Salaried people - You can do it yourself easily.

Before proceeding to e-fill, please read this whole post once.

The last date for filling the Income Tax Return is approaching fast and it's better you fill it sooner because most people try to fill it towards the end and the site often experiences issues during that peak time. So to begin with click on the link and login. You can search and log in to the site as well.

https://www.incometax.gov.in/iec/foportal

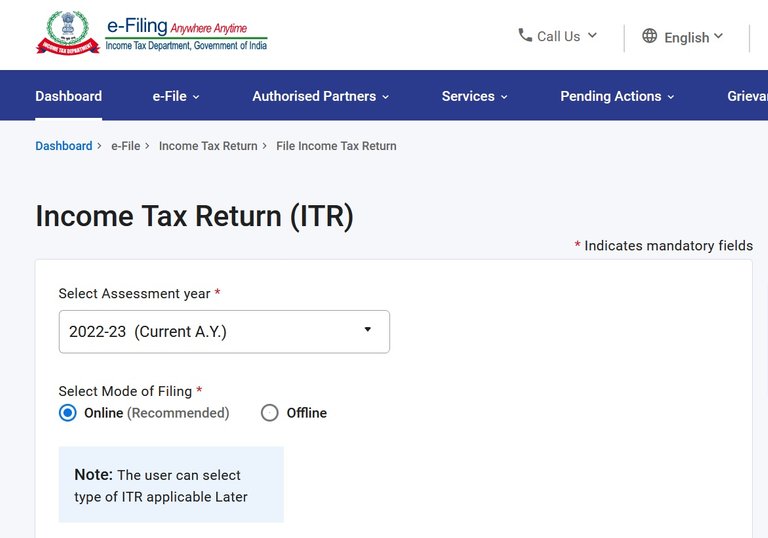

Once you log in , it will show you this option, click on File Now. Then it will take you to the next screen.

Select the current A.Y. (refer the first screen), as you are going to file the tax return of previous year, that is getting accessed this year. Select Online mode and continue.

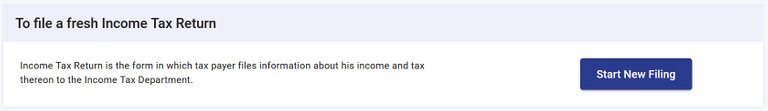

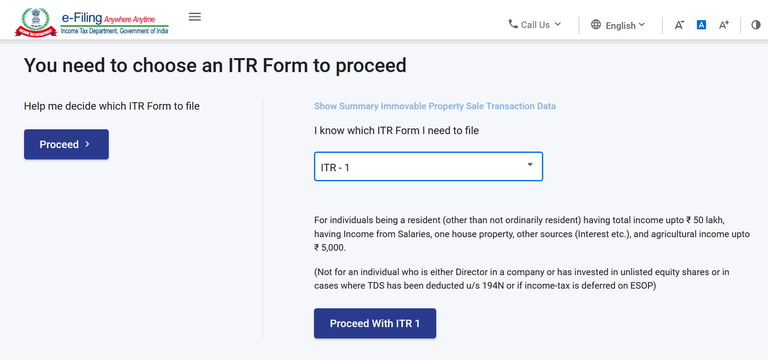

In the next screen click on Start New filling. It will take you to be bellow screen , where the status is pre-selected by the department based on previous year data.

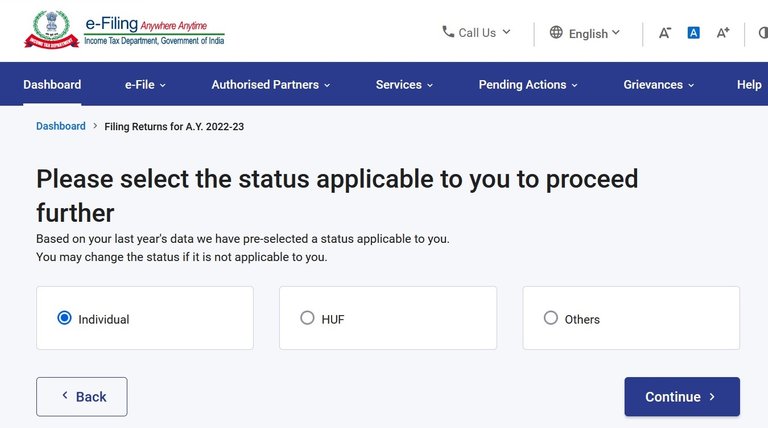

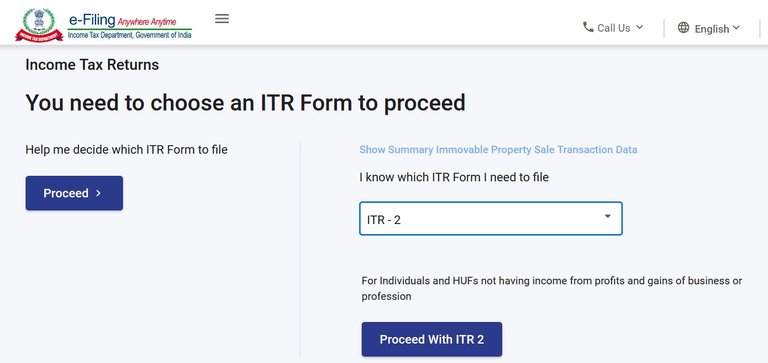

I think, it does not change for most of us, so click Continue. It takes you to the next screen where you need to choose the ITR.

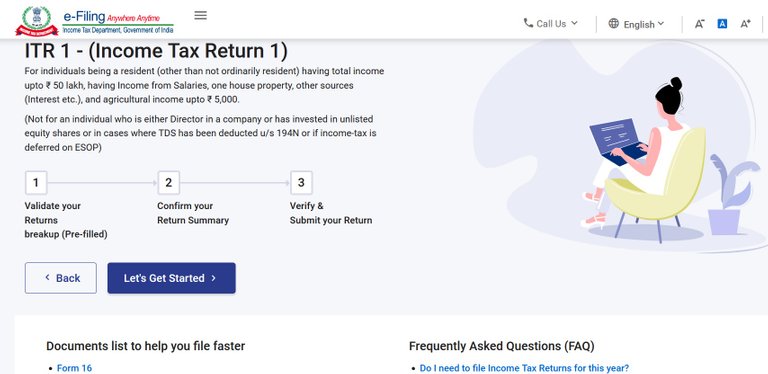

For most, ITR-1 will suffice. As shown, it is meant "For individuals being a resident (other than not ordinarily resident) having total income upto ₹ 50 lakh, having Income from Salaries, one house property, other sources (Interest etc.), and agricultural income upto ₹ 5,000."

But you can also select ITR-2, if your income exceeds 50 lakhs, or you want to show more than one house property or you want to show income from Capital Gains etc. Once you proceed to the next screen, it will present you Summery screen.

So at a high level, it consists of three steps :

- Validate your Returns breakup (Pre-filled)

- Confirm your Return Summary

- Verify & Submit your Return

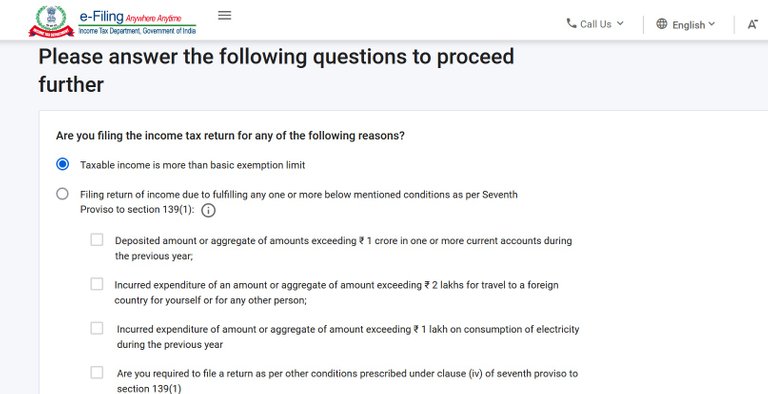

Click on Let's Get started, it will take you to this questionnaire screen.

