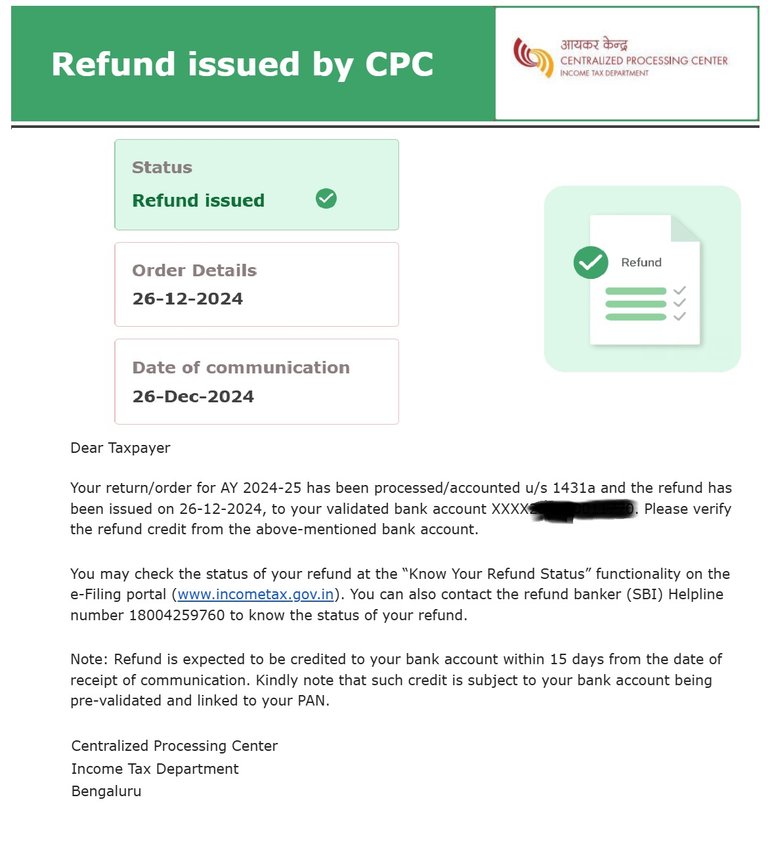

From the Income Tax department, after I claimed.

Couple of years back, I had consolidated a lot of accounts of Dad, and kept all the amount in Mom's account as Dad is not able to remember even about his accounts. At this age, financial stability matters a lot, and having money in her own account provides some kind of mental peace. Even though she is more confident about me taking care of them, till I am alive, I thought, let's park all that money in her account, adding some more from my side. Now a days, PAN card is a must, so I also created one for her and gave that in the bank. The bank never told us that, they are deducting TDS on her deposits from last two years. And we have not availed online facility for her accounts, because Mom can easily fall prey to scams, so there was no way of even checking, what's going on. Few months back, out of curiosity, I asked the bank about TDS, and then only came to know that they are deducting TDS. As per Section 203 of the Income Tax Act, 1961, one is entitled to receive a certificate whenever they deduct TDS, but now a days, Banks expect you to download it online. So we never got that, can say an oversight from us as well. However, Form 15G and 15H can be submitted asking the bank to not deduct TDS, as her income is below the basic exemption limit. They should have told us to submit this at least, and now we have submitted that, however what about the TDS they already deducted and submitted to Income tax department ? They could not even give me a statement of that, because of technical issues in their portal.

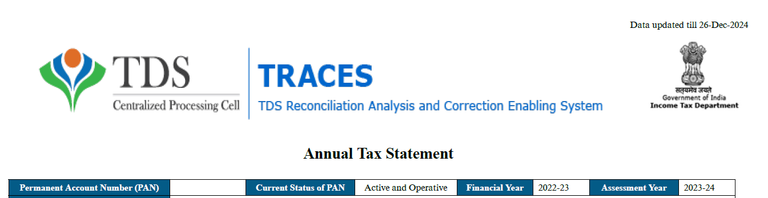

So this was one of my to do list during these holidays, and I logged into the Income Tax portal, and downloaded the Annual Information Statement (AIS) and Annual Tax Statement, that showed me the exact amounts. The next step was to file a return, and this was a delayed return, since the default date is July 31st.

