The household debt of a nation is one of the major economic indicators that provides information on how the country is performing. Canada now has the highest level of household debt among the other G7 countries. This data is not a good sign for a country reeling from the negative impact of the pandemic in the last two years. This also means the residents are going through one of the worst economic situations among the G7 countries. The reason behind this is over dependency on how the housing market. let's talk about what the situation is and how can that impact Canadian economy.

First, let’s understand what do we mean by Household Debt.

Household debt refers to the total amount of debt owed by individuals or families within a country. It includes various types of debt, such as mortgages, credit card debt, student loans, and personal loans. This is an important economic indicator as it provides a bird-eye view on what the borrowing behavior of household is and where the state needs to intervene if it is out of control.

For me there are two reasons to make sure the household debt is on check.

First it is about housing market dynamics as the mortgage debt is closely linked to the housing market. High level of mortgage debt may increase the household vulnerability to housing market fluctuations which in turns will in fact the financial well-being of individuals.

Second is their influence of household debt on inflation. The Central Banks are raising interest rates to lower inflation. The higher interest rate will affect the ability of households to serve as the mortgage debt and other type of household debts. That means the household debt can impact the effectiveness of monetary policy which is at play right now.

Household debt in Canada-

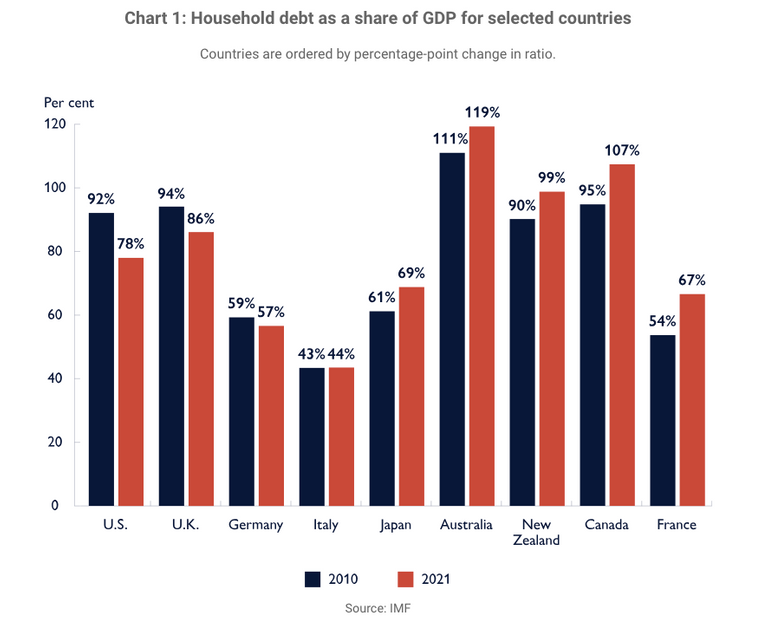

Household debt in Canada has reached alarming levels, surpassing that of any other G7 country and even exceeding the country's entire GDP. The Canada Mortgage and Housing Corporation has identified high home prices as the main cause of this soaring debt. While household debt in the US and the UK has decreased over the past decade, Canada has experienced a continuous increase, making its economy vulnerable to global economic crises. The agency emphasized that 75% of Canada's household debt stems from mortgages, which escalate as home prices rise.

Take a look at the graph below from Statistics Canada.

Let’s crunch some numbers

According to the most recent data, the average Canadian household debt, not including a mortgage, is almost $41,500. If a mortgage is included in the calculation, then the average per person debt in Canada rises to almost $75,000.

It's worth noting that Canadian households owed an average of $1.71 for every dollar of disposable income in the third quarter of 2020. This means that household debt as a percentage of disposable income rose to 170.7% in the third quarter of 2020. This ratio is a Canadian record and up from about 100% 20 years ago.

What are the potential negative impacts of this debt?

High household debt can have a significant impact on the economy. When households have high levels of debt, they tend to spend less on goods and services, which can lead to a decrease in economic growth.

On the other hand, higher debt results in more consumption by households and a larger share of economic output coming from consumption. At the same time, this results in the country running a larger current account deficit with the rest of the world as imports increase, with consumption goods making up a larger share of those imports.

