Almost four years ago, I decided to put a huge chunk of my retirement portfolio into two investments often discussed here: Bitcoin and Silver ( PSLV - Physical Silver ETF). The goal? To see how each performed as a hedge against fiat currency and inflation over the long term. Additionally I wanted to hedge my risky bets on BTC and ETH with a more stable asset: Silver.

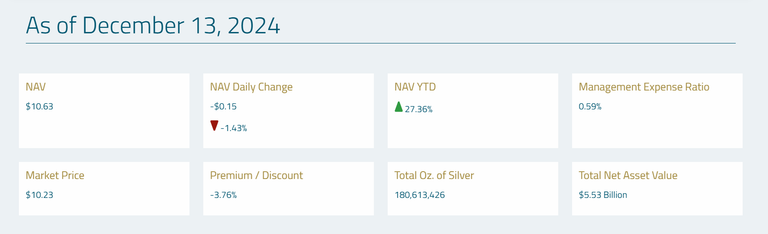

Why did I choose PSLV as a silver proxy vs other ETFs like SLV?

When it comes to investing in silver, ETFs (Exchange-Traded Funds) offer a convenient way to gain exposure to this precious metal without the hassle of storing physical bullion. Also, in my case I am doing this in my Charles Schwab retirement account, so buying actual silver is not an option. Two prominent options are the Sprott Physical Silver Trust (PSLV) and the iShares Silver Trust (SLV). While both ETFs serve as vehicles for silver investment, PSLV has significant advantages over SLV. Here’s why PSLV is often considered the superior choice for serious silver investors.

1. Direct Ownership of Physical Silver

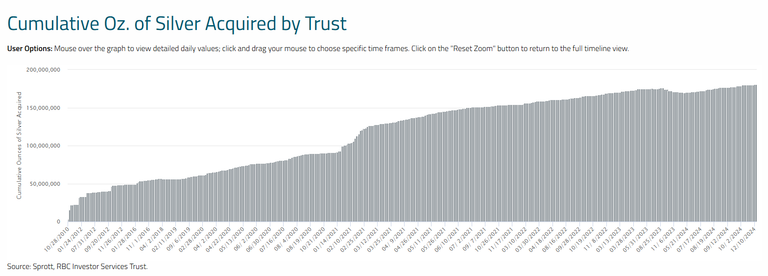

PSLV is a closed-end fund designed to hold fully allocated physical silver stored in secure vaults. Each share of PSLV represents actual silver bars that are audited and accounted for. Investors can even redeem their shares for physical silver if they meet the minimum requirements, offering peace of mind that their investment is backed by tangible assets.

In contrast, SLV is an open-ended ETF that may not guarantee fully allocated silver ownership. Critics often raise concerns about SLV’s ability to meet its physical silver obligations, as it relies on custodians and sub-custodians whose accountability can be opaque.

2. Transparency and Trust

PSLV is renowned for its high level of transparency. The fund’s silver holdings are regularly audited, and detailed reports are made available to the public. Investors know where their silver is stored and can verify the existence of their assets.

SLV, on the other hand, has faced scrutiny over its lack of transparency. The complexity of its custodial arrangements and the potential for leasing or rehypothecation of its silver have raised questions about whether SLV truly holds all the silver it claims to.

3. Protection Against Paper Silver Manipulation

The silver market is infamous for price manipulation, often attributed to paper contracts that far exceed the actual physical supply of silver. PSLV’s model ensures that each share corresponds to real, allocated silver, reducing the risk of manipulation. By investing in PSLV, you’re effectively supporting a system that prioritizes physical over paper silver.

SLV, with its reliance on custodians and paper-based systems, doesn’t offer the same level of protection. Critics argue that SLV’s structure may contribute to the very price suppression that silver stackers seek to combat.

Additionally, PSLV resonates strongly with investors who believe in the principles of sound money and the importance of owning physical assets. The fund’s structure aligns with these values, making it a favorite among silver stackers and those skeptical of fiat currency.

SLV, while more widely recognized, is often seen as a mainstream product tailored to institutional investors rather than individual savers and stackers. For those who value sovereignty and transparency, PSLV’s philosophy is a better match.

Silver (PSLV) vs BTC and ETH

So I decided to hedge my retirement portfolio against inflation in USD. My risky investment was Digital Gold: BTC and even more risky Digital Silver: ETH.

