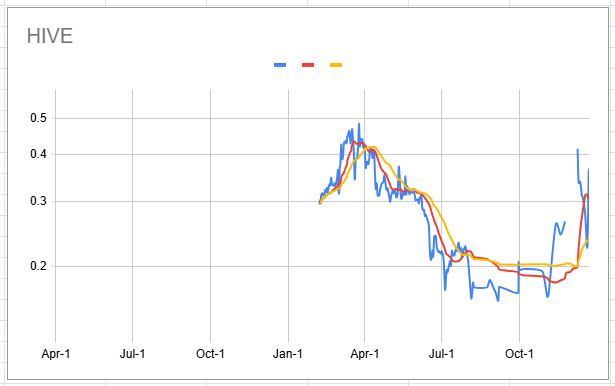

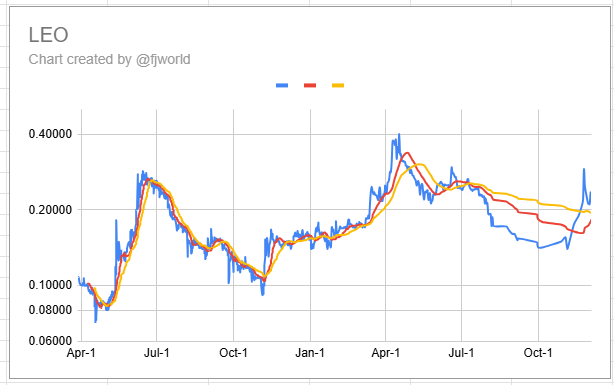

After reading the latest update from the LEO team I decided to take a closer look at the price comparison between HIVE and LEO.

In the update,

The price of LEO is not dependent on the price of Hive. They are related, but

https://peakd.com/hive-167922/@khaleelkazi/leos-market-position-beyond-hive-bky

So let us take a quick look at the two tokens.

I see similarity in the trading pattern, do you?

the LEO price went up, but during Hive's correction, it kept going up, so LEO is not directly tied to Hive's dynamics.

I suppose that is true now that Hive bounce back up in the last 2 days and LEO dropped. It dropped enough that I was surprise to see my buy orders filled.

So all this chart stuff is a demonstration of basic technical analysis. The price a token trade is reflective of what buyers and sellers think of the underlying value of a product and service.

Now if I am looking at fundamental value, I see HIVE as having a higher underlying value and more likely to trade 10 times higher within 5 years. There will be much price fluctuation along the way but the slope will remain positive in the long term.

Risk Analysis. LEO offers a greater risk so you would expect a greater return and a greater loss. As much as I see the value added from bringing people into the HIVE community, I also see greater risk when your service is tied to some externalities. Meaning your revenue streams are dependent on third party risks outside of your mitigation ability.

Well that completes my quick look and see analysis.

I am currently a holder of some LEO and I have staked a few hundred tokens plus delegated 50 tokens to @leo.voter I still need to see the benefit of my delegation. Nevertheless, ownership is my way of connecting with the emotional component that often determines the strength and weakness of a bullish or bearish market reaction.

Do let me know what you think will happen in the next 5 years. Which token will be a 10 bagger? My 2025 goal is to see my #TooFuckeh token trading higher than LEO so your feedback will help me adjust my expectations.

May Positive pepEntropy be with you.

)

)