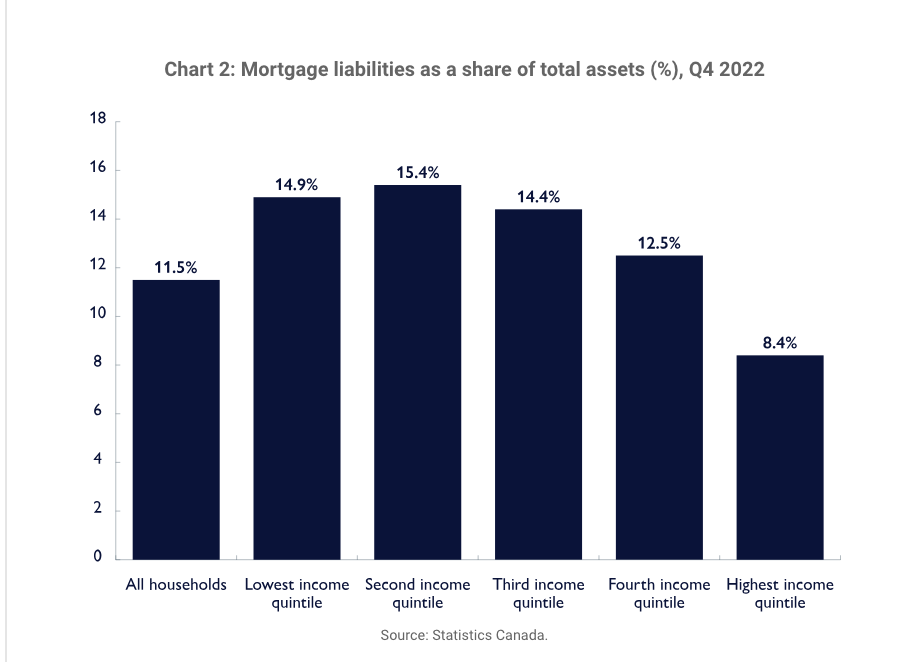

Households will have less financial flexibility in a high debt scenario. High household debt levels raise significant distributional concerns, particularly for households with lower incomes. These households often carry higher debt burdens and depend on employment to manage their debt payments. As a result, they are disproportionately vulnerable to economic downturns. The current situation exacerbates their challenges as they face increased pressure from rising housing costs. This dynamic highlights e importance of addressing housing affordability issues to alleviate the financial strain on vulnerable households and reduce the disparities stemming from high debt levels.

Impact on Households

Elevated interest rates and declining house prices are reducing households' financial flexibility in Canada. While most are currently handling higher debt-servicing costs, early signs of financial stress are emerging. As homeowners renew their mortgages, more households will be affected by increased interest rates. High debt-servicing costs and low homeowner equity make households vulnerable to default in case of income drops. In a severe recession with unemployment, defaults and credit losses could rise, leading banks to restrict credit, potentially amplifying the recession. Addressing these vulnerabilities is crucial to protect households and improve financial resilience.

How do we manage the situation?

To mitigate the issue, the Canadian agency stressed the importance of restoring housing affordability in Canada. The average home price in the country is approximately C$716,083 ($528,000), with prices reaching even higher levels in cities like Toronto and Vancouver. These cities consistently rank among the most unaffordable in the world. Since 2011, the average value of a Canadian home has more than doubled, leading to the current household debt exceeding the GDP by 7%.

In comparison, the US has seen a decline in household debt as a percentage of GDP, falling from 100% in 2008 to about 75% in 2021. The UK also experienced a decrease from 94% in 2010 to 86% in 2021. The Canadian government has faced mounting pressure to address the issue of housing unaffordability. Earlier this year, a two-year ban on foreigners buying homes was implemented to alleviate the situation. Additionally, calls have been made for measures to increase housing supply in response to the significant population growth the country has witnessed.

Finally,

Overall, the high levels of household debt in Canada pose a significant risk to the economy, making it imperative for the government to address housing affordability and take measures to curb the rising debt. Monitoring household debt levels and ensuring their sustainability are important for policymakers and regulators. Balancing the benefits of debt-fueled economic growth with the risks of excessive debt is essential for maintaining financial stability and sustainable economic development.

Posted Using LeoFinance Alpha