For all salaried people, the first answer is the right choice, you are supposed to file a return if you are paying tax, as your income is more than basic exemption limit. The second choice is for those, who usually are not required to furnish the return, but have to file the return due to some other conditions laid down as choices. So select the first one and click Continue.

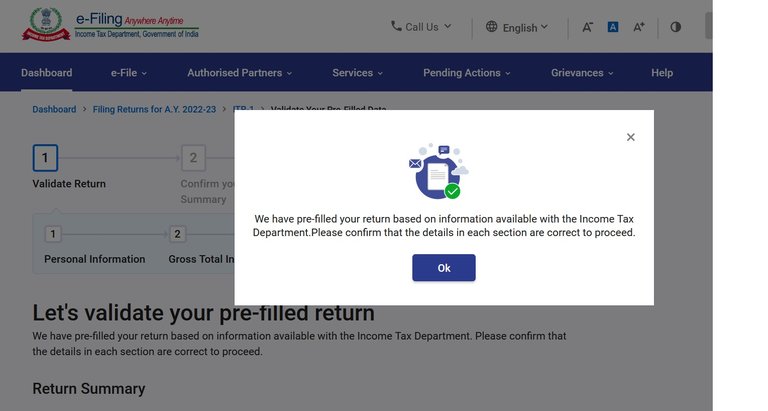

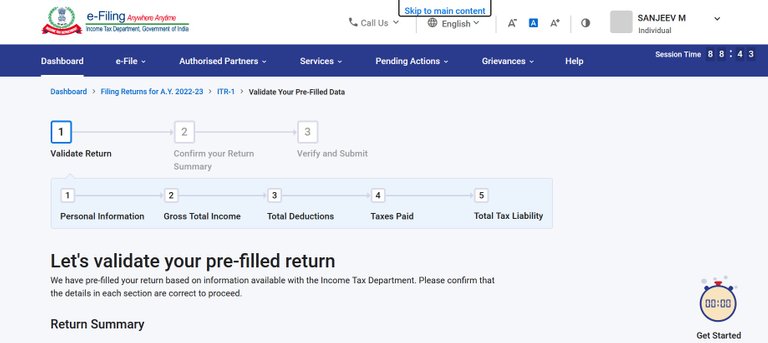

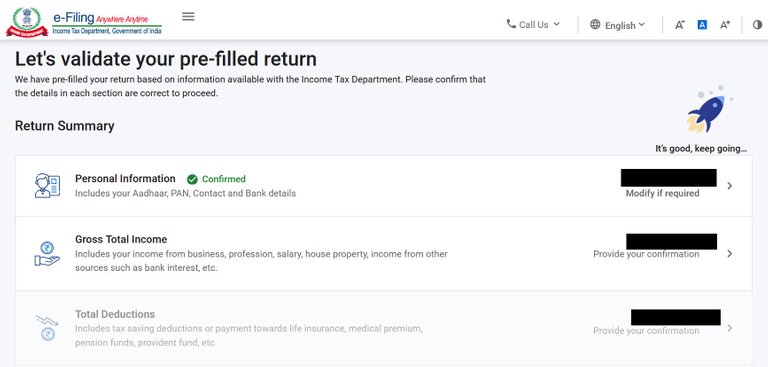

It will show you a notification saying, they have pre-filled your return with the data available with the IT department, but it's your responsibility to confirm that the data is correct. Click Ok and it will present you the Validate Your Pre-Filled Data screen.

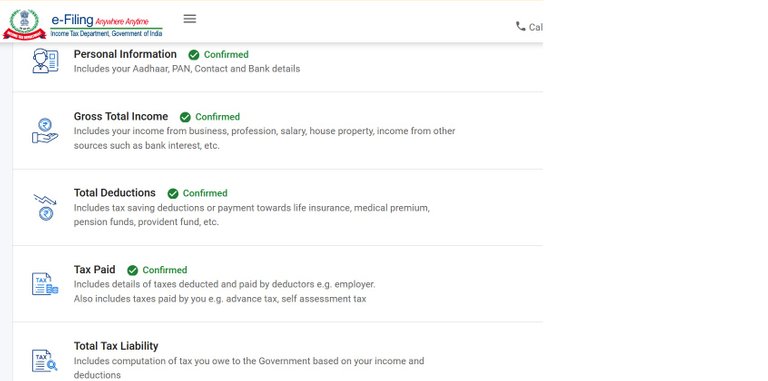

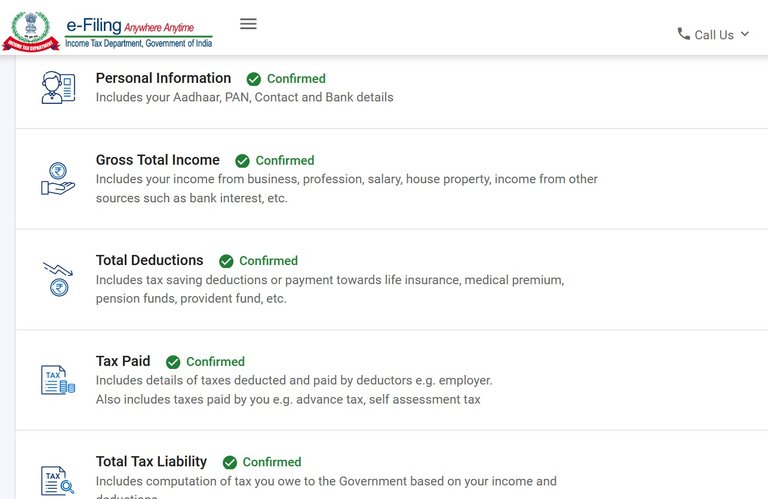

As you see, it has five different sections, and you have to validate them in order, i.e. you can go to the subsequent one, only after validating the previous :

- Personal Information

- Gross Total Income

- Total Deductions

- Taxes Paid

- Total Tax Liability

Usually, they get most of the things right except in the second section, showing your Gross Total Income different than that shown in your Form 16. But let's get there.

