I was quite happy with my BTC and ETH sitting in the Cub Kingdoms until I was unable to harvest either of the rewards for them via the regular front end and had to do an emergency withdrawal to get my funds out, forgoing those rewards.

So while the returns in those Kingdoms look good - 8% and 13% on BTC and ETH respectively, for me it was actually 0 so I may as well have just left them both unwrapped in cold storage!

And I am still tempted to do just that at the moment - just leave all my classic crypto in cold storage and wait out the bear market - I mean what's the point in putting my assets at risk if I have to emergency extract anything for nothing...?

However I am still looking around at what's on offer - NOT either of Cub or PolyCub I'm done with piling any major assets in to either of those after my experience with getting my funds stuck, and so I've been looking around to see what's on offer elsewhere for BTC and ETH...

(NB for stables I've pretty much just settled on HBDs for the time being!)

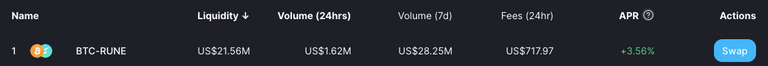

Thorchain

I thought I'd start with ThorChain as this is the only option for pooling native BTC and ETH for a return and they offer 3% and 6% respectively...

The problem here is that you have to pool with Rune, and while i do still hold Rune man am I glad I HAVEN'T had any BTC or ETH assets pooled with it over the last year, as Rune is down from over $10 to $1 - people who have been in any pools long term are now either stuck in the hope that Rune picks back up in price or going to have to come out at a sever loss.

Of course NOW might actually be a good time to go in on these pools and even buy more Rune - I mean what with CEXs collapsing all over the place maybe now is the time to have a punt on genuine DEXs, now there's a thought.

So I MIGHT risk a little BTC in here, and I mean a very little!

I mean RUNE can't go any lower, right?!?

And to be fair today was the first time I'd checked back in with Rune in ages and it does seem swankier!

Aave

I always check Aave as it's one of the largest TVL projects out there, but the returns can't even compete with contemporary FIAT savings accounts....

With offerings of only 1.3% on ETH and 0.12% on BTC I'd rather just keep my funds in cold storage.

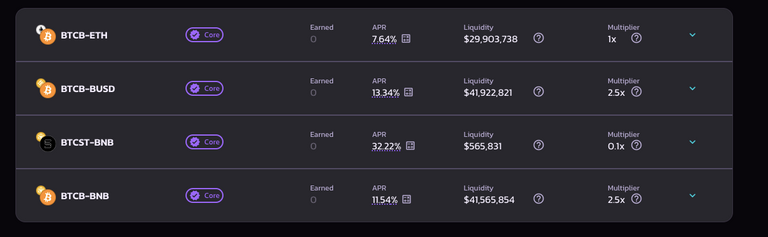

Pancake Swap

PancakeSwap is one of the best known and established DEFI projects on BSC and offers some reasonable returns on a range of pools...

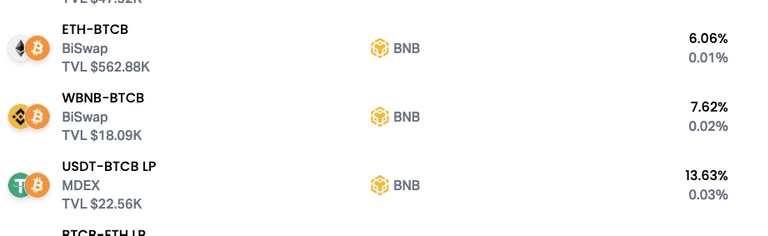

Autofarm

Autofarm is one of the first DEFI projects I got into and so I like to keep an eye on it and if currently offers some reasonable returns on ETH-BTC, BNB-BTCB and USDT-BTC...

Tempting given that I don't mind a hedge with a stable coin that 13% pool!

Final Thoughts - Where will I put my BTC and ETH...?

I think I'm going to risk 20% of each across Pancake and Thorswap - with a 15%-5% split, but 80% is going to stay in cold storage!

It's a shame Cub has let me down, that was going so well, but when my funds get stuck, I don't go back.

If you have any other reliable DEFI options which offer a decent return on staking BTC or ETH do let me know in the comments!