Been tracking the Philippine Stock Exchange Index (PSEi) for about 2 months now to see where I re-enter the market. I have been waiting for a retracement to close to 6300 and seems like now's the time!

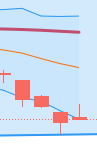

The chart below shows the uptrend nature of PSEi which has still maintained higher lows for over a year.

I entered back (bought units) through an Index Fund mainly due to the following:

1.) Buying close to the support (trend line) near 6400.

2.) RSI shows oversold region for the second time in 2 months.

3.) Candlestick pattern as of the latest shows a hammer pattern, which may indicate a bullish reversal.

On #3, this is still a weak signal though. Zooming into the last 5 days, this is what we see:

1.) All red candles - Opening prices start higher but end up closing lower.

2.) Hammer formation - 4th day shows the first potential hammer signal for a bullish reversal; however, the succeeding one shows an inverted hammer which sorts of negates the push.

I decided to buy mid-day as I saw the candle was still green. Nevertheless, I think not bad for a first tranche of buying in case there would still be another drop after this.

Stock Picking:

I did also buy a few stocks (AEV, SM) into my portfolio. Both were fundamentally recommended (More room to gain based on Target price) anyway by one of my brokers, just a matter of choosing when to enter. Both stocks were trading within a rectangular range and I thought buying at the lower end would be a good entry. AEV broke lower from the range though while SM is still intact. You can check more details about AEV as I shared here.

Christmas Rally Soon? Looking forward to next week!

Caveat:

This is not financial advice. Do your own Research (DYOR). This is just a trading journal of mine as I share my thought process in terms of investing. I don't claim expertise in trading, but happy to discuss and engage with people of similar interests in the field of Finance.