Legal Troubles for FTX Founder and CEO Sam Bankman-Fried

- SBF legal troubles grow, as two USA government regulatory bodies file charges against him.

- Recent stories indicate charges have been filed against him.

- FTX is a cryptocurrency exchange that is headquartered in the Bahamas. It was founded by Sam Bankman-Fried in 2019. source

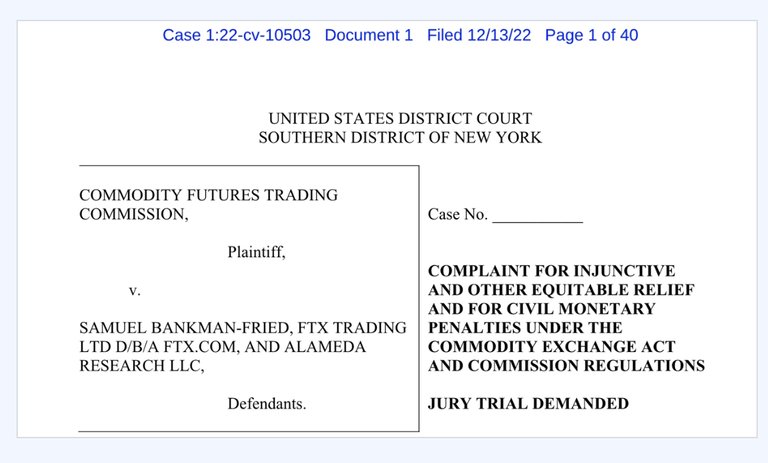

U.S. Commodity Futures Trading Commission

- The USA Government body, the Commodity Futures Trading Commission (CFTC) filed a lawsuit against Sam Bankman-Fried (SBF), FTX Trading LTD., and Alameda Research.