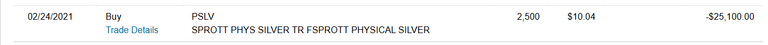

I believed in long term success of Bitcoin and ETH in 2021 and I also wanted to hedge my bet by investing in what I perceived as a lower risk investment: Silver. So I started buying PSLV in February of 2021 and as I normally do I dollar-cost averaged into the position between February and April of 2021:

I also did some selling at a modest profit in May and June of 2021 but overall I was a net buyer of PSLV.

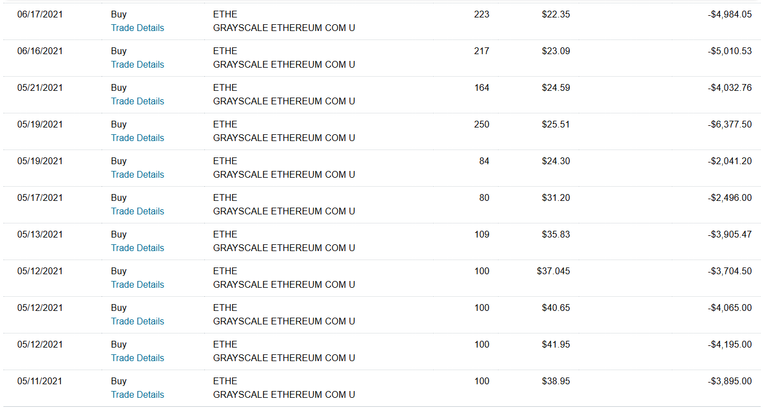

My next step was to build up my position in Ethereum (ETH) via the only option available at that time ETHE (Grayscale Ethereum ETF). I started buying in June of 2021 and finished building up my position by mid July of 2021.

If you have followed ETH at that time you would know that I was buying into a major selloff in Ethereum and crypto markets in general, so the price of ETHE was taking as I was DCA-ing into it:

I bought my last ETHE at $19.19 which was half the cost of where I started and it kept tanking after that... Definitely volatility in the crypto markets is not for the faint of heart...

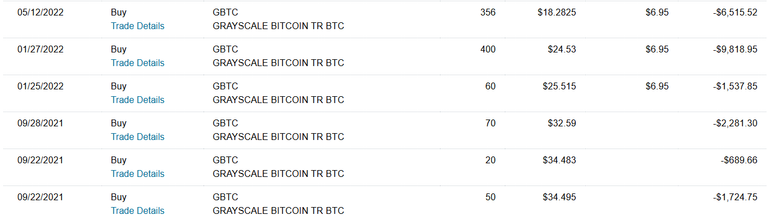

As the great crypto crash of 2021 was coming to the close I started building my position in Bitcoin via the GBTC (Grayscale Bitcoin ETF):

What I learned from this experience is that you have to enter positions over a longer period of time, that works much better and let's you get closer to the bottom in a falling market and you should exit your positions over a longer period of time so that you have a better chance of catching the top. I have started exiting my BTC position even though I think that the BTC top will be somewhere between 120,000 and $150,000 this cycle.

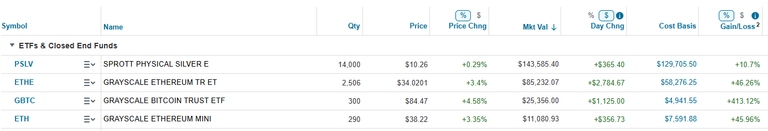

So what are the results after almost four years? Here is how my investments performed:

I would say for simplicity divide returns by four years to get the average performance per year

- BTC: 91% per year

- ETH: 11.5% per year

- Silver: 2.675% per year

I must admit Silver was quite disappointing not even keeping up with inflation!

This chart illustrates performance of both assets since Mid February of 2021:

Clearly GBTC and Bitcoin were more volatile during this time period with GBTC loosing close to 80% of it's value, but then it went on to recover and return over 200%! While PSLV went down almost 20% and recovered to post a 24% gain.

So I learned that crypto is indeed more risky and I intend to take profits during this crypto bull cycle. I also learned that Silver is not a great hedge against inflation and I will be looking to exit my PSLV position on any pumps and re-allocate it to assets with more potential. Ideally during a downturn in crypto and stock market in the future.