencer on YouTube and Twitter will start tossing random numbers (like $250,000 or even a million dollars), data suggests $100,000 is the ultimate top.

This article is not financial advice but is based on the assumption that the fourth BTC halving will initiate a bull run as it did the three previous times (2012, 2016, 2020).

Since each halving has a lower effect than the previous one (approximately 82% less, as we calculated here), this leads us to the $100k price for Bitcoin (BTC) for 2024 or (the beginning of 2025).

In an alternate reality, where Bitcoin had implemented scaling measures in 2015, we would have had a vast network effect and a price several times higher. With the enforced stagnation by Bitcoin developers, the price shifted to auto-pilot all these years (since 2015), only tracking the halving effect.

As the last halving with significance will be the one in 2024, in the next five years, we will see drastic changes applying in the cryptocurrency industry, with Bitcoin (BTC) losing its current fragile supremacy.

*Cover on Pixabay: link (modified)

Images, and material in this article are used for research, and educational purposes and fall under the guidelines of fair use. No copyright infringement intended. If you are, or represent, the copyright owner of images used in this article, and have an issue with the use of said material, please notify me.

Not Financial Advice

- Originally published on Medium

Find me on:

Medium - Noise Cash - Read Cash - Hive - Vocal - Minds - Steemit - Publish0x - Twitter - Reddit

Subscribe & Like if you enjoyed this story!

Posted Using LeoFinance Beta