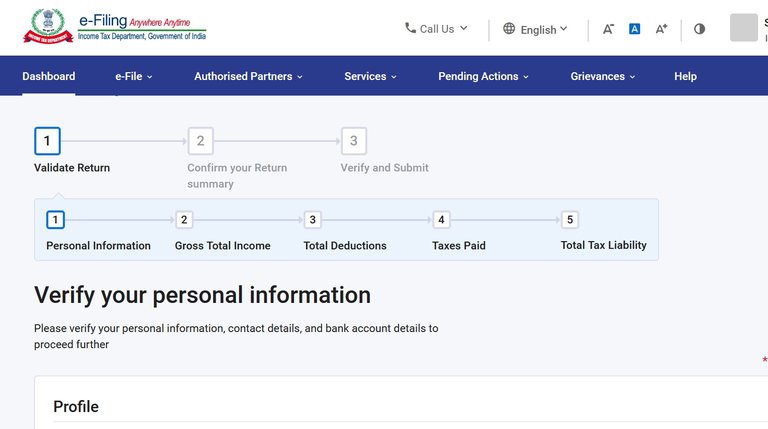

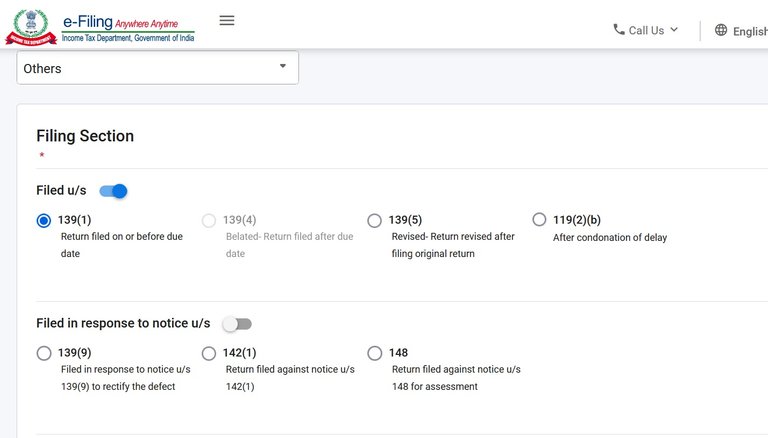

So verify your personal information, make sure your personal details and bank details are right (which is true for most, but better to double check). For the Filing Section, by default it would have selected section 139(1) Return filed on or before due date - yes, that is what we are doing, filling the return voluntarily before the due date.

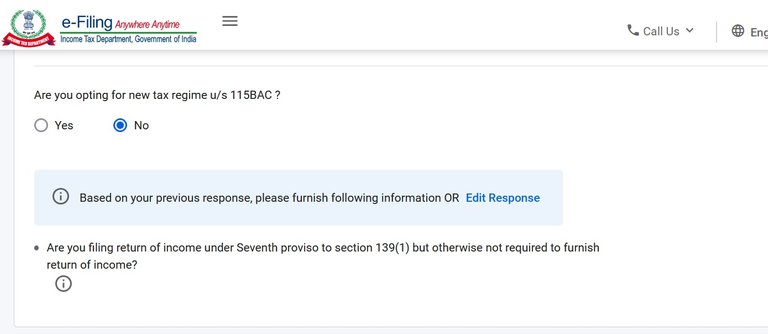

One other very important task in this page is to confirm your Tax regime.

You must have opted for a tax regime and your employer would have calculated the tax based on that. So make sure, you choose the same here : new vs old. It can make a big difference otherwise. And you should have minimum one account selected for refund credit, based on your previous filling. Once you are done, click Confirm and you will will be back to the main page, showing your personal information confirmed.

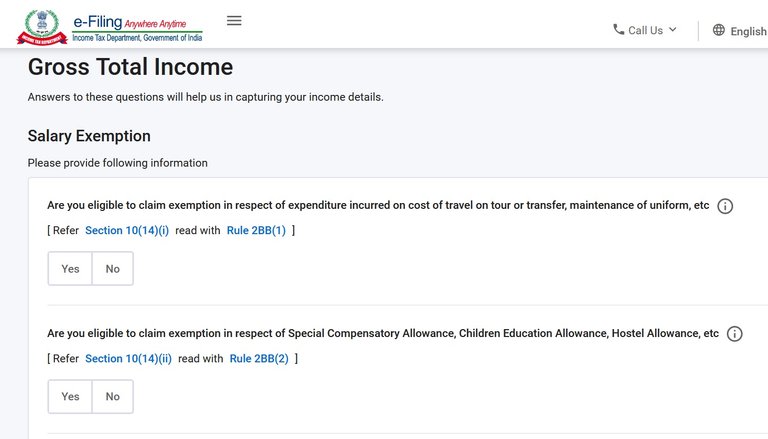

Now you can navigate to the Gross Total Income section, which is the most important section to calculate your tax. Navigate inside and you will be landed in the Exemption section and this is what get's wrong most of the time, and you need to fix it.

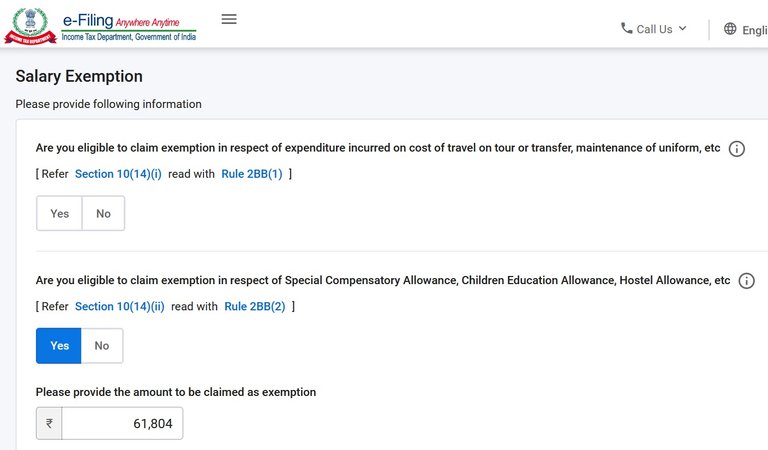

The allowances like Telephone/Internet Reimbursement, Meal Cards, Fuel Reimbursements etc, provided by your employer are often not reflected and you have to fill them. At times it reflects the Children Education Allowance, so you can edit that and put the entire amount as per your Form 16. If nothing is there then click Yes and fill the amount. The amount should ideally be the Total amount of any other exemption under section 10 in your Form 16. Your employer would also have given you a break down of the total amount. There is a separate section for House Rent Allowance and most of the time they get it right. Also if want to claim Leave Travel Allowance, that was not considered by your employer ( because, you traveled after your employer closed advanced tax calculation), you can fill it here and get the amount as refund.

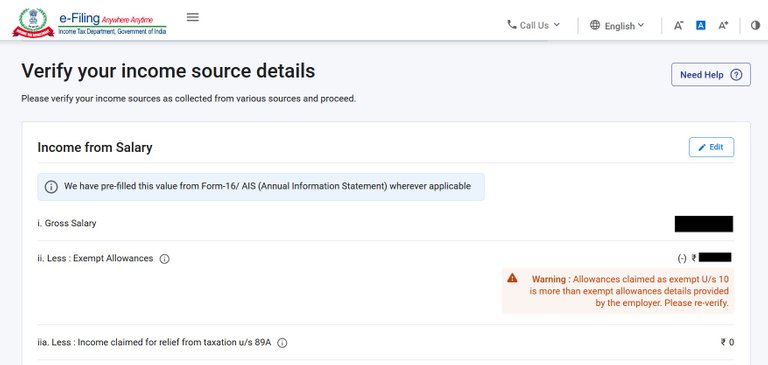

After you put the amounts and continue to the next screen, it shows you a warning, which you can ignore, because we filled details that was not prefilled.

You can also go the next page and Edit and add these, but it involves a little extra work of deleting sections with empty amounts. Make sure, you add the amount under section 10(14)(ii) as shown below.

So I would edit this amount and put ₹ 61804 /-. But then it would show error for empty sections, which you will have to delete. So the first way is much better. I just showed this way, so that you are clear on what is being added.

