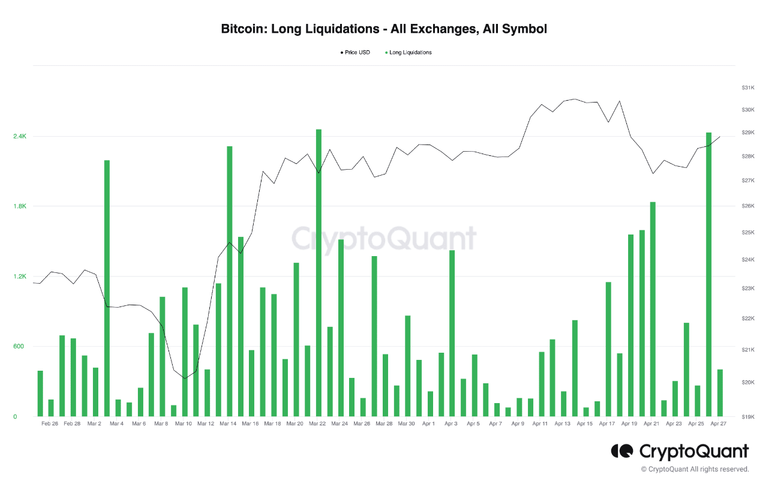

Yesterday was an extreme day for futures traders as There were rumors related with Mt.Gox and US government BTC reserves selling off. Futures market makers used that opportunity to liquidates all optimistic high leveraged Long Positions As we know upwards movement before was also supported with short liquidations So first liquidate shorts then liquidated longs nice profit for big guys yesterday as crypto YouTube have already started shouting for bull run.

Tradingview

Bitcoin went on a real rollercoaster by pumping to a local peak of $30,000 before dumping just as hard by $3,000. Most altcoins followed suit with similar volatility but have now calmed slightly in the red on a daily scale.

The primary cryptocurrency rarely sits quietly in terms of price movements, which is why yesterday’s rollercoaster was to be expected to an extent. This is because the asset stood in a tight range between $27,000 and $28,000 for several consecutive days.

However, the trend changed when the bulls took charge and pushed BTC north hard. In a matter of a day, it skyrocketed to $30,000, leaving over $100 million in shorts liquidated. However, fake news emerged at this point claiming that wallets connected to the US government and Mt. Gox creditors have started disposing of their bitcoin.

The consequences were felt immediately as BTC slumped by $3,000 to $27,200. As the reports were refuted, bitcoin went back on the offensive and recovered roughly $2,000.

As of now, the cryptocurrency trades at around $29,000, which is still a minor increase compared to its price 24 hours ago. Its market cap still stands above $560 billion, and its dominance over the alts is close to 47% after gaining over 1% in the past few days.