Governments rely on control of the money supply in order to control the global economy and maintain power.

They printed a third of it in the last two years, aka Quantitative Easing, and clearly a lot of that got spent on or leveraged into Bitcoin.

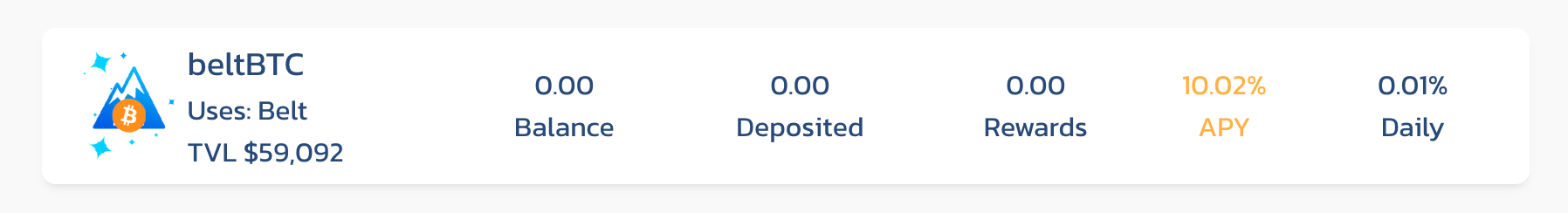

And then, probably just because of fortunate/ unfortunate timing meaning the golden age of DEFI coinciding with all that free money being printed, BTC and crypto more generally offered some great returns.

And then the bubble burst (surprise!), and now that governments are putting up interest rates and squeezing the money supply, people are selling out of higher risk assets and Bitcoin as the returns don't look so great anymore.... so the sell off accelerates...

But let's not forget that one massive advantage Bitcoin has over FIAT currencies is its fixed supply, and it's fixed and now VERY limited rate of inflation, with < 3M out of a total supply of 21M yet to be printed.

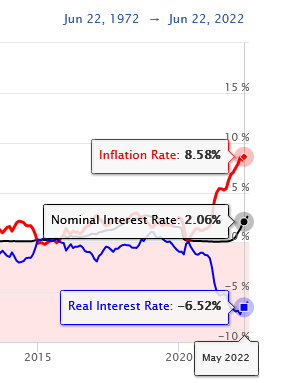

This means that holding BTC is basically a hedge against the value of FIAT money, which, let's not forget has genuinely gone down in value over the last couple years.

And, frankly, there's little sign of the global economy picking up anytime soon, the global capitalist system was already fit to burst before Covid and now with normalisation of three nations happy to be involved in overt military imperialism - Russia, the US and China will probably wade in soon.

And Bitcoin is a stand against all of that - it's a currency which just works outside of the banking system, a currency that no one can devalue by just printing more of it.

However Clearly People Haven't seen it Like that!

Of course Bitcoin is more than just an anti-government hedge, it's also an asset class which people speculate on - and OBVIOUSLY that's how MOST investors see it - hence why it's an easy sell...

More and more people see there as being more potential to make money elsewhere (stocks/ art/ whatever) or at the very least, they see selling it into stables as a means to not LOSE more, and I imagine there's a fair bit of shorting going on ATM.

And in terms of seeing BTC as an investment vehicle, there is a slight problem - it doesn't, like stocks, represent a share in anything tangible - unless you count 'anti-government-fiat-sentiment' as have a value (which I think it does, but valuing it is pretty much impossible) - hence why it's an easy sell, faster than stocks which do tend to represent something tangible...

But I don't think comparing it to stocks is fair, it was never designed to have that function.

Bitcoin as Gold/ Art/ A Status Asset...?

This is something to think about... now that the crazy DEFI bubble has burst, and the 100% yields are over, what is the 'underlying' status value of BTC...?

How many people, for example, will hold 1 BITCOIN or 10 or 100 or 1000 BTC just because of status - and what price will they want to hold it at...?

There are plenty people who are rich enough to hold onto 1 BTC at $10 000 just for the sake of holding BTC for example, even if it doesn't offer much of a return and is a risk, and once it hits that point, it probably isn't going to go down much more....

And I can't help but have this feeling that a lot of people are shorting BTC to try and either pick up more or skim off a few dollars on the way down, I mean I am, so surely many other people are!

The Bitcoin Price - Final Thoughts

The last 12 months has maybe seen mainstream money come into BTC and pump the price, much of which has now left, it will be extremely interesting to see where the die-hard hodlers' floor is... that average value at which hodlers just say 'NO' not selling at less than this thank you very much...?!?

Posted Using LeoFinance Beta