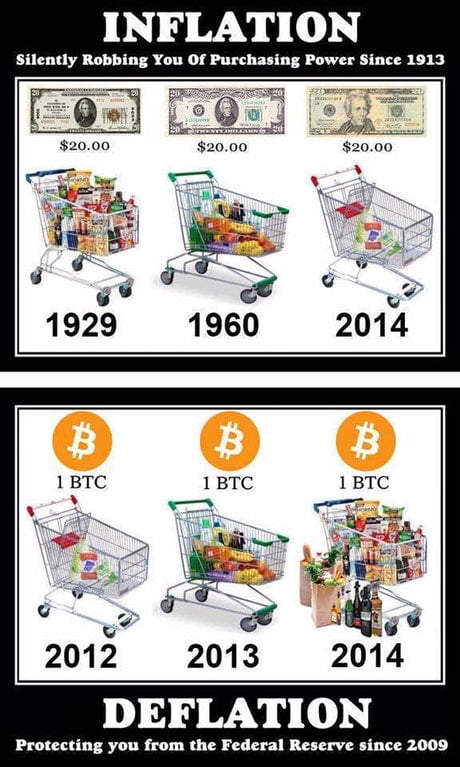

It's seems economies are falling left and right. Wherever you look a bank is declaring bankruptcy, some organization is defaulting, or countries struggling with crippling inflation. That last one differs from country to country, some being noticeable and extreme for the citizens, while other countries are dealing with really small percentages of inflation.

There is definitely a difference in seeing prices grow 10 times what they used to be in 5 years versus a 5% increase over twice that amount of time.

But it seems that all these happenings might come with some benefits for those of us who are keen on investing in alternative financial means. Whether it be the riskiest of all, cryptocurrency, or maybe a more traditional approach in the world of traditional stocks and all the other things in that environment.

So what are the possible benefits? Well, when the main economy is failing, people tend to start trusting banks less and less and then they start seeking out the alternatives. We've seen that over and over again with things like art increasing in price in hard times. This might be the case as well for crypto and traditional stocks. And logically that benefits the people who have a head start in that department, no matter how big or small that head start is.

Obviously, I can't and won't give any advice, because this is still all speculation and based on my own viewpoints, but it would be safe to say that you should at least do even more of your own research right now. And be mindful of dips in prices even more, because there might be opportunity lurking around the corner.

What are your financial plans when the possible turmoil strikes? Are you buying more crypto? Or stocks? Or maybe real estate. Or maybe something entirely different.

![]()

[ Uniquely Clever Sign Out Message Goes Here ]

Posted Using LeoFinance Beta