I've been watching with interest as the TerraUSD (UST) algorithmic stable coin lost its dollar peg this past week.

I've been watching with interest as the TerraUSD (UST) algorithmic stable coin lost its dollar peg this past week.

The Hive Backed Dollar (HBD) is a Hive-based algorithmic stable coin that uses a different algorithm for its peg, and is not affiliated with Terra, but the news of the UST collapse will have a significant impact on the confidence people have in stable coins in general. What was once thought of by many to be a "sure thing" in the world of crypto APY, it's worth taking a closer look at how the stable coins in your portfolio are actually pegged to their indicator and whether you should do some hedging or take other action to preserve your principal in such a volatile crypto environment.

Unlike a truly currency-backed stablecoin, an algorithmic stable coin relies on economic incentives to push people into making certain purchase and sale decisions in order to capitalize on that incentive. This incentivized push/pull effect is intended to lower the price of a stablecoin if it moves higher than its peg and move it higher when the value falls below its peg.

In the case of HBD, when the price falls below $1 worth of HIVE, users are enticed into buying HBD at the less than $1 price because they can then convert it to $1 worth of HIVE. In theory, the spread between the price of HBD and $1 is a potential profit for employing this conversion process.

When HBD rises more than 5% above the targeted $1 peg, users are incentivized to convert their HIVE to HBD at a guaranteed $1 per HBD conversion price (minus a 5% fee). You could then sell your HBD at whatever the market price is and your cost basis would be $1 for each HBD (minus the fee). This will put some downward pressure on the price of HBD, thereby maintaining the intended peg.

Coin Telegraph has a good primer on stablecoins and the different kinds of backing they use to attempt to maintain a peg.

As I'm writing this, the price of UST has plummeted to below $0.30 each. The UST stablecoin is tied to the value of LUNA, it's backing token. LUNA has fallen over 95% in value over the past week as users panic-sell the token. The founder of the UST stablecoin has a foundation that is intended to stabilize UST in times like these. The problem is that the foundation holds billions of dollars of Bitcoin, which must be sold first. Selling that magnitude of Bitcoin will put even more downward pressure on all cryptocurrencies, including UST and LUNA. It becomes a self-fulfilling circle of losses.

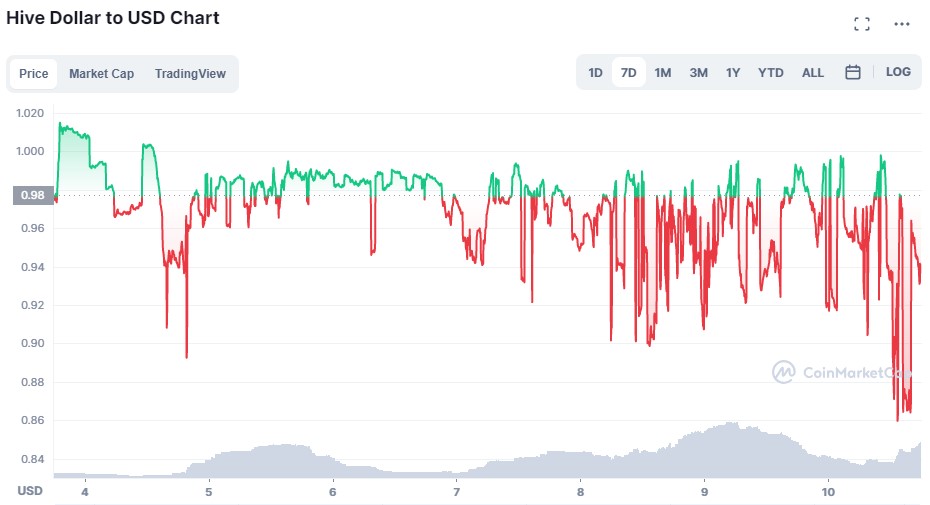

I am by no means an expert in cryptocurrency, but many of the features of UST seem to exist with HBD as well. Including the HBD Stabilizer, which seems it may serve a similar function to the Luna Foundation. HIVE has fallen 50% in the past few weeks and while I have seen HBD dip into the mid-80 cent range today, it has held up remarkably well given the volatility in the market.

I have poked around Hive for some more technical discussions of the workings and support mechanics for HBD, but haven't come up with much. If you know of any resources for better understanding the technical nuances of HBD and the stabilizer, please drop them in the comments as I'd love to dig into it deeper. I think this Terra stablecoin situation could be a great case study on how to ensure we can prevent a similar situation from unfolding on the Hive blockchain, or at the very least know how to properly hedge against it on our own.

Posted Using LeoFinance Beta