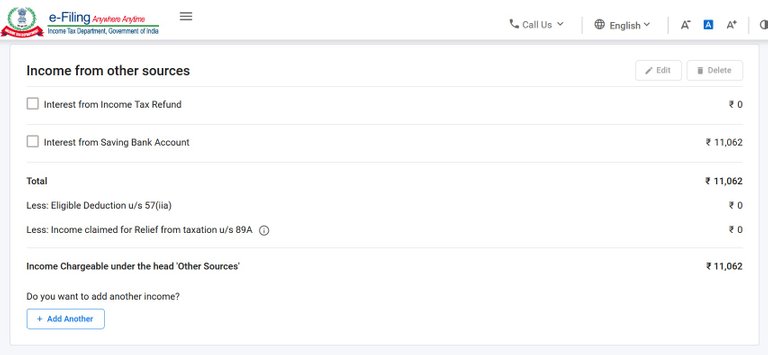

After this, the Income Chargeable under the head ‘Salaries’ should match to the amount shown in your Form 16. And that would be a big respite, because, usually you know, your employer would have calculated your tax without any mistake. But hold on. This year the IT department has been very smart to show you, how much interest you earned from Saving Bank Accounts and add it to your income. Honestly I never checked my interest because I know, its very negligible. But they did not forget to show me.

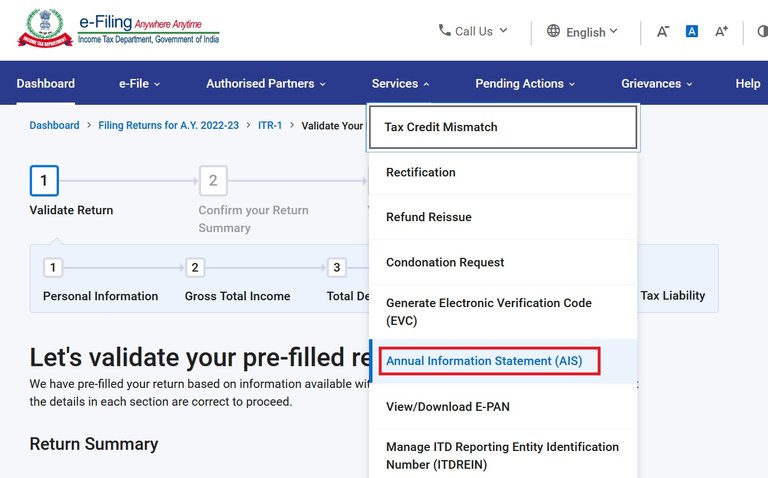

So that means I have to pay tax on this. And wondering from where it came ? It has been prefilled from the AIS (Annual Information Statement), which contains the information that is with the tax department. You can download and see what they have. In the same portal, go to 'Services' tab, click on Annual Information Statement (AIS) as shown.

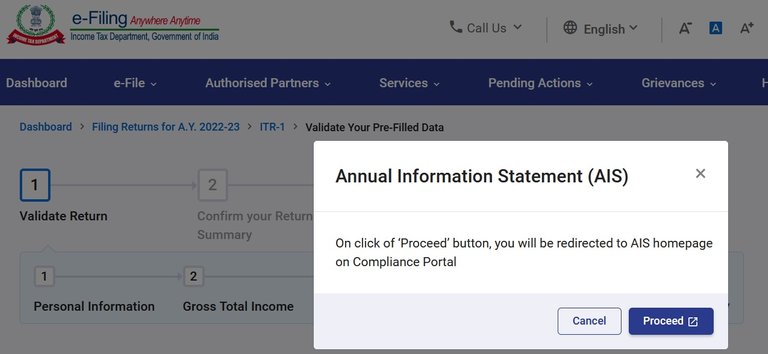

Then it will show you a little notification to navigate to AIS homepage.

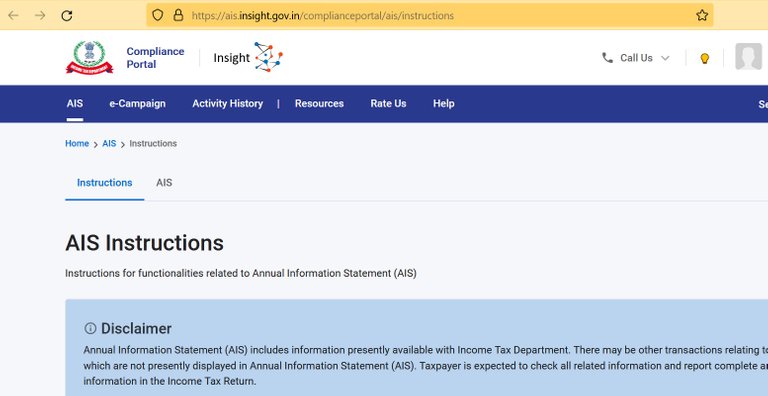

Click on Proceed and it will open the AIS homepage in a new tab.

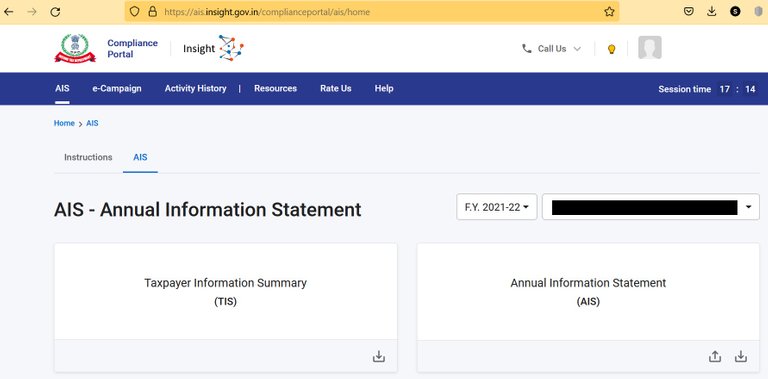

Do you see the AIS tab here ? It's just beside the Instructions, and click on that, you should see the AIS page, from where you can view or download the AIS as well as the Taxpayer Information Summary. And the information is for F.Y. 2021-22, i.e. last financial year, for which you are filling your return.

You can click on either of this and view it as well. Click on the Taxpayer Information Summary, and that will also show your income details that includes Interest from savings bank , with details of each bank. If you click on Annual Information Statement, then Part B will have your TDS information and then SFT information will show the interest details. Feel free to download these and explore them. You will know how much information is collected by the IT department.

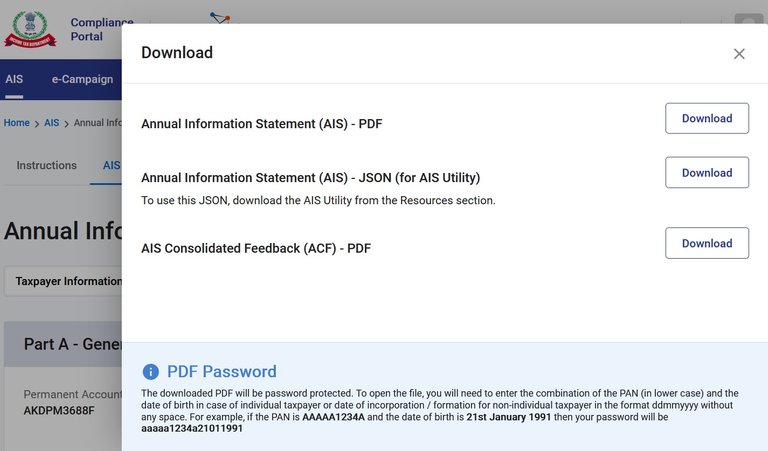

And don't forget to observe the password format, yes, you will need a password specific to you to open those files.

