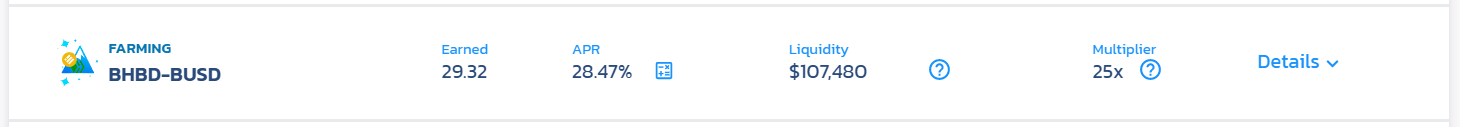

The APR of the BHBD-BUSD liquidity pool has decreased from just under 50% to just under 30% in under a two weeks. It is unlikely to never go below 20% no matter how low the price of CUB dives.

Why?

Because if it does, anyone who has provided liquidity to it has the opportunity to take his/her funds out of the pool and unwrap the bHBD into HBD on Hive and earn 20% by putting the coins into a savings account pretty much free of risk so long as the price of HIVE does not collapse and make the HBD -> HIVE conversion process stop from giving $1 worth of HIVE for each converted HBD and thus backing the value of HBD.

This is where you find all the bridges enabling you to wrap coins on Hive to use them on other chains and to unwrap them back to coins on Hive:

What does token wrapping mean?

The basic idea of the wrapping process is to lock coins on Hive by sending them to an address controlled by an oracle thus effectively removing them from circulation and to release corresponding tokens on another chain. During unwrapping the wrapped token is destroyed/locked and thus removed from circulation and the original tokens on Hive are released. The process maintains the combined floating supply constant.

The price history of CUB

Take a look at this chart:

This is almost entire the price history of CUB.

The last three months

After a volatile start and a complete crash and a slow bleeding of value, it seems that the token may have found support.

The yields on the farms where CUB is the one of the coins range from 33.64% to 72.55% at present time.

Beware of impermanent loss and slippage

What is impermanent loss? It means losing value compared to the situation where you'd have held the same coins without providing liquidity with them.

For example, if the pool contains a stablecoin and some volatile coin, and the volatile coin goes up in value, your share of the pool will contain a fewer of the volatile coins and more of the stablecoins than initially thus being a loss for you relatively speaking. In general, you always end up with more of the coins that have lost value relative to the other than you had initially. The situation is called impermanent because the loss can be reversed given the right kind of price action.

Slippage can cost you money even when investing in a small liquidity pool that only has stablecoins if you have to buy a lot of one of the coins with the other. The distribution of coins may become temporarily lopsided as a result, allowing arbitrage traders to cash in by utilizing the situation at your cost because the coin that has suddenly become scarce in the pool is likely to be available cheaper elsewhere.

Conclusion

I recommend experimenting with a small sum first to get a feel of how the pools work.

This tool shows the value of your share of the pool (all of them on the same chain DEX):

This is the Masterchef address of Cub Finance:

0x227e79C83065edB8B954848c46ca50b96CB33E16

Posted Using LeoFinance Beta