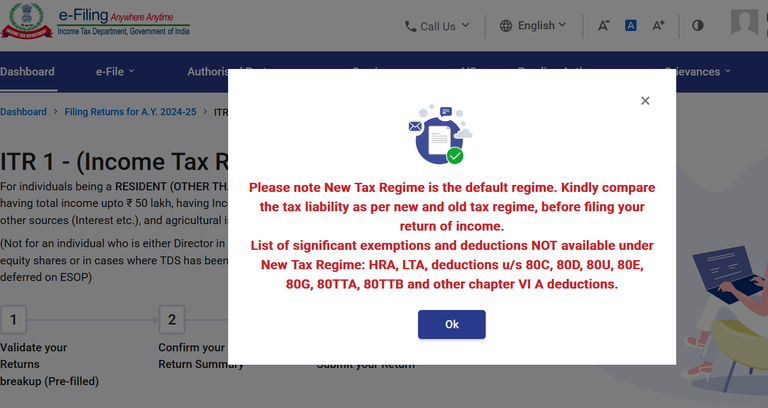

Since this was first time, I filed her return, New Tax Regime was selected by default. And ITR 1 is enough for her return, so I had to consolidate all her incomes, and report them. Interestingly, the TDS deducted even did not show up, and I had to fill it manually. So finally, I claimed a return of ₹9998 for the last financial year, and they were so good to return it, making it a round 10k.

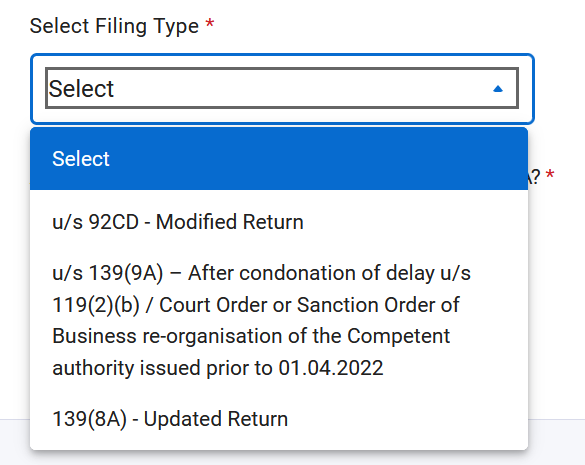

Next I found out that, the bank also deducted TDS of ₹6258.00 for the assessment year 2023-24 and ideally, one is not allowed to fill a normal return for previous assessment years, but there is a provision to fill ITR-U (Updated Tax Return) for previous assessment years ( a belated return), but again that has to be within two years from the end of that relevant assessment year. I did not know about this provision, so had to google and read a lot about it, to understand the process, but still its not very clearly told anywhere. Even there is a video from the Income tax department, describing who and how of this ITR-U, but unfortunately, it still does not tell me the exact steps of getting this done.

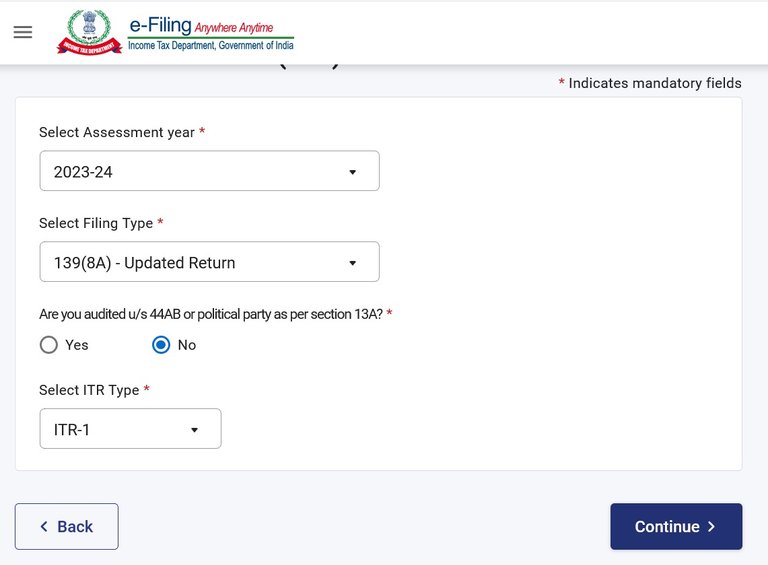

So finally I decided to give it a try in the Income Tax efilling site, to discover the ground realities. The moment you select the previous assessment year, it gives you very few options as shown below for filling type.