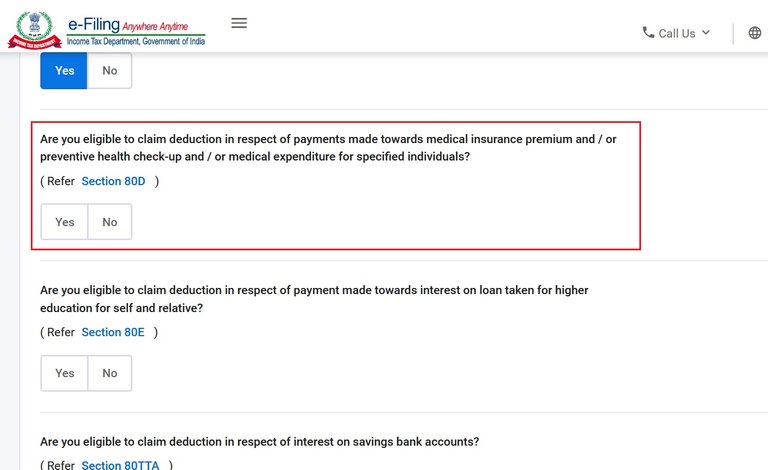

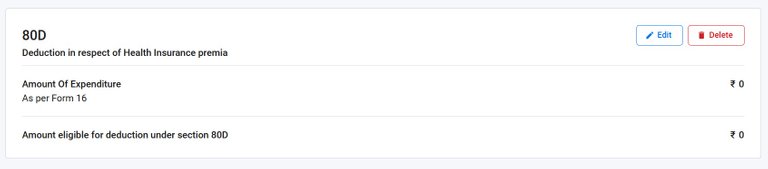

Now coming to the tax for the Interest from savings bank, interest up to ₹ 10,000 (collectively earned from all savings bank accounts) is not taxable. So you have to pay tax for the excess amount, i.e. if your interest earned is ₹ 15,000, then you will have to pay tax on ₹ 5,000. I will come to the details about how to pay the tax for this, but for a moment, look at your Summary. You cannot navigate to "Tax Paid" and "Total Tax Liability" section, without confirming the "Total Deductions", but what surprised me is substantial difference between of "Tax Paid" and "Total Tax Liability". Ideally, it should have been negligible, because the tax on that small interest amount ( in excess of 10,000 ) should be very small. So something is wrong and I had to verify what is missing. I navigated to "Total Deductions" again and started cross checking each amount with my Form 16 and after a while, figured out that the premium paid towards medical insurance under section 80D is missing (Does not show any amount).

So I click Yes, ideally, it should have allowed me to fill the amount , but seems there is a bug here.

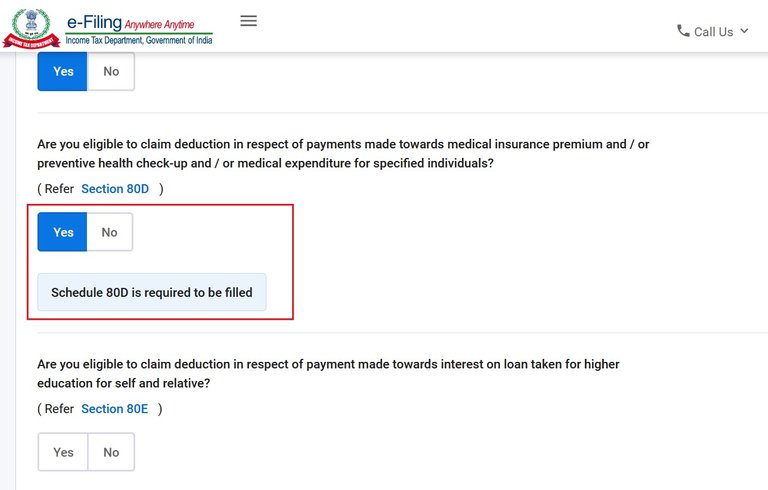

Without showing any prompt to enter the amount, it just tells me Schedule 80D is required to be filled, and even does not tell how. So without worrying much, click Continue to navigate to the next page.

You will see the section with amount shown as zero. Click Edit and it will open the schedule to be filled.

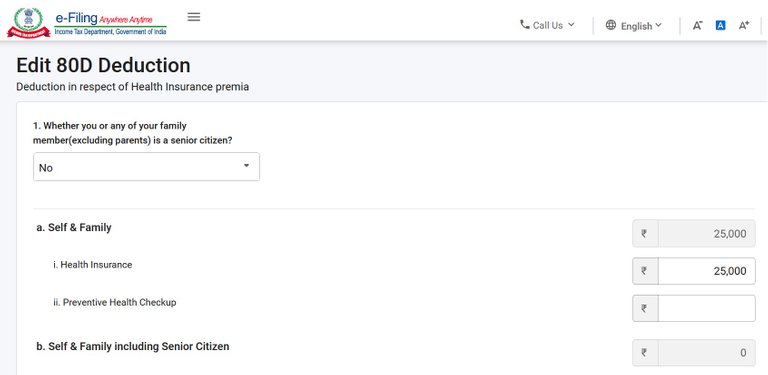

In order to fill this, you should know details about deductions that are allowed u/s 80D. A simple google search can help you to fill the amounts in right way. For Self, Spouse and Children, you can claim maximum ₹25,000 (assuming you are below 60 yrs), that includes the health insurance premium as well as any amount paid for preventive health check up. If you have taken insurance for your parents, then it comes under a separate section. You can get maximum exemption of ₹50,000 for your parents if they are senior citizens. So fill the amounts appropriately so that it matches with what has been shown as part of your Form 16, and Save and then Confirm (We will come back again). It may show you a warning saying, the amount does not match with what your Employer has shown, but you can ignore that. I am not sure, why the 80D section does not reflect here, even though it is part of our Form 16. As long as we have proof, nothing to worry.

If you have taken a personal policy as well as a paid policy from the company, you should have clubbed them and have it considered as part of your Form 16. However, one important point is that, you can claim the amount, even if its not part of your Form 16. For example, you have taken a policy in March and by that time, your employer closed your advanced tax calculation. So there was no way to show your premium in your Form 16. Now you can fill the amount here and claim the excess tax paid as refund. Make sure to have all the proofs ready to show, if the IT department, wants to verify later.

The next section is Tax Paid, and usually that will be right. So if the figure matches as provided by your employer, navigate inside the section, verify and Confirm.

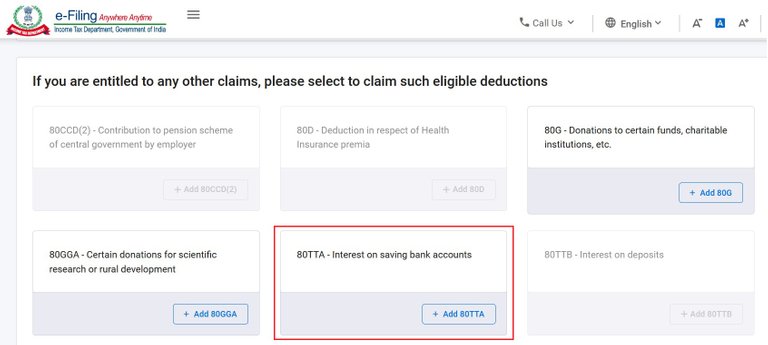

Now the Total Tax liability would ideally match near to what your employer provided. The excess amount should be only the tax on Interest from savings bank. However, hold and don't pay the tax. The department did not forget to report the interest, but it did forget to add the exemptions for ₹ 10,000 and instead calculate tax on the entire amount. So you will have to manually add it. Go inside "Total Deductions" section again, even though it's confirmed, we can edit it. In the second page (after clicking Continue), you should see a panel like this :

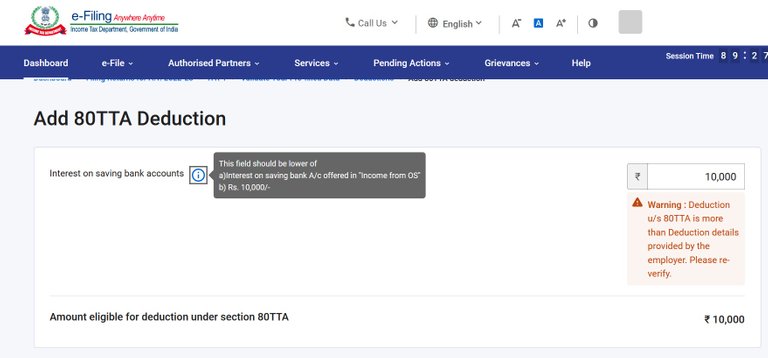

Notice the 80TTA ? You will have to add this.

