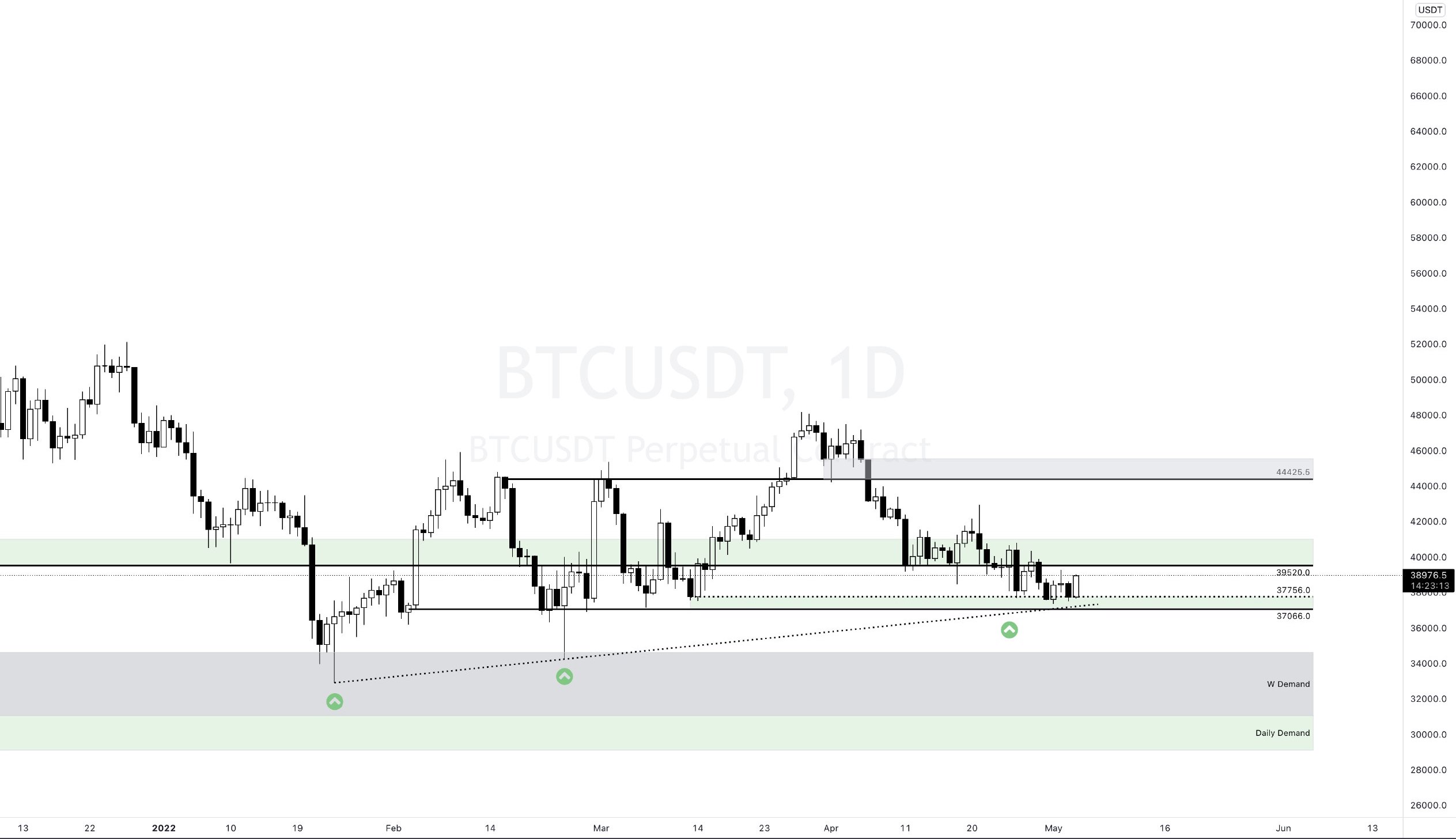

$BTC is positive before the FOMC, but so far, price and OI movements are mostly about closing shorts.

I wrote it in the last analysis, but let me repeat, 50bps and below (as it is highly likely to be priced) can cause an increase, while 75bps can cause a deepening of the decrease. Of course, we do not know what exactly is priced or not, but since the 50bps signal has been given clearly since the last fed meeting, I think the 50bps negative impact will not be too heavy.

Fed meeting today. Participating in the speculation that starts in the morning on such days may give some premium until the FED time, but the volatility that will start with the FED decision is not for everyone. During these hours, there will be very rapid movements both up and down. Those who are positioned close will definitely be kicked out of the game.

Re-polling may come down to 38.1 as the last USD 700-800 movement remained very thin in volume.

39.6 and 40.5 above are initial resistances and below are levels to be protected. Selling could deepen if we lose 38.1 below on hourly closes basis.

At best if $ZEC can push it up to 130/140 right now, it could be a 100 and 80's macro image with resale from there. If I see weakness and they can push the price up to that level, I'll try to find a nice short opportunity.

Take it easy,

It is not investment advice.

Graph Source: Tradingview

Posted Using LeoFinance Beta