In this week, POLYCUB price was dumped significantly. High emission rate in 1st few week and airdrop just give the feeling that POLYCUB is printed from the thin air and it has no value. I see there are several comments like this in some posts about POLYCUB.

So one of the biggest question is where the revenue of POLYCUB comes from?

I go to POLYCUB doc --> PoL and it has mentioned it

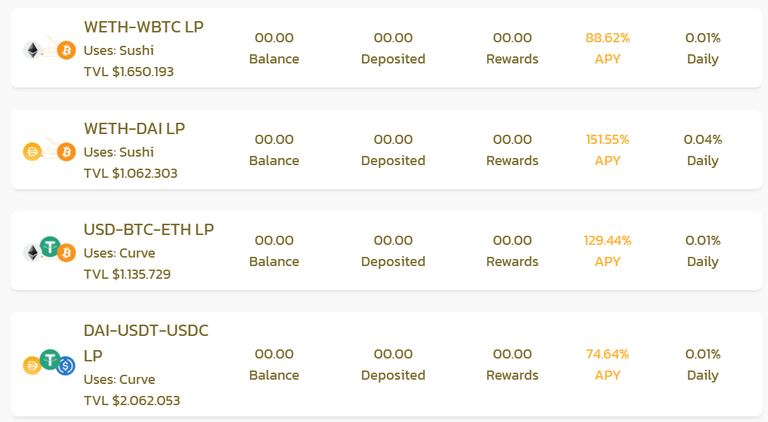

The protocol generates revenue through the 10% management fee on autocompounding harvests - i.e. when a Sushiswap or Quickswap Kingdom is autocompounded, 90% of the yield is autonomously compounded into the balance of the protocol participants and 10% of the yield is set aside into the PolyCUB Treasury address.

This address deploys the management fees into various assets and deposits those assets into vaults to generate yield.

As the TVL in PolyCUB Kingdoms continually grow over time, the PolyCUB PoL will also grow and create endlessly deepening TVL.

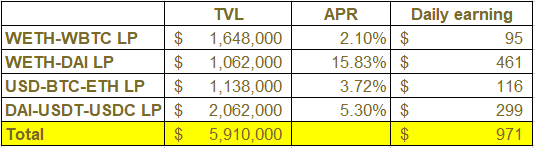

Then I go to Kingdoms in POLYCUB and make a calculation on the daily revenue of PoL

We have 4 Kingdoms with TVL is $5.91 mil and each Kingdom has different APR and all is daily compound.

The below table shows the daily earing of all Kingdoms, excluded pCUB rewards.

With 10% management fee, the daily revenue of Kingdoms is $97

This information can explain a bit why the pCUB is so low at the moment. I'm expecting the Bonds and Collateralized Lending released and it will increase more PoL and create more yield and value of pCUB.

P/S : This is not financial advise and DYOR before investing on POLYCUB

Posted Using LeoFinance Beta