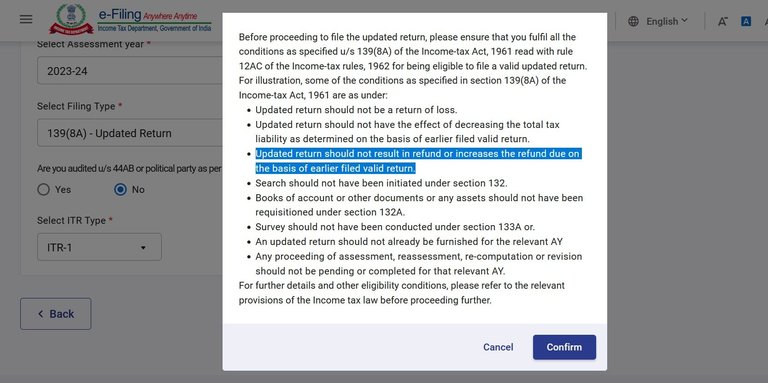

So I select the last one and click Continue and then there is a scary pop-up that shows up like a legal notice to make sure, we fulfill all the conditions under section 139(8A), WHICH honestly took more than half a day for me, and I still did not understand it all. They could have simply told to call their helpline numbers if one still has doubt, don't we deserve that much as a honest tax payer!!

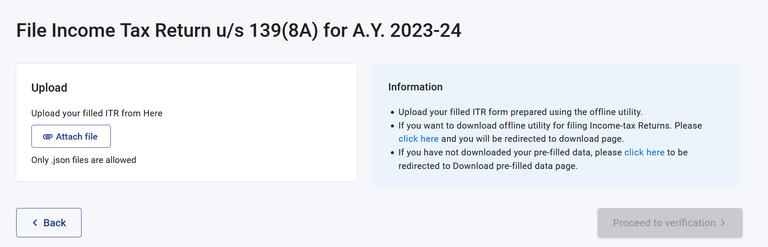

So Confirm and move forward to see how it goes and it gets stuck in the very next step.

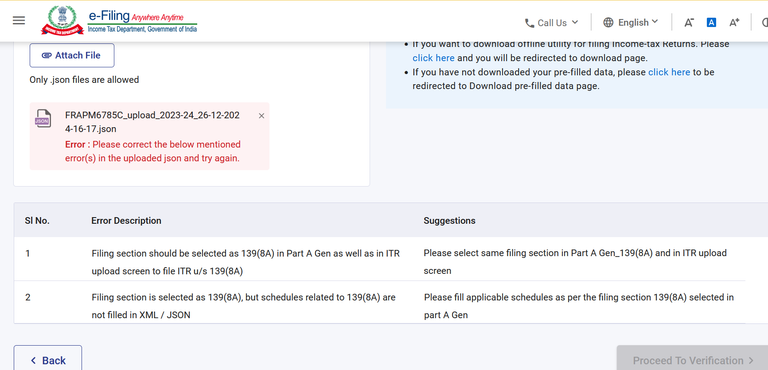

You don't have any online facility to fill the return, and have to attach your filled ITR in json format. And to prepare the filled ITR, you will have to download an offline utility. Why this is so complex !! But anyways, without any other option, I downloaded and tried the offline utility.

