Everyone is always talking about "not your keys, not your crypto", and rightfully so. As I've brought up quite often, exchanges are now becoming one of the biggest marks on the radars of governments in terms of things to control. Exchanges are mostly powerless to government demands as they are following the laws and regulations of the nation that they are licensed in (we are talking about centralized exchanges here of course).

Due to things like KYC and geo-location requirements, governments have a pretty good idea of who is doing what and where they are doing it from, if they need to sanction you or control your funds to push forward their political ideals (Russia and Canada), there is nothing the exchange can do to protect your funds you have stored there.

Take this tweet from Kraken as an example:

For them to function without being deemed money launderers or enablers of criminal activity in the nations they are operating in, they are forced to comply with law enforcement requests at all times. Kraken and their CEO have been wildly open about this and are showing that it is really beyond their control, it is up to the individual to custody their funds if they don't want to risk having their assets frozen.

Of course, the freezing of assets in a western democracy that is functioning with the freedoms guaranteed by their constitution in mind... But as we've seen that is a utopian ideal and we are really living with much less freedom than we realize.

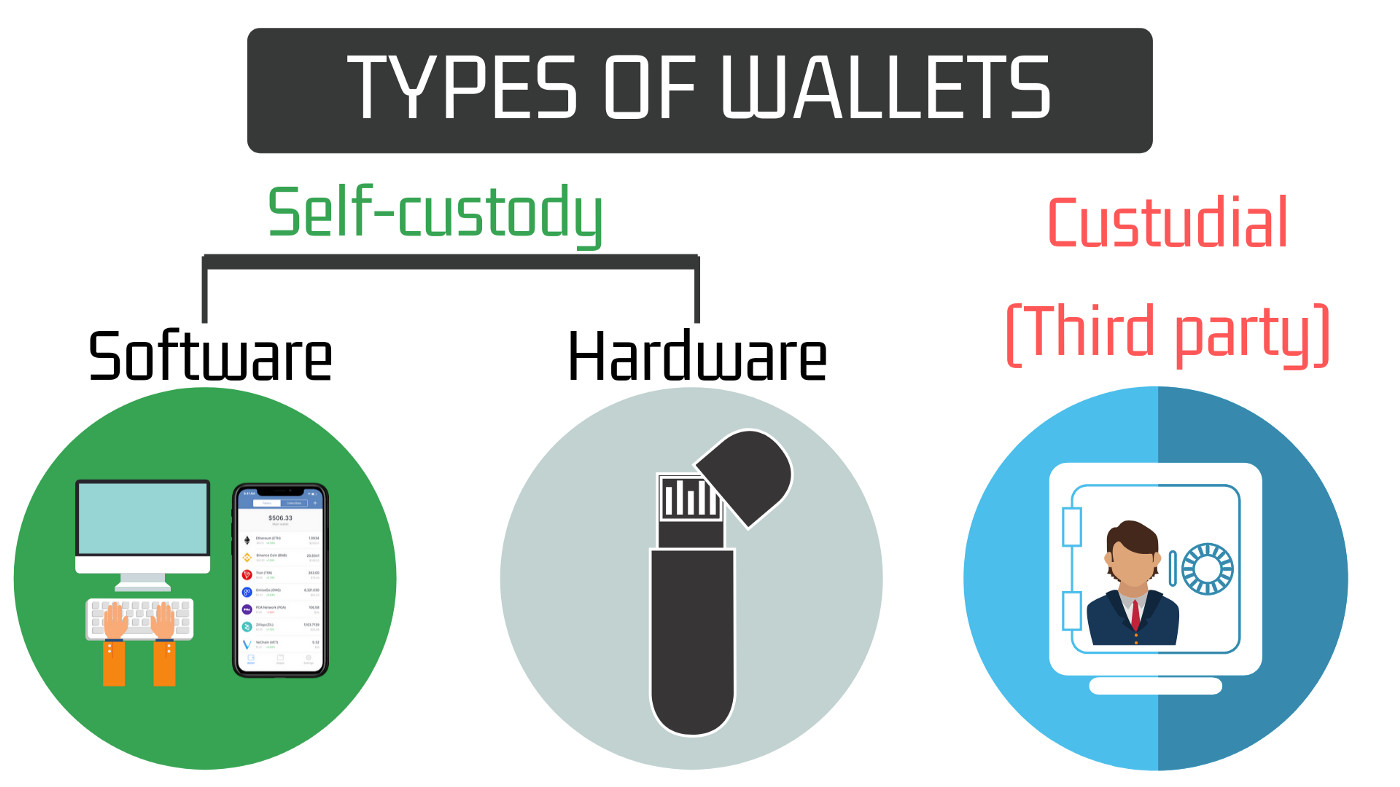

So if it is up to you, what do you need? Very simple - your own cryptocurrency wallets. There are many options including hardware and software wallets, but as long as you are holding your own keys and not logging in with email and password somewhere, the odds are pretty good that you will be in control of your own finances. A government cannot freeze your assets if they cannot access them (unless they come and physically confiscate your wallet... something that should never happen in our world, but is something we also need to prepare for).

Additionally, other than plotting for safety against corrupt governments or criminals/hackers, being responsible for the custody of your own crypto presents a lot of short term benefits. For one, you will have assurance that there is more than an email and password guess in the way of you losing your hard earned funds.

Additionally, I have been keeping my wallet somewhere that is not physically close to me and that has presented me with a great savings mechanism to avoid temptations like short term spending or wasting it on vices. You can't trigger any transactions without the wallet, so by putting physical distance between it and myself, I am already seeing my savings build at a steady (though admittedly slow) rate.

There are of course risks to self-custody including sending your money to the wrong place or forgetting your seed phrase, so there are definitely safety measures to keep in mind. At the end of the day however, the peace of mind knowing that things are up to me and not up to an entity beyond my control is worth the risk of making a mistake with my money.

Not your keys, not your crypto!

Come talk basketball on Dunk Social!

Come talk comedy on PeakD community - Com3dy Central

Links and Connections:

Join me on Splinterlands exploring blockchain gaming

Get paid for your search results with Presearch

Follow me on Twitter/Instagram: @ Rob_Minnick23

Hive: @ rob23

NEW TRIBE: @dunksocial

Join me on Torum

Check out Cake DeFi for staking rewards

Bitcoin Cash Apps: @ rob23

Join me on Publish0x to talk crypto

Who I am:

My name is Rob and I am a prospective law student with interests in cryptocurrency and blockchain. I have enjoyed my time thus far engaging with Web 3.0 and am looking to continue learning more and sharing what I learn through my experience

Posted Using LeoFinance Beta