The maximum amount can be ₹ 10,000, if the interest is more than that. Otherwise, enter the amount if its below ₹10,000. Ignore the warning, Add and Confirm. I am not sure, why the employer need to provide this. If the IT department added the interest based on information provided by bank, then ideally they should have added this based on the amount ( that is how we can tell it's user friendly, isn't it ?) Now your tax liability should be very close to what you paid and you only need to pay the tax on the interest amount, in excess of ₹10,000. So navigate to Total Tax Liability and confirm after verifying the figures at a high level one last time.

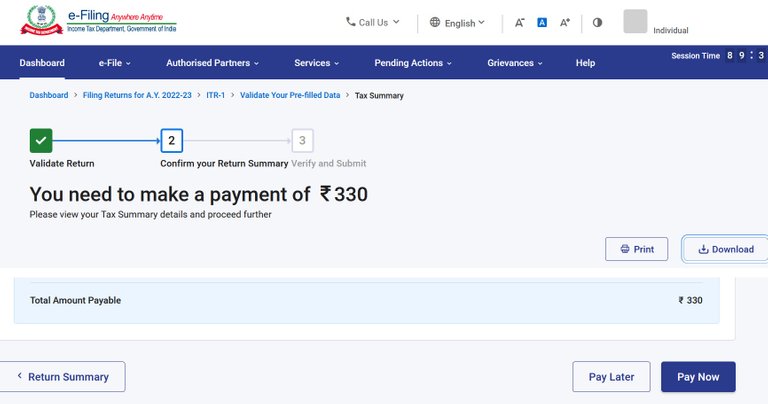

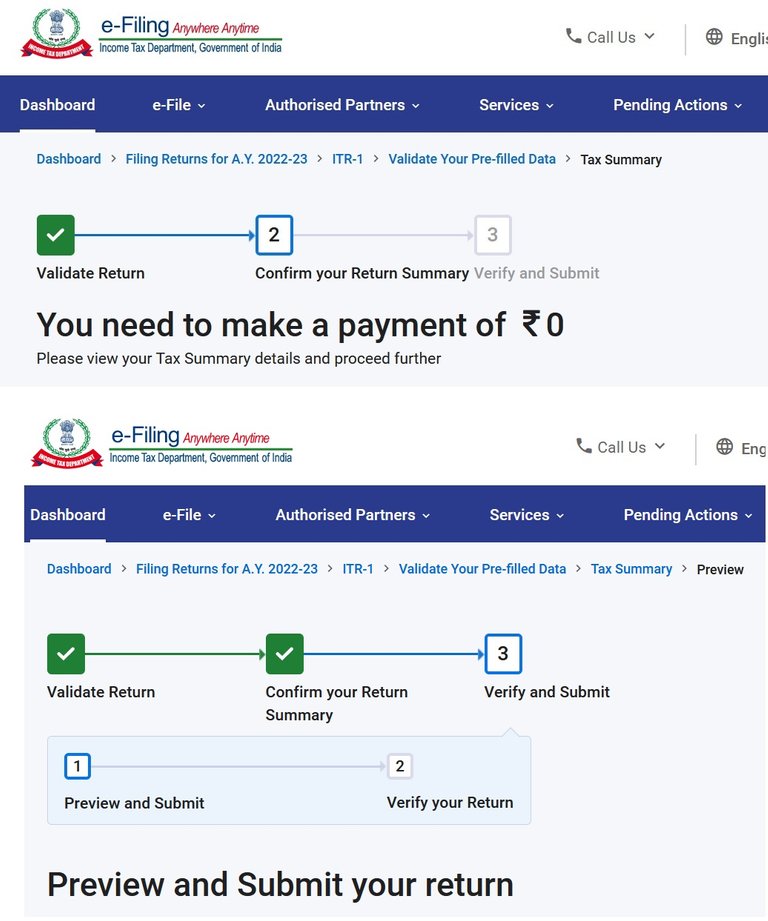

You will see a Download JSON button and click on that, it will download a JSON file ( text) , save it temporarily, just in case needed later. And then click on Proceed. In the next page, it will you show you how much tax you need to pay along with options to Print or download details. And it also shows details of Calculation of Your Taxable Income. And then under that, options to Pay Now or Pay Later.

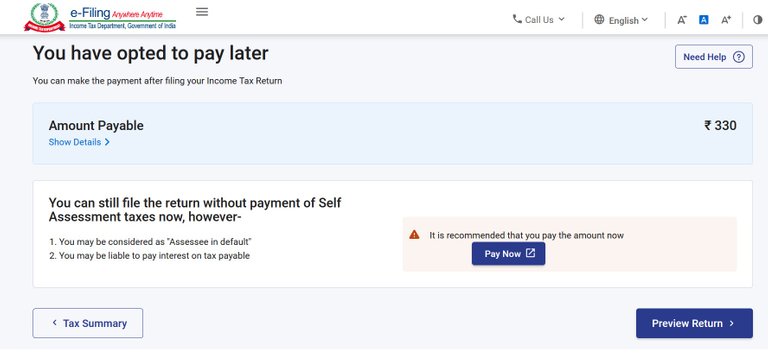

If you wonder, what will happen if you click on Pay Later , then feel free to click and see it yourself.

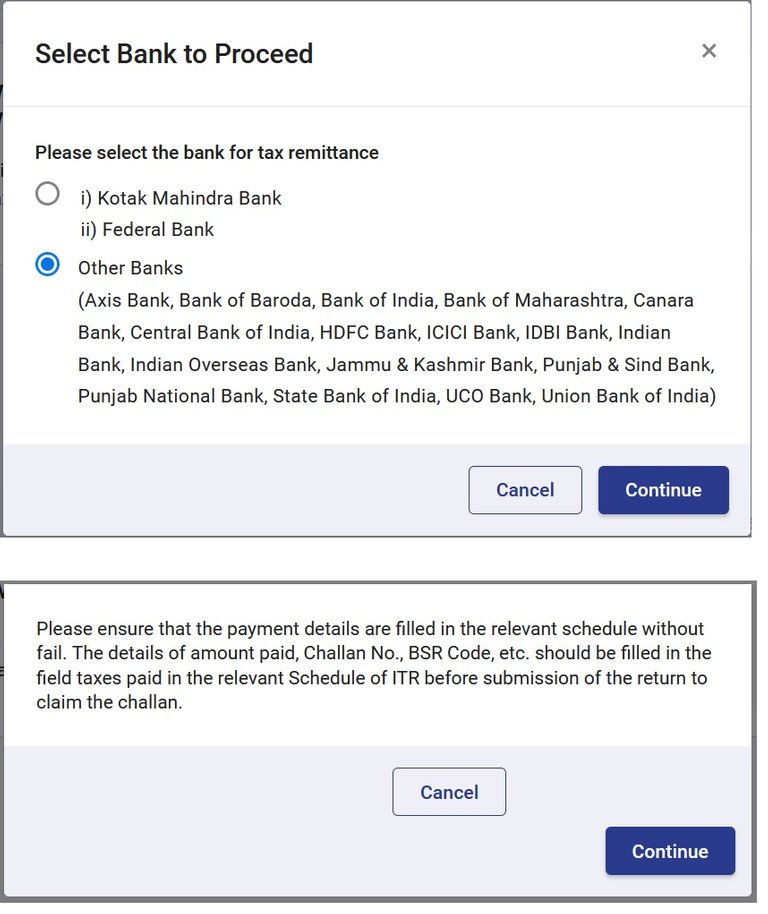

You may be considered as "Assessee in default" and liable to pay interest on tax payable. So wise to Pay Now !! Click on Pay Now and you will see a pop-up to select your bank, followed by another prompt that puts the ownership on you to ensure the payment details are filled in the relevant schedule without fail.