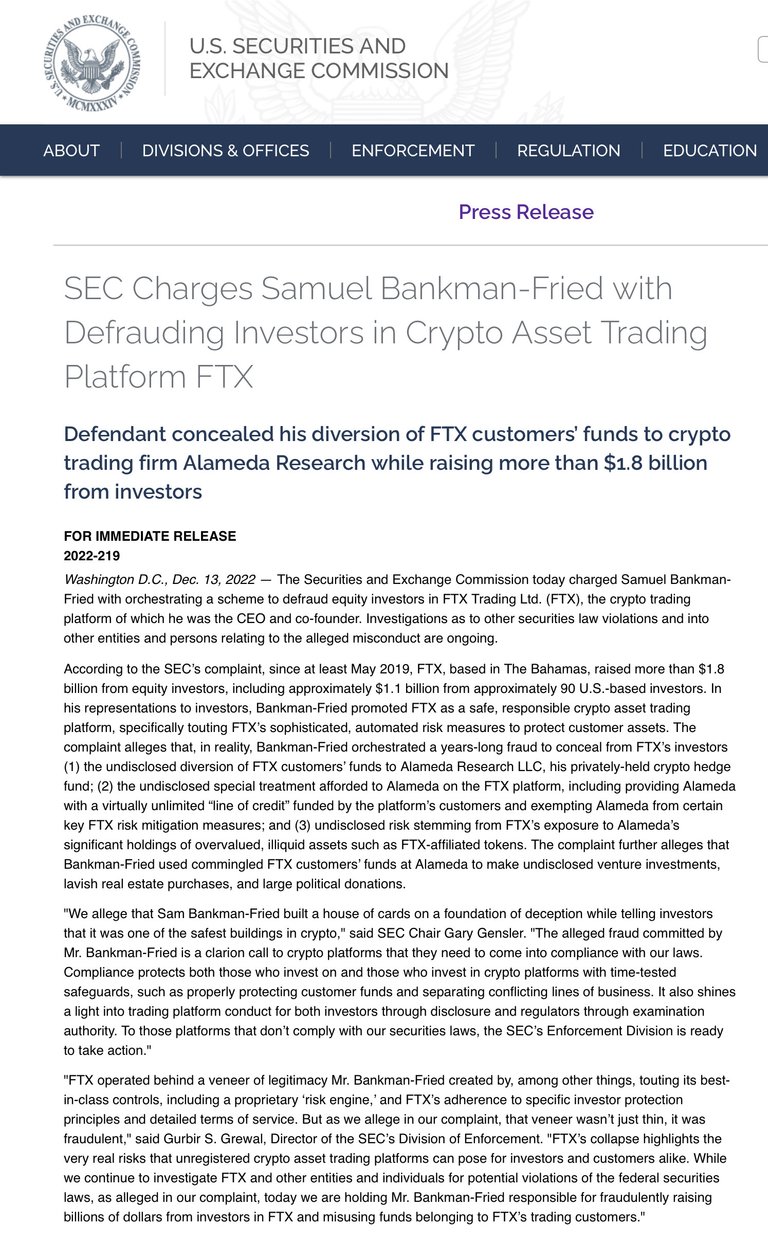

U.S. Securities and Exchange Commission SEC

- SEC Definition: An independent federal regulatory agency that is tasked with the oversight of the securities markets. One of the main goals is to protect investors from predatory and criminal activity.source

- The SEC has also revealed charges against the FTX co-founder. Fraud

What are the charges against Sam Bankman-Fried?

In the indictment unsealed on Tuesday morning, U.S. prosecutors said Bankman-Fried had engaged in a scheme to defraud FTX's customers by misappropriating their deposits to pay for expenses and debts and to make investments on behalf of his crypto hedge fund, Alameda Research LLC. source

Further charges include:

He also defrauded lenders to Alameda by providing false and misleading information about the hedge fund's condition, and sought to disguise the money he had earned from committing wire fraud, prosecutors said. source

SEC and CFTC

Both the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) alleged Bankman-Fried committed fraud in lawsuits filed on Tuesday.

sourceThe CFTC sued Bankman-Fried, Alameda and FTX on Tuesday, alleging fraud involving digital commodity assets. source

SEC statement;

Since at least May 2019, FTX raised more than $1.8 billion from equity investors in a years-long "brazen, multi-year scheme" in which Bankman-Fried concealed FTX was diverting customer funds to Alameda Research, the SEC alleged. source

115 Years

U.S. prosecutors on Tuesday accused Sam Bankman-Fried, the founder of crypto currency exchange FTX, of fraud and violating campaign finance laws.

sourceU.S. Attorney Damian Williams in New York said Bankman-Fried made illegal campaign contributions to Democrats and Republicans with "stolen customer money," saying it was part of one of the "biggest financial frauds in American history."

sourceU.S. Attorney Damian Williams in New York said Bankman-Fried faces a maximum sentence of 115 years in prison if convicted on all eight counts, prosecutors said, though any sentence would depend on a range of factors.

source

Where is Sam Bankman-Fried?

- He was ordered remanded to a correctional facility in the island nation until Feb. 8, where he will initially held in the medical department, according to a local official. source

- A judge in the Bahamas denied him bail, sending him to a local correctional facility instead. Saying he was a flight risk.

source - The former FTX CEO, who was arrested in the Bahamas on Monday, lowered his head and hugged his parents after the magistrate judge refused bail citing a "great" risk of flight. source

Last words

- I am not one to celebrate anyone else’s misery.

- And we still don’t know if SBF will actually serve time in prison in the USA..

- But perhaps these events offer some solace to the literally one million FTX account holders who may never get their money back, and for many of them these deposits were their life savings.

- ‘I pray he survives this ordeal, and doesn’t die in custody, from suicide.

About @shortsegments

Shortsegments is a writer focused on cryptocurrency, the blockchain, non-fungible digital tokens or NFTs, and decentralized finance for over four years.

He is also a project builder, with two current projects:

- No Loss lottery, a prize linked savings account here on Hive, which awards more the 100 Leo in prizes weekly, and which recent surpassed 5000 tickets sold. @nolosslottery

- Easy DeFi, which creates a community investment pool allowing community members to invest in the Cubfinance DeFi project created by a known Hive Community member and whose code is audited and modeled after PanCakeSwap, the largest and perhaps safest project on Binance.

- This allows pool members to benefit from being liquidity providers and earning high APR yields as high as 128% on their investment capitol.

- Cubfinance is the Hive communities home grown Yield Farm and is audited by CertiK, a third party which certifies DeFi projects on Ethereum, Binance and polygon ecosystems.

Leofinance, where you can blog or share financial topic content to earn cryptocurrency, as part of a passionate social media community.

GIF created by @mariosfame

Learn more about Leofinance with my Seven Minute Quick overview and QuickStart Earning Guide. Then you can Join for FREE! Signup takes 20 Seconds!

Click Here

Posted Using LeoFinance Beta