With the successful launch of Polycub yesterday, which includes a tasty stales staking option in the form of a USDT-USDC-DAI tri-pool, I thought it appropriate to view what the competition on Polygon has to offer in terms of stable-staking options...

I imagine there will be a honey-moon return phase for a few more days yet where we see some insane returns, but these will quickly settle down as more people pile into the pools, and it's the rate that we end up with that's going to be important in the longer term...

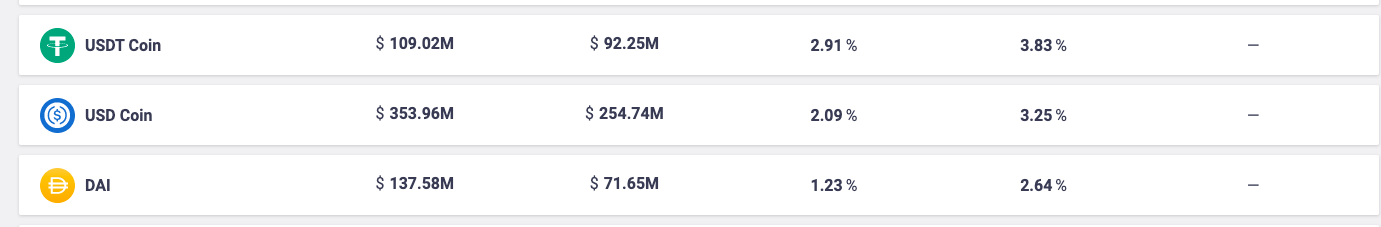

There is currently around $3 bn staked to various contracts on Polygon, and (as with Avalanche) Aave has the largest amount of funds by Total Value Locked (TVL), with around $1.2 bn staked to it, but only offers around a 2% return on most stables https://app.aave.com/#/markets, and only on DAI/ USDC and USDT.

I'm including it here just a base reference point, and because almost a third of funds staked on Polygon are staked to Aave, but I think it's fairer to look to other Yield Aggregator options for a closer comparison....