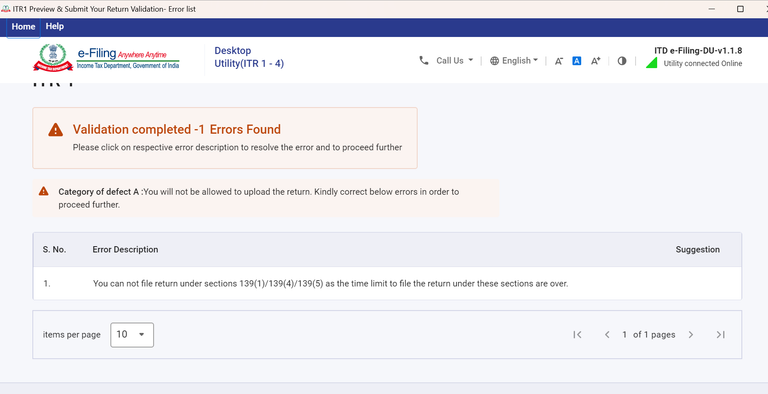

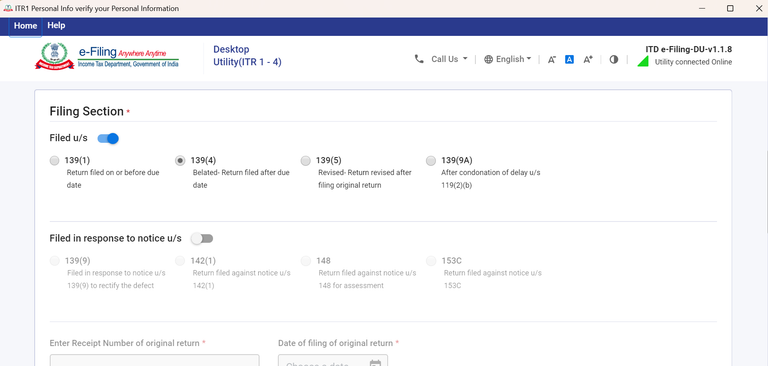

Unfortunately after spending more than a hour on this to prepare the return, export json and upload to the efilling site, I realized, this utility does not have provision to fill an updated return under section 139(8A), and the json it produces fails validation during upload. So for my own satisfaction, went back to the utility and verified the sections available and here is what we have in the utility.

For previous assessment year, it has by default selected 139(4) and there is no option for 139(8A). So who is wrong, me or the utility ? Section 139(4) is for belated return for this assessment year only, so the normal deadline is July 31st, but you still have option to file the belated return under section 139(4), but there may be some penalty for that. And for the current assessment year 2024-25, you can file belated ITR only if you have opted for the new tax regime. So much to learn, if you miss by chance......which would be treated as ignorance though.

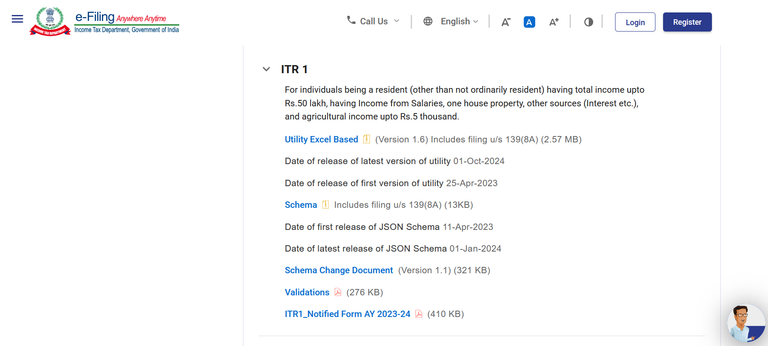

Going back to our section 139(8A), did some more research and then found out this :

There is another Excel Based Utility that has provision to fill return u/s 139(8A), and it's available in the Download section, only after you select the AY and click the ITR 1 form. They should have pointed to this at the very first place - who cares being user friendly, when the law considers you, accountable for not filling your return !!! If you owe tax, then they have penalties, if you fail to comply the process, but if they owe refund, then its your responsibility to demand it, else they don't bother to pay you - Democracy at its best. There is no system in this country to hold govt accountable - unless you go to court and fight. Now curious how it ended up ?

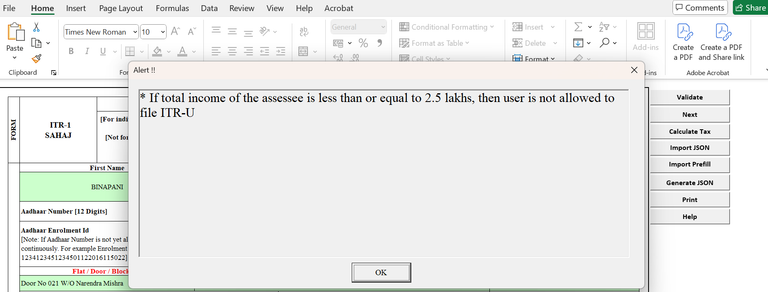

After playing a hour with the excel utility and having completed everything ( it has lot of validations and you have to enable macros), finally it said : She is not allowed to file ITR-U, if the income is less than or equal to 2.5 lakhs, which is the case. So that's the end of story, the google search did not tell me this in the very first place. Does anyone knows if there is any other way ?

And before wrapping this I most tell you the fun fact : By the time I completed exploring all these, the return for AY 2024-25 came to her bank account - that was quite impressive - return filled in morning and credited in the afternoon - we have efficient systems - may be just lack of efficient policies and people ? Mom does not know any technical details but when she heard that she got 10k in her account, she was so happy - was like a Christmas gift for her.

And I was wondering, how old aged people like our parents who do not know a lot about all these formalities can keep their money safe, they even can't keep it at home.

copyrights @sanjeevm - content created uniquely with passion for #HIVE platform — NOT posted anywhere else! #HIVE is my only social diary - my blog is my life.