Hello great finds today we are going to talk about Demand and supply trading style in the forex market, is it a good way to trade or not . let's learn together.

Introduction

Supply and demand trading is a fundamental concept in the world of finance and economics. It is the basic principle that determines the price of goods and services in a market. Understanding the principles of supply and demand is crucial for any trader who wants to be successful in the stock market, commodity market, or any other type of market. In this article, we will delve into the basics of supply and demand trading, explain how it affects prices, and provide techniques and strategies for identifying and trading in markets with imbalances in supply and demand. We will also discuss the risks and considerations involved in this type of trading and how to manage them effectively. Whether you are a beginner or an experienced trader, this article will provide you with valuable insights and information that will help you navigate the markets and make profitable trades.

Source

Source

The Basics of Supply and Demand Trading

The basics of supply and demand trading can be broken down into two key concepts: supply and demand. Supply refers to the amount of a good or service that is available for purchase, while demand refers to the amount of a good or service that consumers are willing to purchase. When there is a high level of demand for a good or service, but a low level of supply, prices will tend to rise. On the other hand, when there is a high level of supply and a low level of demand, prices will tend to fall.

One key aspect of supply and demand trading is understanding how changes in supply and demand affect prices. For example, if a new product is introduced to the market and there is a high level of demand for it, the price of that product will likely rise. Similarly, if a major supplier of a product goes out of business, the supply of that product will decrease, and the price will likely rise.

Another important aspect of supply and demand trading is understanding how different markets and industries can be affected by changes in supply and demand. For example, the price of oil is heavily influenced by supply and demand factors, as changes in global oil production and consumption can significantly impact the price of oil. Similarly, the stock market is also heavily influenced by supply and demand, as changes in investor sentiment can cause fluctuations in the prices of individual stocks and the overall market.

How supply and demand affect prices

Supply and demand are the two most important factors that determine the price of a good or service. The relationship between supply and demand is represented by the supply and demand curve, which shows the quantity of a good or service that consumers are willing to purchase at different prices.

When there is a high level of demand and a low level of supply,prices tend to rise. This is because there are many buyers but few sellers, so sellers can charge higher prices. On the other hand, when there is a high level of supply and a low level of demand, prices tend to fall. This is because there are many sellers but few buyers, so sellers must lower their prices to attract buyers.

The balance point between supply and demand is known as the equilibrium point. At this point, the quantity of a good or service that consumers are willing to purchase is exactly equal to the quantity that producers are willing to sell. The price at the equilibrium point is known as the market price.

However, it's important to note that the market price does not always remain at the equilibrium point. When there is anan imbalance between supply and demand, the market price will change until the market reaches a new equilibrium point. For example, if there is a sudden increase in demand for a product, the price will rise, while if there is a sudden increase in supply, the price will fall.

It's also important to note that the relationship between supply and demand is not linear, meaning that the change in price will not always be proportionate to the change in demand or supply. Sometimes a small change in demand or supply can cause a large change in price, and vice versa.

Tools and indicators for analyzing supply and demand

There are several tools and indicators that traders can use to analyze supply and demand in the market. Some of the most popular ones include:

Order flow: Order flow refers to the buying and selling activity in a market. Analyzing order flow can provide insight into the level of supply and demand for a particular security.

Volume: Volume is the number of shares or contracts that are traded in a given period of time. High volume can indicate strong demand for a security, while low volume can indicate a lack of interest.

Price action: Price action refers to the movement of the price of a security over time. Analyzing price action can provide insight into the underlying supply and demand forces that are driving the market.

Source

Source

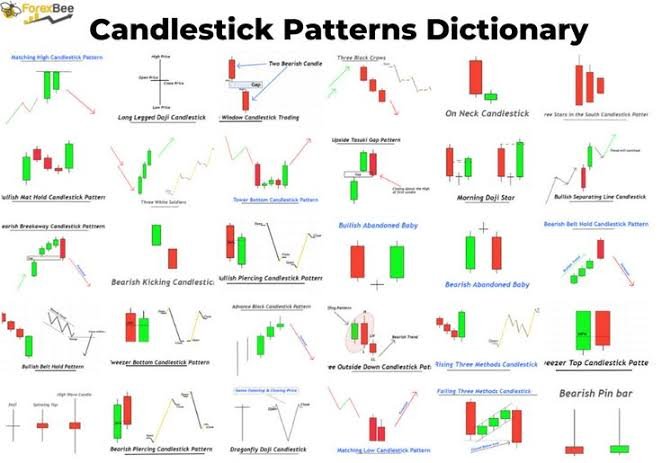

Candlestick charts: Candlestick charts are a type of chart that is commonly used in technical analysis. They provide a visual representation of the supply and demand forces in a market by showing the open, high, low, and close prices for a security.

Source

Source

Risks and Considerations.

Risks involved in supply and demand trading.

these are somethingsto consider;

1- Market volatility: The market can be highly volatile, and prices can fluctuate rapidly. This can make it difficult to predict the direction of prices, and can lead to losses for traders.

2-False signals: There is a risk of interpreting signals incorrectly, or being led by false signals.This can happen when a trader is relying too heavily on a single indicator or tool, or when a trader is not sufficiently familiar with the market they are trading in.

3-Margin trading: Many traders use margin trading to increase their buying power, but this can also increase the risk of losses. If the market moves against a trader, they may be required to deposit additional funds to maintain their position, or their position may be closed out at a loss.

4-Emotionally driven decisions: Trading based on emotions can lead to impulsive decisions and can result in losses. Traders should have a strategy in place and stick to it, instead of allowing emotions to drive their decisions.

How to manage risk in supply and demand trading.

1-Risk management plan: Traders should have a well-defined risk management plan in place before they begin trading. This plan should include the amount of capital that the trader is willing to risk on each trade, as well as the maximum loss that they are willing to accept.

2-Position sizing: Positionsizing is the process of determining the appropriate size of a trade based on the trader's risk management plan. Traders should only risk a small percentage of their capital on each trade, to ensure that a single loss does not wipe out their entire account.

3-Stop-loss orders: Stop-loss orders are used to automatically close a trade at a specific price to limit the potential loss on a trade. This is a good risk management tool for traders, as it allows them to set a limit on their potential losses before they enter a trade.

4-Take profit orders: Similar to stop-loss orders, take-profit orders can be used to automatically close a trade when it reaches a certain profit level. This can help traders lock in profits and manage their risk.

5-Continuously monitoring and adjusting: Risk management is not a one-time process, but an ongoing one. Traders should continuously monitor and adjust their risk management strategy based on the market conditions and their own performance.

I hope this helps someone make informed decisions. for further studies here are some good books to read .

1"The Supply and Demand of Commodities" by John J. Merrick.

2-Supply and Demand Trading for Stocks and Options" by Michael C. Thomsett.

3-Trading in the Shadow of the Smart Money" by Al Brooks.

4-How Markets Really Work: Quantitative Guide to Stock Market Behavior" by Larry Connors.

5-The Complete Guide to Market Breadth Indicators" by Gregory Morris.

6-The Art and Science of Technical Analysis" by Adam