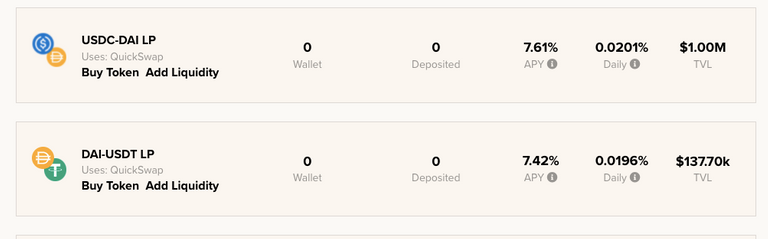

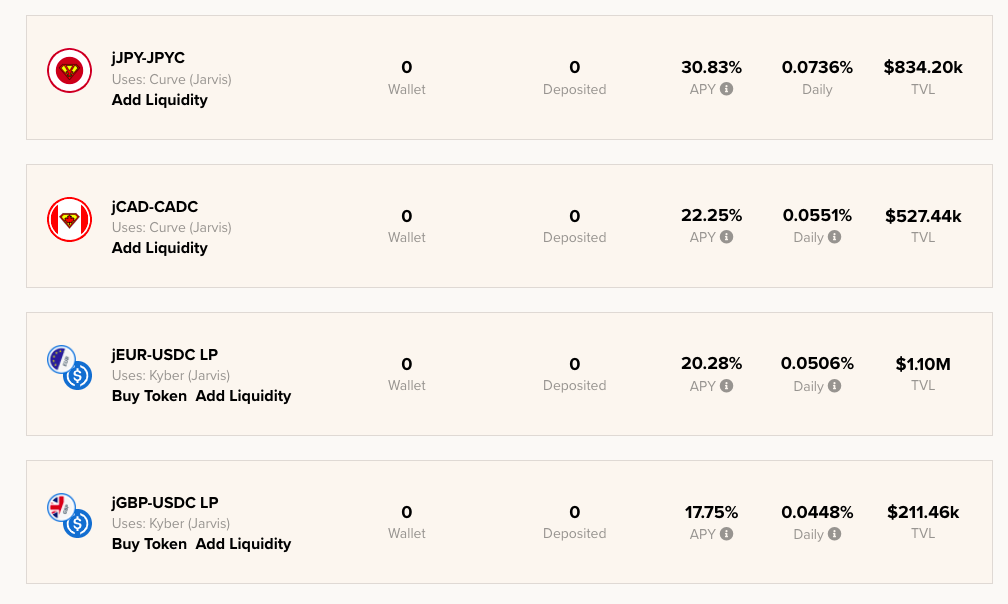

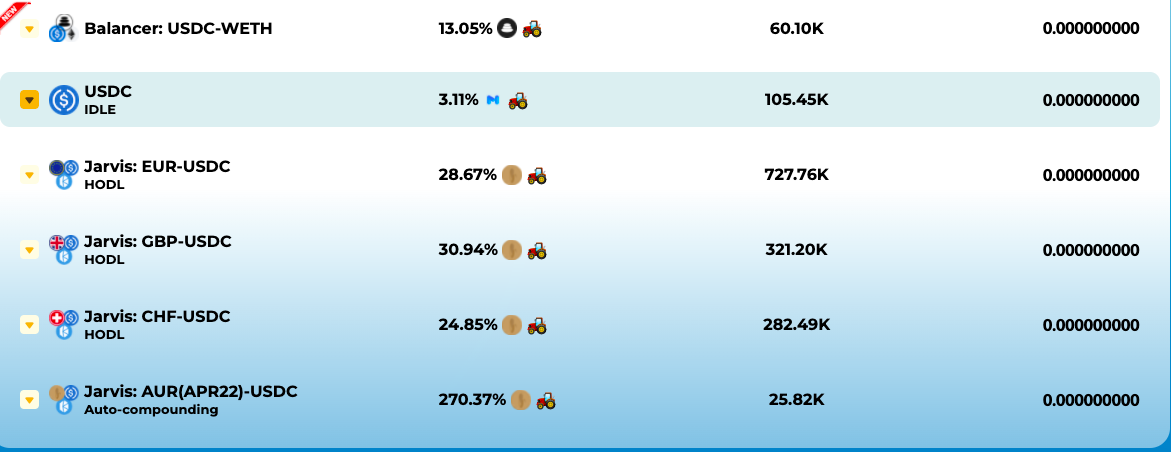

Beefy Finance - 7% on classic stable pools, 30% on 'funny stables'

Beefy Finance is the largest Yield Optimiser on Polygon by TVL and offers a not-too shabby 7% on the classic pure stable pools...

It also has some interesting options on 'J' currency pairs - such as GBP-EU..... NB I've only just stumbled on this so haven't researched it, but there are options!

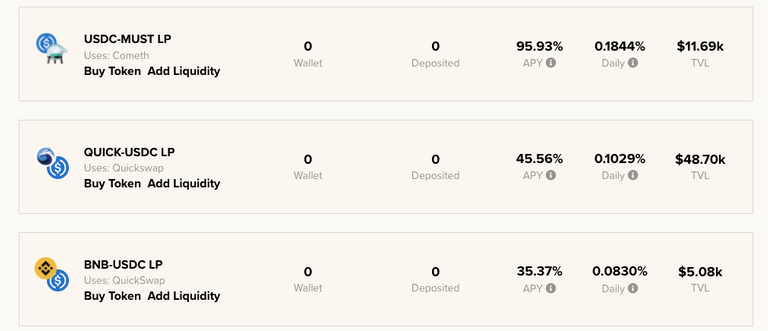

In case there's a PCUB-USDC pool here are the corresponding returns on other 'stable-DEFICOIN' pools, ranging from 35% to 70%.

I guess the BNB option would be similar to a MATIC-stable option if it appears on Polycub.

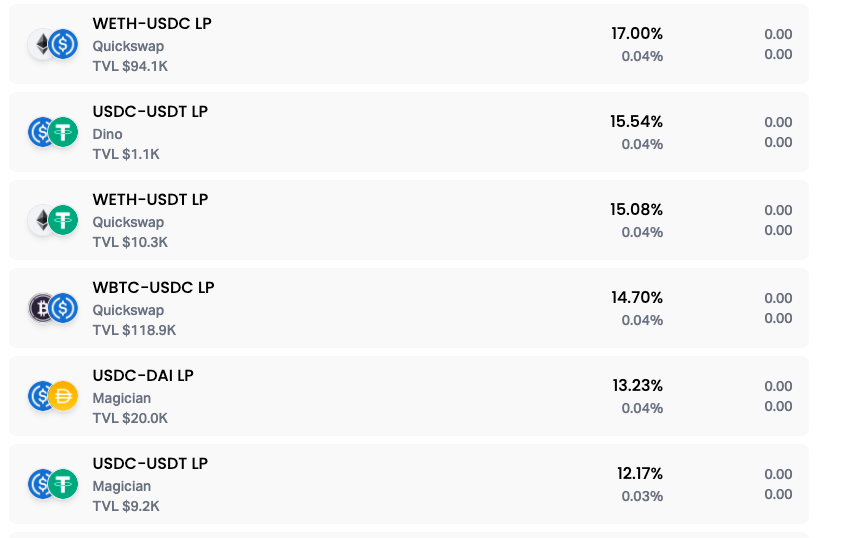

Autofarm - pure stables options at 15%

Good old Autofarm is the second largest Yield Aggregator on Polygon offering a range of stable options from single digit returns all the way up to 15%

It also offers a similar tri-pool to the one which is going to be launched on Polycub....

NB there's also returns on stable-randomdefishitcoin of several hundred percentage points, so clearly PolyCub isn't the only new kid on the block this weekend.

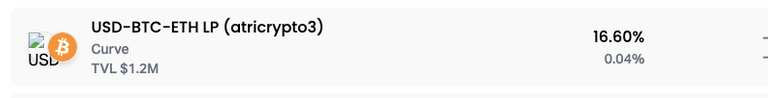

Harvest Finance: more decent options...10% to 270%

Harvest Finance is the third in size by TVL, but here we are down to only $8 million in value, but we have a decent range of options, although you might well classify some of these as degenerate:

It also offers a 4-stable pool similar to 4belt at 10%.

Final Thoughts... what's a good rate of return on yer Cub stables, once the dust settles...?

Given that AutoFarm is a reliable old-school (ironically) DEFI platform, I think this is a good point of comparison, so I'd really be wanting at least 15% from my pure stables pool on Cub, and similar from the tri-pool.

Where pooling stables with MATIC or PCub are concerned, anything over 35% for the former and 70% for the later would be hard to beat on other trusted platforms, I mean there are higher returns, but maybe with too much risk!

Posted Using LeoFinance Beta