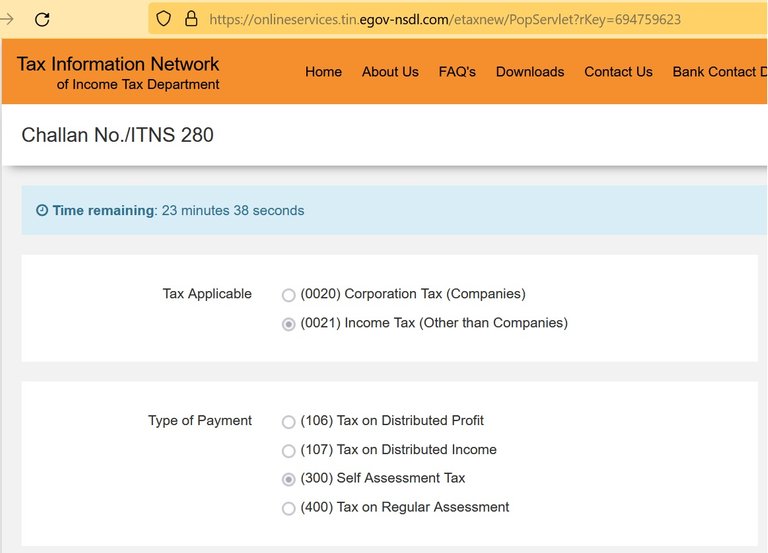

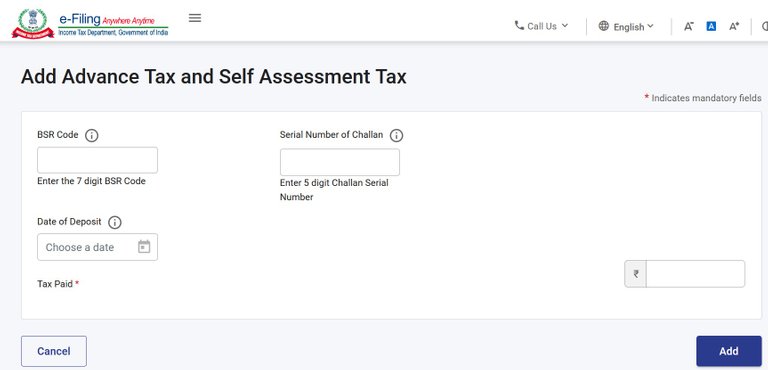

And if you read this right, then you will have to fill the details ( amount paid, Challan No, BSR Code etc ) in the Taxes paid section before submission of the return - yes, it's very important. So if you click on Continue, it will land you in nsdl site, filling the details in the Challan 280.

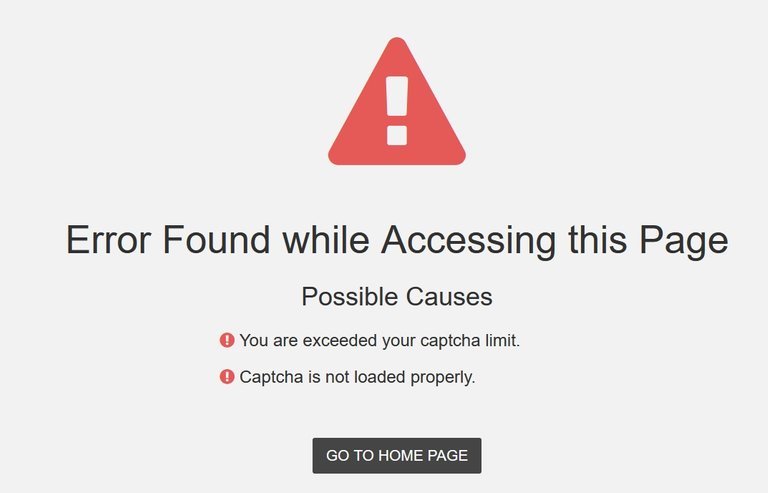

And it gives you 30 minutes to do that, but don't worry, if you cannot pay within 30 minutes. Because you can come back any time ( well before due date) and retry the same by clicking on that link again. And its your responsibility to pay this tax and then add details to Taxes Paid section, before submitting the return. So you can do it later or pay it by any other means (like paying from your bank account) and fill the details. Notice what is getting filled. As you see, Tax Applicable is Income Tax and the Type of Payment is Self Assessment Tax - yes, that is what we did , we accessed our tax liability and this tax amount was derived. It will prefill the amount and your details and you can pay through Net banking or Debit Card. And then there is a captcha that you need to refresh. If you do not want to pay now, then take a screenshot so that it helps you to fill the details if you want to pay by any other means. For me, the captcha expired first time and then it failed to refresh.

But I know, nothing will happen if I go to nsdl home page. So I close this and decide to try again by going back to the income tax e-filling site and try Pay Now again. One other thing you may notice that the nsdl site shows your details which may not be current. But that is what is in their records, unless you have changed. You will possibly see the same every where. As long as the PAN, name, Tax details are right, it's still ok to pay here. It does tell you that, by showing the message. So go ahead and submit.

The name of the taxpayer is as per the ITD PAN Master. You are required to verify the name before making payment. In case any discrepancy is observed, please confirm the PAN displayed. Any change required in the name displayed as per the PAN Master can be updated by filling up the relevant change request form for PAN.

If the name is correct, then click on "Submit to the Bank"

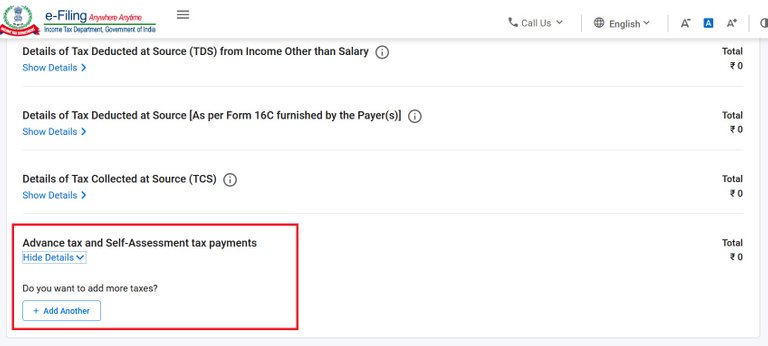

Once you pay the tax, you will need to add the tax paid details under Taxes Paid, so navigate inside and click on Show Details and Add Another.

Fill these details from the Taxpayers Counterfoil that you got after paying the tax ( or the pdf receipt). Click Add, and then Confirm. You should see zero tax liability.

