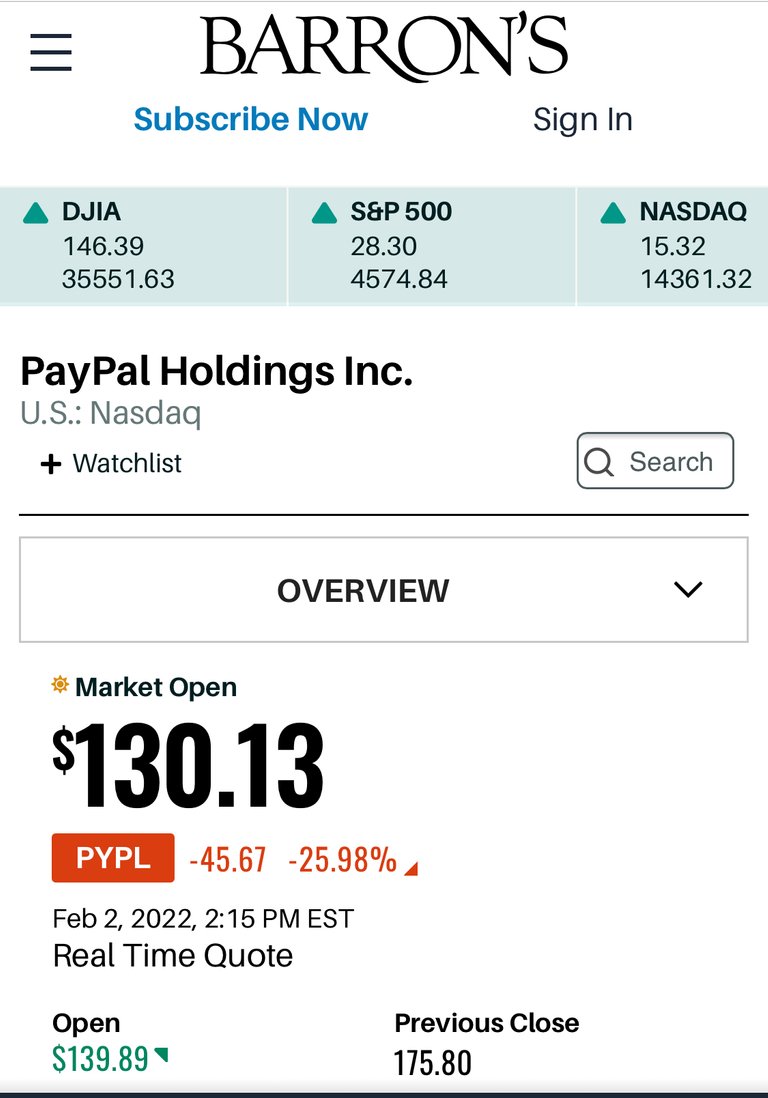

PayPal stock plunge despite earnings exceeding projections and 22 million new accounts? What’s a company got to do to get a good rating?

PayPal’s performance for the 4th quarter 2021

- So your one of the largest companies of your kind in the world, and you made 6.9 billion dollars in the last three months of 2021.

- Which is an increase over last year, you know the year of the pandemic.

- And added 22 million new accounts.

- And stock analysts are downgrading your stock?

- What…?

PayPal’s fourth-quarter earnings, and particularly its disappointing outlook, are spooking investors. Wall Street is already reassessing the stock.

The payments company reported a fourth-quarter profit of $1.11 a share, narrowly missing forecasts of $1.12 a share. Sales of $6.92 billion topped estimates for $6.89 billion. But it was PayPal’s 2022 guidance that really upset the apple cart.

So PayPal made literally 7 billion dollars and added 22 million new customers, the equivalent of a small country. And told its investors growth may slow down, but we plan to offer more services and choices to our customers, so we will make more revenue off each customer.

So a growing, extremely profitable company… (7 billion dollars in 3 months, I think that’s extremely profitable,) tells its investors new account growth may slow, but we have a plan to create more revenue by serving our customers better…

- You would think investors would say. Okay, we have seven billion reasons to think you know what your doing.

- And 22 million new customers is 22 million other objective votes of confidence.

- We will keep our money invested here.

But the stock analysts are all gloom, doom and downgrade

- Analyst downgraded it from outperform to market perform or neutral.

- The stock price fell 25% after earnings announcement and the television talking heads sent massive negative vibes into the world.

The fix is in, as in market manipulation

- You think?

- Golly Gee Willickers! They wouldn’t do that? Would they?

- Does the Pope pray?

- Do bears poop in the woods?

Yep straight up stock manipulation, this is how money is made

- Forget technical analysis, PE ratios, actual products and utility.

- Hello FOMO and FUD, fear of missing out and it’s cousin fear, uncertainty and doubt

- These things that move the market and these are what the talking heads are excellent at!

- Actual company knowledge none, manipulation of the Sheeple, they know all the tricks!

If you can’t beat them, join them

- Learn what they do and do it too.

- This is a perfect post earnings drop play.

- If this was financial advice.. which it isn’t . . .

- I would say Ladies and Gentlemen, pick your leverage instrument buy calls or puts and give yourself enough time for mean reversion to kick in and make 25%

- Not financial advice, education or entertainment, depending on your point of view

Learn from this…

- I suggest not trading this move, but watch what happens and learn from it.

- The world is your classroom

- Pay attention

- Learn from these experiences

What do you think?

@shortsegments penned by my hand on the 2nd of February 2022

Posted Using LeoFinance Beta