"Ah! I wish I had done this earlier!" We all have this regret in life! We always want to go back to the past and solve our mistakes! Instead of looking at the future, we always pass the time in grief!

In this article, I will share some money-making tips that you can start doing from now. So stop crying about the past and start from now!

Invest Early

Early to bed and early to rise makes and man healthy, wealthy and wise?

Not only getting up will make you wealthy. You need to be early in investing as well, and investing early is better than leaving your money in the bank account. This is definitely one of the best money tips you'll ever get.

People are always scared of investing - "What if I lose my money?" But they forget the most crucial thing: inflation will slowly eat your money every month if they keep money idle!

According to Trading Economics - "The annual inflation rate in the US accelerated to 7.5% in January of 2022, the highest since February of 1982 and well above market forecasts of 7.3%, as soaring energy costs, labour shortages, and supply disruptions coupled with strong demand weigh."

This means if the inflation rate stays similar the rest of the year, you are about to lose 7.5% of your money yearly! For example, if you have 100k Dollars in your bank, at this rate, you will lose 7500 dollars every year! Sounds pathetic! Right?

But that's not all! Let's say you have worked 20 years, and you have 500k dollars. Assume that the average inflation rate is 1.5% per year. After 25 years, 500k dollars will be only left with around 344k Dollars. Where did the money go? The inflation ate it!

So invest your idle money in the place where you expect a better return than the bank's 0.50% interest! I will suggest going for the stock and crypto market in the long term. This is risky but can give you a better return in the long term.

Do Your Own Due Diligence While Investing

If you buy a stock of a company that is already drowning, then you can lose all investment if the company is bankrupt! You only do this because you are not analyzing before investing!

Youtubers, Twitter influencers like WallStreetbets are sharing investing ideas every day! Does this mean their ideas are good? Of course not. If Elon Musk said you should buy Dogecoin, and you followed, that's Elon Musk's idea. Not yours. And I can't imagine how many people lost money just by buying Doge at the top!

Read Also - Five Ways to Identify and Avoid Crypto Scams

Most fund managers were found to be underperforming the market over the long term! Even Warren Buffet can make mistakes! So, if you are investing, never ever follow anyone blindly. If you want to buy Tesla, go to various social groups regarding this, like you can join Tesla Reddit or Facebook communities. Then you analyze the company's financial data. Then maybe you can take the critical decision because you are responsible for your own money at the end of the day!

Spend Money on Life Experience

Most of the people target to save money for retirement! What's the point of this if you can't enjoy your life? Travel the world and gather experience about different cultures and nature. It'll help you freshen your mind and give you lots of good ideas about your life!

It's hard to travel when you have one to two kids, and it's even harder in your 60s or 70s. So better step out now! I traveled to many countries already like Thailand, Malaysia, Indonesia, India, Nepal. And I have so many on my bucket list. You will appreciate all of these things one day when you are older. I follow a popular Youtube channel, Yes Theory! They do stuff to step out of their comfort zone, like traveling to the North Pole, testing the body in the snow, finding pyramids in the forest.

So try to enjoy life and explore the world while you can! That's the whole point of being alive!

Treat Credit Card like Debit Card!

The title says it all! It sounds straightforward but super important! Having a credit card is like you have an infinite amount of money. But if you end up spending money on unnecessary stuff, you might end up being unable to pay it back! The credit card company is going to come after you with a 25% interest rate! Which is super duper high! This rate can vary from country to country! But the rate is high in all the places if you default.

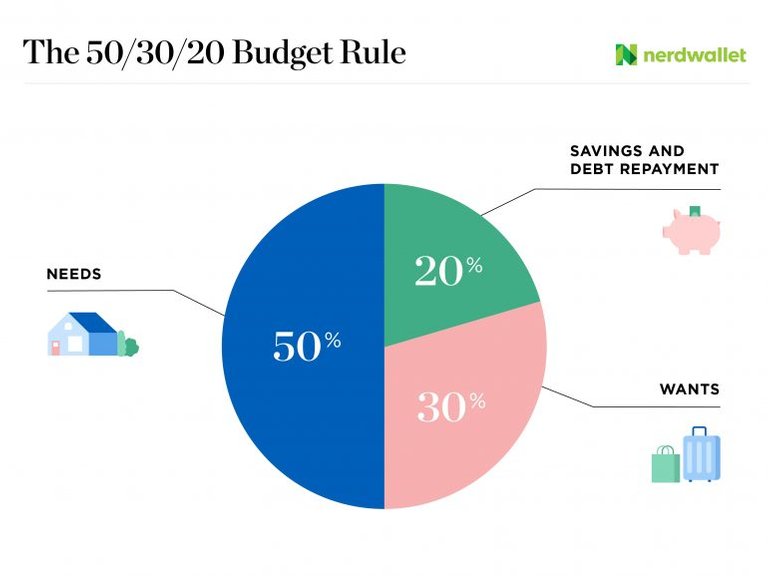

So, treat your credit card like a debit card. Follow the 50, 30, 20 rules and save the remaining 20%.

Spend Money on Improving Yourself

This point is quite debatable. Personally, I believe if you invest in yourself, you will get the highest return compared to anything out there. I know everyone doesn't get a good job but let me show this example. Suppose you spent $30,000 to learn in the university. After being graduated, you get a job that pays you $4000 a month! So, you're earning around $48,000. You are making your investment back within a year with a profit. Okay, maybe that's not a very good example, but I believe you got my point.

Now investing in yourself is almost free as we have free sources like Youtube Google. You can find almost everything on Youtube. All you have to invest is just time. Also, you can buy some good courses from Udemy at a cheap rate. If you are resourceful and you know how to learn by yourself, you'll save tons of money. But it's alright to buy courses if the courses are good.

So these were some of the tips that I wanted to share with all the Hivers and readers out there. Better late than never!

Posted Using LeoFinance Beta