So you are done, now preview and submit. You can download a copy of the preview before proceeding to validation.

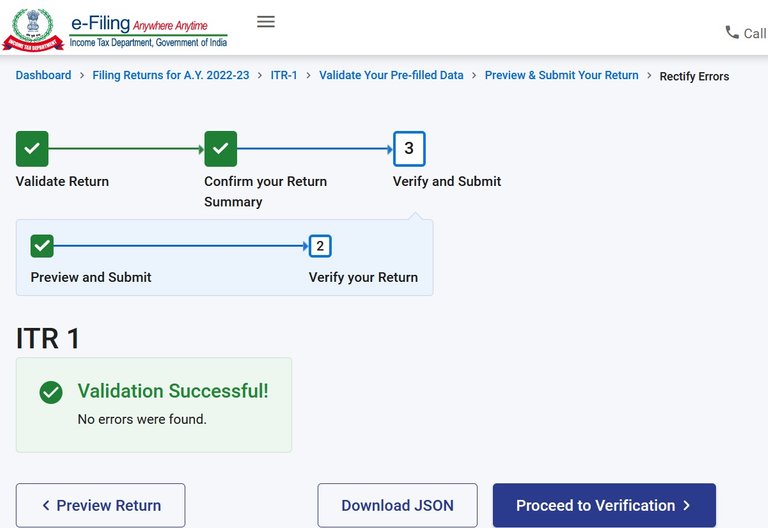

If it shows Validation Successful, then download the JSON (keep this final one), and proceed to verification.

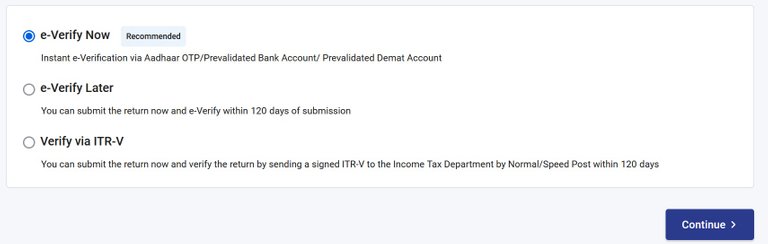

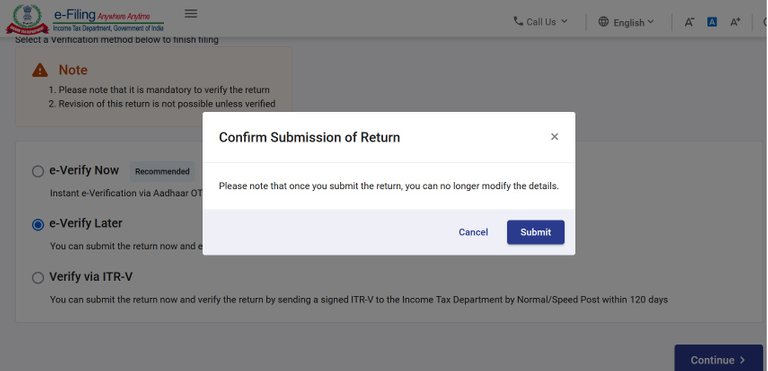

You can select Instant e-Verification via Aadhaar OTP, if your Aadhaar is registered with your mobile. This is the recommended approach as verifying it instantly completes the process. However, you may also choose verify later or even submit the return and send the signed ITR-V to the Income Tax Department by Normal/Speed Post within 120 days, which was the older way. For me, unfortunately nothing happened when I tried to verify now. May be some issue with the site, so I clicked on the second option to verify later and that brings this pop-up.

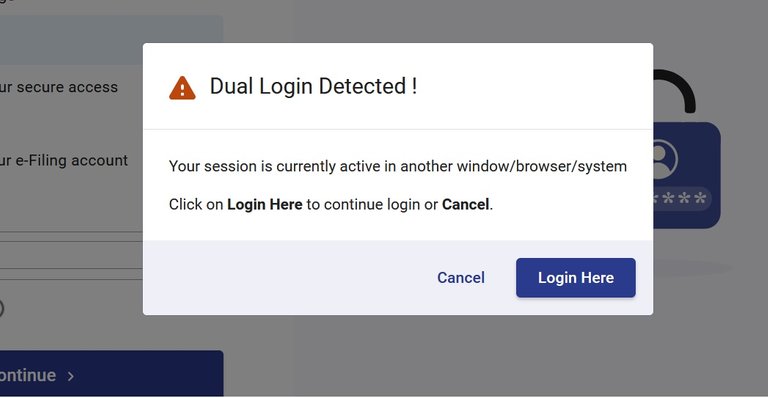

So it tells me that once I submit the return, it cannot be changed, which is fine. Click on Submit and still nothing happens. Most likely, these are session management issues in the site and you can log in again and submit and verify. Some times I felt, the site went down, and not coming back for few minutes - we saw similar issues last year and unfortunately they have not been fixed yet. Imagine, what will happen during peak loads as the last date approaches. And do not do the browser refresh, it lands you nowhere. Click on this link so that it opens in a new tab or window and then log in again and continue to submit and verify.

https://www.incometax.gov.in/iec/foportal

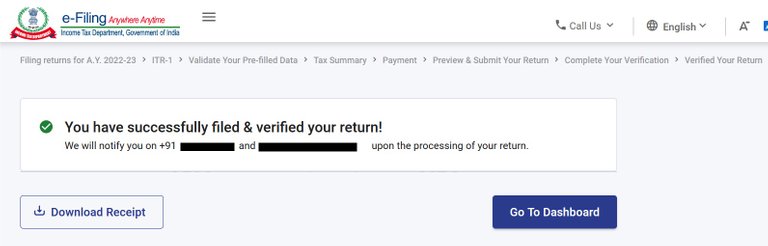

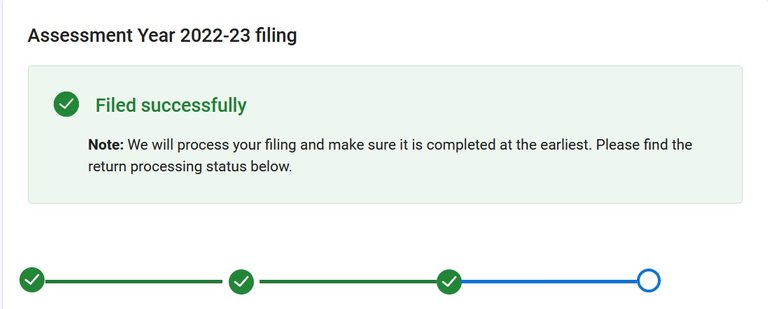

It may show you this warning, so Login Here. And one other thing I need to mention, you will not fill anything for the TRP (Tax Return Preparer), as you are filling it yourself. So if all goes well, you should see this :

Hope this helps. I am not a Tax expert, but it's not very difficult to fill your returns, if you are salaried. More ever, you should know what you are filling ,instead of giving it to some third party and paying a fees to them. Remember the ownership always lies with you, if the TRP fills something wrong, you will be accountable. And now a days, I heard, they charge around ₹1000. So do it yourself, and donate the money for a noble cause.

I have been freely helping many of my friends since many years, hope this will help some more people. And if you still need some hand holding, then you can reach me at https://twitter.com/sanjeevmbbsr , I won't charge you anything, but promise me to pay something for a noble cause.

copyrights @sanjeevm - content created uniquely with passion for #HIVE platform — NOT posted anywhere else! #HIVE is my only social diary - my blog is my life.

Posted Using LeoFinance Beta